Table of Contents

Upside and Downside Capture Ratio

Upside/downside capture ratio guide an investor- whether a fund is outperformed i.e. gained more or lost less than a broad Market benchmark- during the phase of the market upside (strong) or downside (weak), and more importantly by how much. Capture ratios have an analytical structure which indicates the intrinsic strength of a Mutual Fund scheme to face market turbulence.

These ratios essentialy guide an investor how much the fund had risen when the markets rallied and how much it fell during corrections. Upside and Downside capture ratios are two easy-to-understand measures used to analyze performance of a volatile instrument.

What is Upside Capture Ratio

The upside capture ratio is used to analyze the performance of a fund manager during bullish runs i.e. when the benchmark had risen. Well, an upside ratio of over 100 means that a given fund has beaten the benchmark during the period of positive returns. A fund having upside capture ratio of say 150 shows that it gained 50 percent more than its benchmark in bull runs. The ratio is expressed in percentage.

This ratio shows the ability of the fund to beat the benchmark at the time of bull runs. You get an idea of how much more returns the fund earned as compared to the benchmark.

Formula for Upside Capture Ratio

Upside capture ratio is calculated by dividing fund returns by the benchmark returns during an upmarket period.

The formula for upside capture ratio is-

Upside Capture Ratio = (Fund returns during bull runs/Benchmark Returns)* 100

Talk to our investment specialist

What is Downside Capture Ratio

The downside capture ratio is used to analyze how a fund manager performed during bear runs i.e. when the benchmark had fallen. With this ratio, you get an idea of how much lesser returns the fund or the scheme has lost as compared to the benchmark at the time of bearish market phase.

A downside ratio of less than 100 shows that a given fund has lost less than its benchmark during the phase of dull returns.

Formula for Downside Capture Ratio

Downside capture ratio is calculated by dividing fund returns by the benchmark returns during a down market period.

The formula for downside capture ratio is-

Downside Capture Ratio= (Fund returns during bear runs/Benchmark Returns)* 100

Upside and Downside Capture Ratio

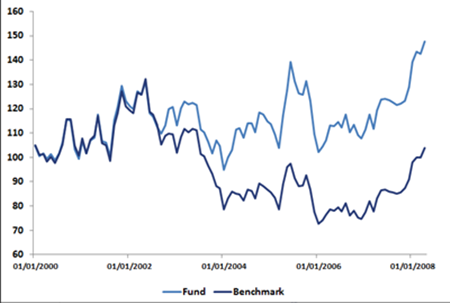

Here's a view of returns from the fund and returns from the benchmark that fund managers tries to outperform.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.