Table of Contents

Defining Demand-Pull Inflation

Demand-pull Inflation refers to the upward pressure on the prices, following a supply shortage that the economists describe as a situation where several rupees chase fewer goods.

Demand-Pull Inflation also means:

- Excessive demand and more money, chasing fewer goods

- The Economy stays at total capacity or full employment

- The economy will grow faster than the long-run trend rate

- The falling rate of unemployment

Demand-Pull Inflation Causes

A few important factors that cause the demand-pull inflation are as follows:

Growing Economy

A growing economy generates good job opportunities for its people, therefore consumers feel more confident and are ready to spend more. This increases the demand and leads to higher prices. In contrast, when the economy is facing a downfall, people are fearful of their future employment. Therefore, they reduce spending and save more for the future.

Rising Inflation Rate

When the inflation rate rises, people start buying more believing that the prices of goods will rise further, this overall increases demand and the supply falls short. This creates demand-pull inflation. While consumers make major purchases to avoid paying higher prices later, some companies may raise their prices to meet the expected inflation.

Government Spending

When the government spends highly on large-scale projects, the cost of production of goods is likely to increase. This causes inflation and also increases the cost of the final goods.

Technology Innovation

When new technology enters the Market, the demand for the product and the services that support them also increases. For example - when a new phone is launched, its supporting services like cases, headphones, etc. also increase in demand. When the demand outweighs the supply, prices rise.

Talk to our investment specialist

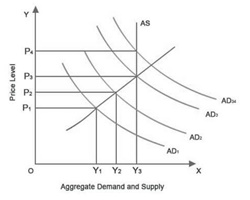

Occurrence of Demand-Pull Inflation

As the firms keep producing more, they start employing more workers, leading to a rise in employment and a fall in unemployment. Therefore, there is an increased demand for the workers that put upward pressure on wages and results in wage-push inflation. Higher wages increase the worker’s disposable Income and lead to increased consumer spending.

Impacts of Demand-Pull Inflation on Unemployment

According to the general economic theory, inflation has an inverse relationship to the unemployment rate. Considering overall,

- As the number of working people increases, there is also an increase in the money transferred to individuals

- With an increase in salaries, people have more money for discretionary spending

- As the rate of discretionary spending increases, the rate of inflation also rises

- As the inflation rate increases, the general price level within an economy also rises

Controlling the Demand-Pull Inflation

To prevent excess inflation, the financial institutions and government have fewer tools at their disposal. For example, the central Bank might increase the interest rates for countering the demand-pull inflation, resulting in the consumers spending less on products and housing needs. This eventually lowers the overall demand and allows producers to catch up with the supplies for restoring balance. The government might also reduce the expenditures or raise the Taxes. If you are looking forward to controlling demand-pull inflation, it is also essential to consider the causes to choose the best and the right action.

Cost-Push Inflation vs Demand-Pull Inflation

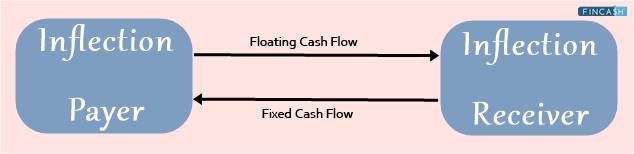

There is cost-push inflation when money transfers from one economic sector to another. Mainly the increased production costs, like the wages and Raw Materials, pass on inevitably to the consumers in the form of the higher prices for the final products and goods.

Demand-pull inflation works similar to cost-pull inflation, but it works over the system’s different aspects. It shows the causes of the increased price. On the other hand, cost-pull inflation shows how difficult it is to stop inflation after it begins.

Example of Demand-Pull Inflation

Let’s take a demand-pull inflation example here. Suppose the economy is booming and the unemployment rate falls further. Interest rates are also lower, and the federal government looking forward to getting the gas-guzzling cars off the road starts with a special tax credit for the buyers who go for fuel-efficient cars.

The bigger automotive companies get over-excited even though they are not expecting a convergence of all the upbeat factors simultaneously. There is then a rapid rise in the demand for many car models, but the manufacturers are unable to be faster for the production. This leads to a rise in the price of more popular models and rare bargains for them. This results in an increase in the average price for the newer car productions. Though, this does not only affect the cars.

With almost everyone getting employed and borrowing rates getting lowered, there is increased expenditure on various goods beyond the supplies available. That is how you can see demand-pull inflation in action.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.