ફિન્કેશ »યુનિયન બેંક ઓફ ઈન્ડિયામાં SIP ટ્રાન્ઝેક્શન માટે બિલર ઉમેરો

Table of Contents

યુનિયન બેંક ઓફ ઇન્ડિયામાં SIP વ્યવહારો માટે બિલર કેવી રીતે ઉમેરવું?

જે લોકોમ્યુચ્યુઅલ ફંડમાં રોકાણ કરો પસંદ કરી શકે છેSIP અથવા વ્યવસ્થિતરોકાણ યોજના રોકાણના મોડ તરીકે. આ મોડમાં, લોકોએ તેમના ઉદ્દેશ્યોને પ્રાપ્ત કરવા માટે યોજનામાં નિયમિત અંતરાલે થોડી રકમ ચૂકવવાની જરૂર છે. SIP દ્વારા, લોકો ખાતરી કરી શકે છે કે તેમનું વર્તમાન બજેટ અવરોધાય નહીં અને તેમના ઉદ્દેશ્યો પણ પ્રાપ્ત થાય. ટેક્નોલોજીની પ્રગતિ સાથે, લોકો તેમની SIP દ્વારા કરી શકે છેનેટ બેન્કિંગ ચેનલ

નેટ બેન્કિંગ પસંદ કરવાના કિસ્સામાં, વ્યક્તિઓ તેમની પ્રથમ ચુકવણી થઈ જાય પછી એક અનન્ય નોંધણી નંબર અથવા URN મેળવે છે. તેમણે નેટ બેંકિંગ દ્વારા બિલર સાથે આ URN ઉમેરવાની જરૂર છે જેથી કરીને તેમની ભાવિ SIP ચૂકવણીઓ સ્વયંસંચાલિત થઈ શકે. ફક્ત, તમારે ખાતરી કરવાની જરૂર છે કે ત્યાં પર્યાપ્ત ભંડોળ છેબેંક એકાઉન્ટ નેટ બેંકિંગમાં બિલર ઉમેરવાની પ્રક્રિયા દરેક બેંક માટે અલગ છે. તેથી, ચાલો યુનિયન બેંક ઓફ ઈન્ડિયાના કિસ્સામાં SIP વ્યવહારો માટે બિલર ઉમેરવાની પ્રક્રિયા તપાસીએ જે છ સરળ પગલાઓમાં કરી શકાય છે.

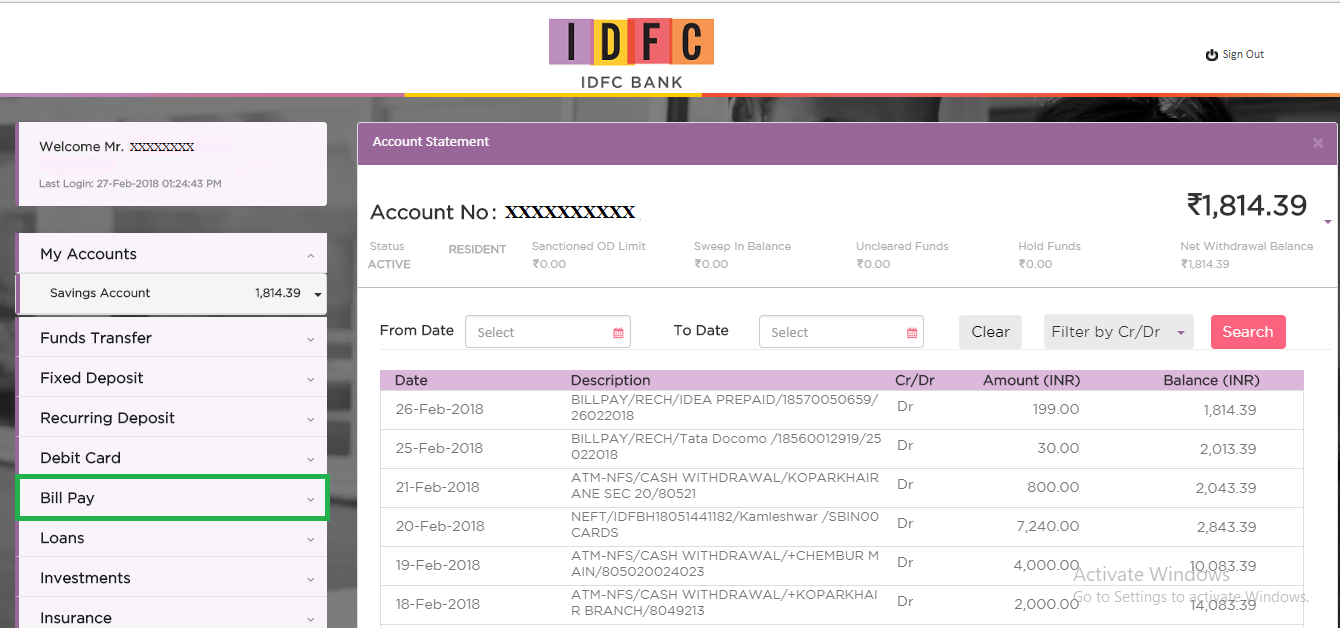

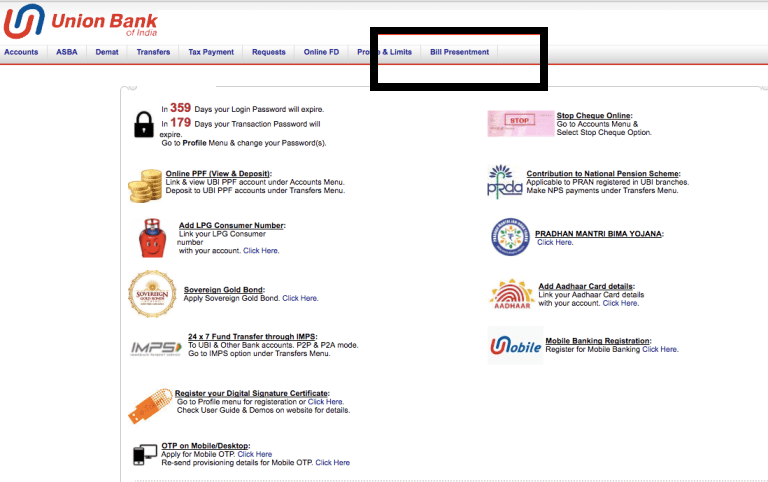

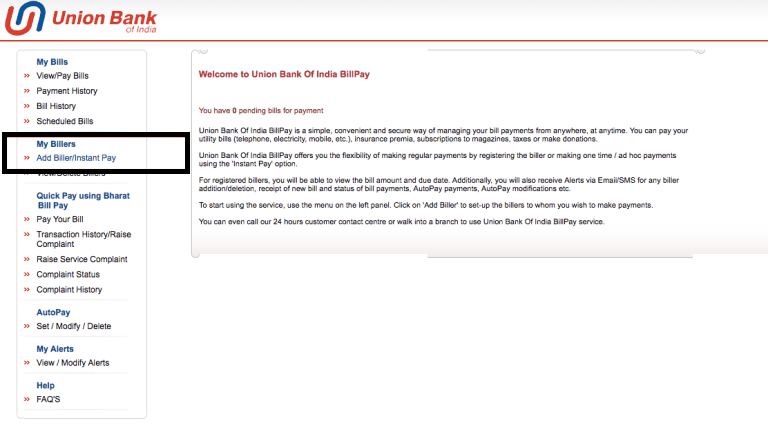

લોગિન કરો અને બિલ પ્રેઝન્ટમેન્ટ ટેબ પસંદ કરો

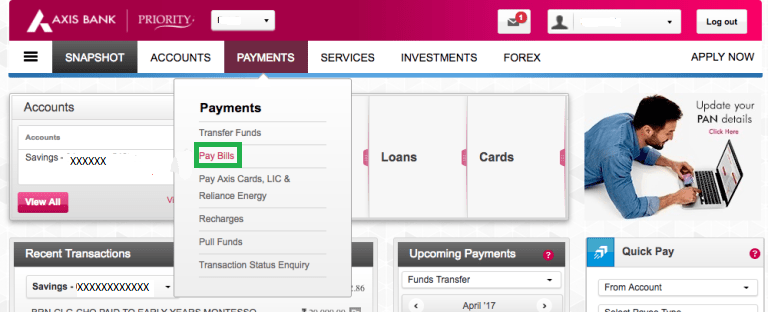

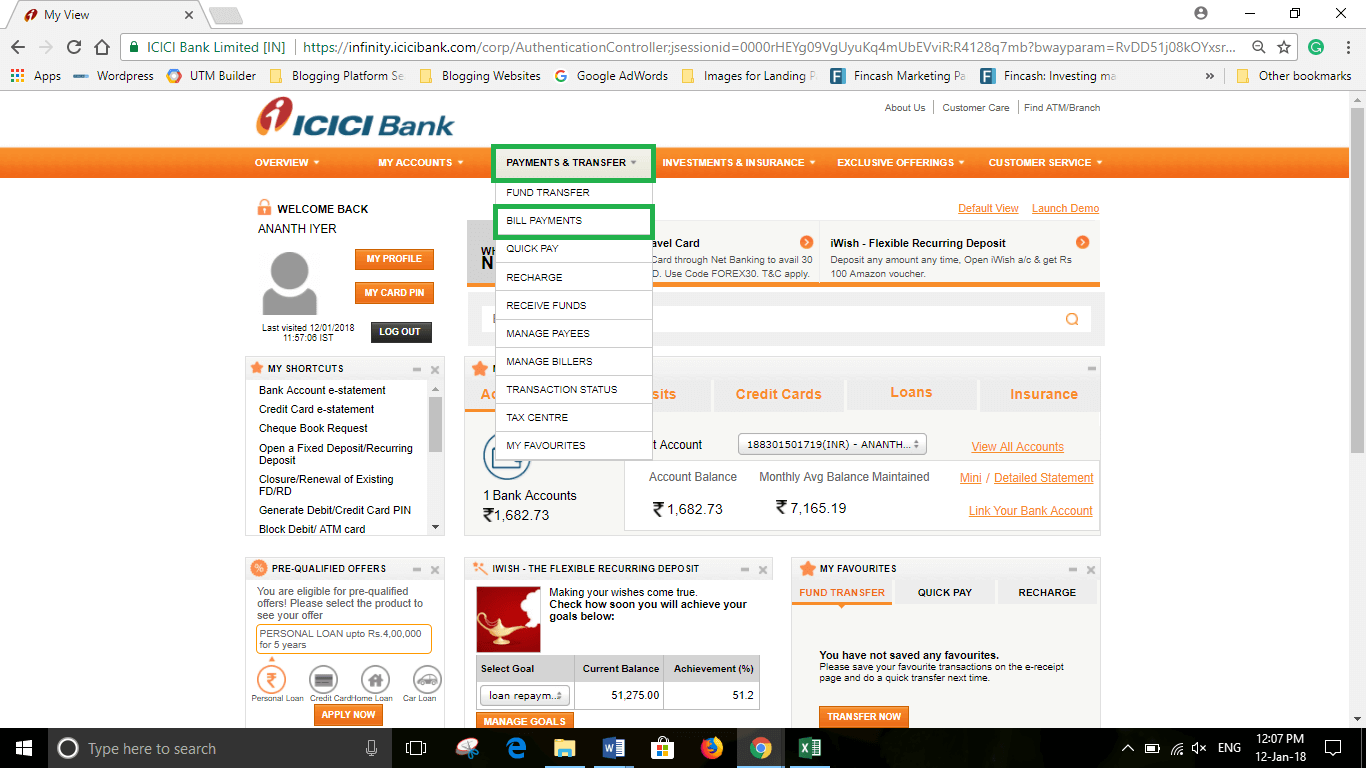

બિલર ઉમેરવાના કિસ્સામાં આ પ્રાથમિક પગલું છે. પ્રથમ, તમારે તમારા ઓળખપત્રો દાખલ કરીને તમારી નેટ બેંકિંગમાં લોગ ઓન કરવાની જરૂર છે. એકવાર તમે લોગ ઇન કરો, તમે તમારી હોમ સ્ક્રીન જોઈ શકો છો. અહીં, સ્ક્રીનની ટોચ પર, તમે વિવિધ ટેબ્સ જોઈ શકો છો જેમ કે એકાઉન્ટ્સ, ડીમેટ, ટ્રાન્સફર અને ઘણું બધું. આમાંથી, તમારે ચાલુ પસંદ કરવાની જરૂર છેબિલ પ્રસ્તુતિ ટેબ આ પગલા માટેની ઇમેજ નીચે આપેલ છે જ્યાં બિલ પ્રેઝન્ટમેન્ટ ટેબ બ્લેકમાં હાઇલાઇટ થયેલ છે.

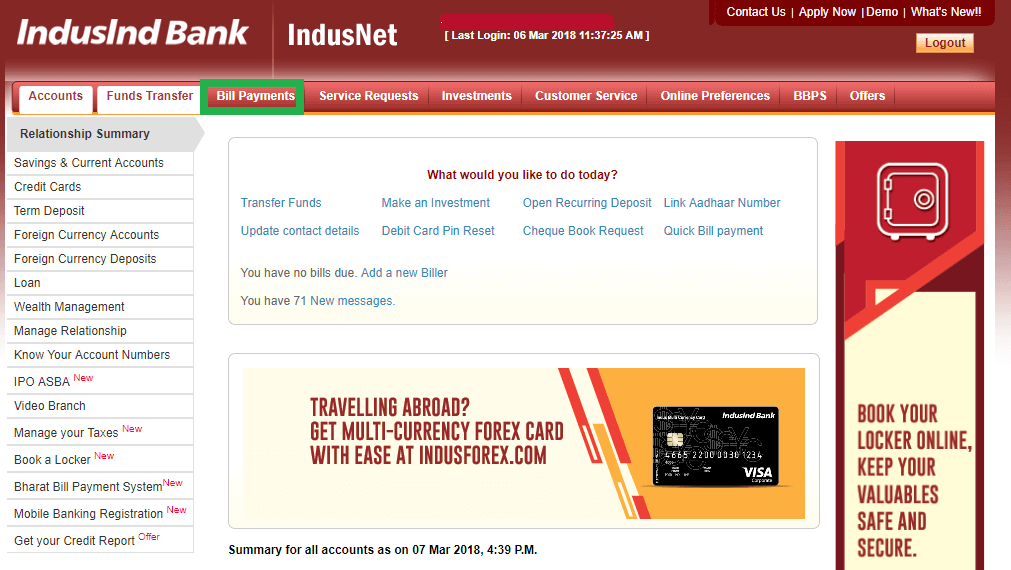

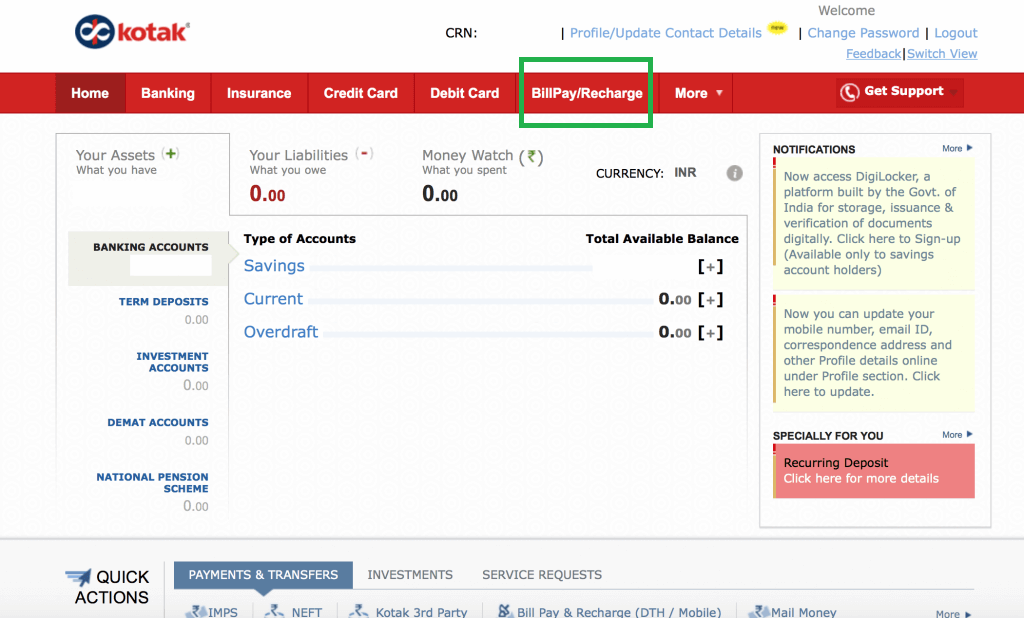

બિલર/ઇન્સ્ટન્ટ પે ઉમેરો વિકલ્પ પસંદ કરો

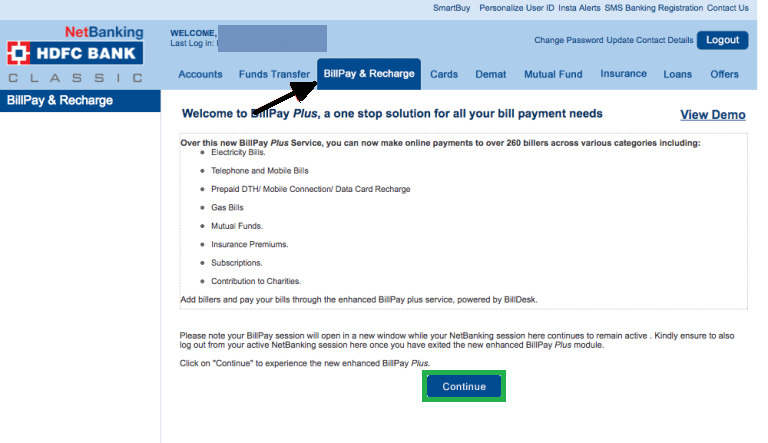

એકવાર તમે પર ક્લિક કરોબિલ પ્રસ્તુતિ ટેબ, નવી સ્ક્રીન ખુલે છે. આ સ્ક્રીનમાં, તમે સ્ક્રીનની ડાબી બાજુએ વિવિધ વિકલ્પો શોધી શકો છો. અહીં, તમારે વિકલ્પ માટે તપાસ કરવાની જરૂર છેબિલર/ ઇન્સ્ટન્ટ પે ઉમેરો માય બિલર્સ શીર્ષક હેઠળ. આ સ્ક્રીન માટેની છબી નીચે આપેલ છે જ્યાંબિલર/ ઇન્સ્ટન્ટ પે ઉમેરો અનેમારા બિલર્સ વિકલ્પ બંને કાળા રંગમાં પ્રકાશિત થયેલ છે.

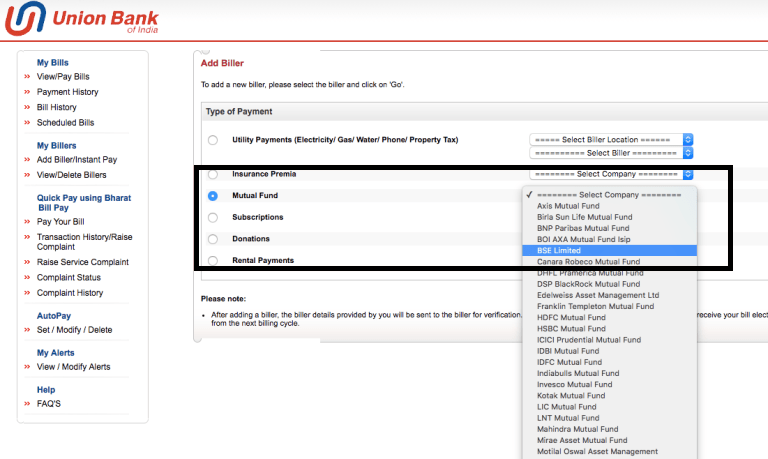

મ્યુચ્યુઅલ ફંડ હેઠળ BSE લિમિટેડ પસંદ કરો

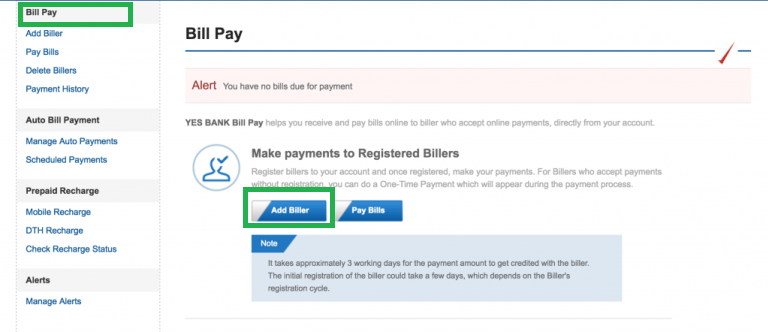

બિલર ઉમેરવાની પ્રક્રિયામાં આ ત્રીજું પગલું છે. આ પગલામાં, એકવાર તમે પર ક્લિક કરોબિલર/ ઇન્સ્ટન્ટ પે ઉમેરો વિકલ્પ; એક નવું પોપ અપ ખુલે છે જેમાં વિવિધ ચુકવણી વિકલ્પો છે જેમ કે યુટિલિટી પેમેન્ટ્સ,વીમા પ્રીમિયા અને અન્ય. અહીં, તમારે પસંદ કરવાની જરૂર છેમ્યુચ્યુઅલ ફંડ વિકલ્પ. એકવાર તમે મ્યુચ્યુઅલ ફંડ વિકલ્પ પર ક્લિક કરો, તેની બાજુમાં એક ડ્રોપ-ડાઉન તમને જ્યાં વિકલ્પ પસંદ કરવાની જરૂર છે તે સક્ષમ કરે છે.BSE લિમિટેડ. એકવાર તમે BSE લિમિટેડ પર ક્લિક કરો, તમારે તેના પર ક્લિક કરવાની જરૂર છેજાઓ. આ પગલા માટેની છબી નીચે આપેલ છે જ્યાંમ્યુચ્યુઅલ ફંડ અને BSE લિમિટેડ વિકલ્પ બ્લેકમાં હાઇલાઇટ થયેલ છે.

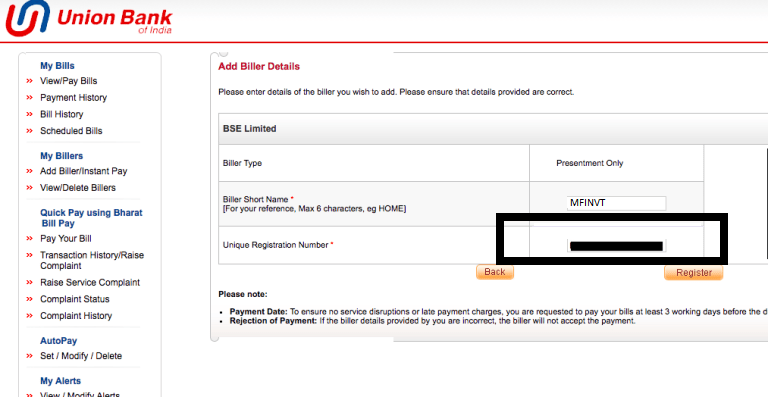

અનન્ય નોંધણી નંબર ઉમેરો

પર ક્લિક કર્યા પછીજાઓ પાછલા પગલામાં, એક નવી સ્ક્રીન ખુલે છે જ્યાં તમારે તમારો URN નંબર દાખલ કરવો જરૂરી છે. આ URN નંબર એ છે જે તમે પ્રથમ SIP ની ચૂકવણી કર્યા પછી તમારા ઇમેઇલ્સમાં પ્રાપ્ત કરો છો. જો તમને SIP રજીસ્ટ્રેશન માટે ઈમેલ ન મળે તો ચિંતા કરશો નહીં. ની વેબસાઇટ પરથી તમે તેને ઍક્સેસ કરી શકો છોwww.fincash.com લૉગ ઇન કરીને અને મુલાકાત લઈનેમારા SIPs વિભાગ. તમારે તમારા બિલર માટે ટૂંકું નામ પણ ઉમેરવાની જરૂર છે. એકવાર તમે બંને ડેટા ઉમેર્યા પછી, તમારે રજિસ્ટર પર ક્લિક કરવાની જરૂર છે. તેના માટે ઇમેજ નીચે આપેલ છે જ્યાં URN બ્લેકમાં હાઇલાઇટ થયેલ છે.

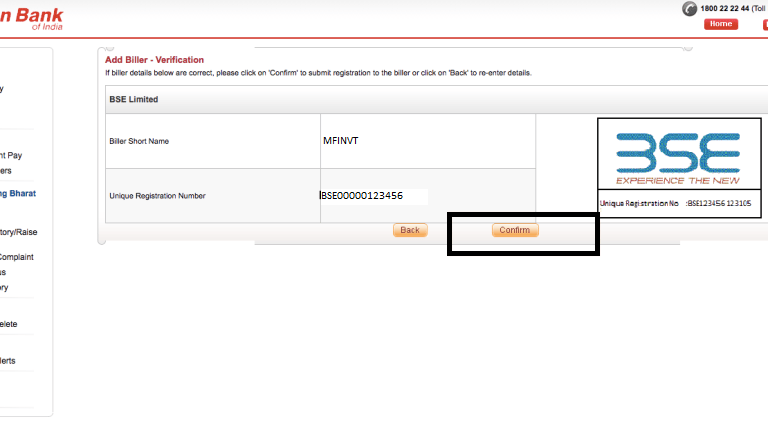

ભરેલા ડેટાનો સારાંશ

એકવાર તમે પર ક્લિક કરોનોંધણી કરો, એક નવી સ્ક્રીન ખુલે છે જ્યાં તમે સંબંધિત ભરેલી માહિતી જોઈ શકો છો. એકવાર તમે તેને ચકાસો અને તપાસો, તમે તેના પર ક્લિક કરી શકો છોપુષ્ટિ કરો. જો તમને લાગે છે કે ડેટામાં કોઈ ભૂલ છે, તો તમારે તેના પર ક્લિક કરવાની જરૂર છેપાછળ. આ સ્ટેપ માટેની ઈમેજ નીચે આપેલ છે જ્યાં કન્ફર્મ બટન બ્લેકમાં હાઈલાઈટ થયેલ છે.

પુષ્ટિકરણ

યુનિયન બેંક ઓફ ઈન્ડિયામાં બિલર ઉમેરવાની પ્રક્રિયામાં આ છેલ્લું પગલું છે. એકવાર તમે પર ક્લિક કરોપુષ્ટિ કરો વિકલ્પ એક નવી સ્ક્રીન પૉપ આઉટ થાય છે જે બતાવે છે કે બિલર સફળતાપૂર્વક નોંધાયેલ છે. આ પગલા માટેની છબી નીચે મુજબ છે જ્યાં અભિનંદન સંદેશ લીલા રંગમાં પ્રકાશિત થયેલ છે.

તેથી, ઉપરોક્ત પગલાંઓ દ્વારા, અમે નિષ્કર્ષ પર આવી શકીએ છીએ કે યુનિયન બેંક ઓફ ઈન્ડિયાના કિસ્સામાં બિલર ઉમેરવું સરળ છે.

વધુ સારું વળતર મેળવવા માટે રોકાણ કરવા માટે શ્રેષ્ઠ SIP

આ પ્રમાણે ભલામણ કરેલ કેટલીક SIP છે5 વર્ષ કરતાં વધુ વળતર અને AUMINR 500 કરોડ:

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Small Cap Fund Growth ₹158.434

↑ 0.05 ₹55,491 100 -2.4 -9.2 5.6 21.7 39 26.1 ICICI Prudential Infrastructure Fund Growth ₹182.84

↑ 0.07 ₹7,214 100 2.6 -3.8 7.1 28.1 38.9 27.4 Motilal Oswal Midcap 30 Fund Growth ₹93.7774

↓ -0.75 ₹26,028 500 -4.3 -10.9 14.9 27 36.9 57.1 IDFC Infrastructure Fund Growth ₹48.021

↓ -0.02 ₹1,563 100 0.9 -6.6 5.3 25.9 36.1 39.3 L&T Emerging Businesses Fund Growth ₹75.5889

↓ -0.36 ₹13,334 500 -5.3 -12.2 3.3 18.4 35.7 28.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 25

The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related instruments of small cap companies and the secondary objective is to generate consistent returns by investing in debt and money market securities. Nippon India Small Cap Fund is a Equity - Small Cap fund was launched on 16 Sep 10. It is a fund with Moderately High risk and has given a Below is the key information for Nippon India Small Cap Fund Returns up to 1 year are on To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. ICICI Prudential Infrastructure Fund is a Equity - Sectoral fund was launched on 31 Aug 05. It is a fund with High risk and has given a Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on (Erstwhile Motilal Oswal MOSt Focused Midcap 30 Fund) The investment objective of the Scheme is to achieve long term capital appreciation by investing in a maximum of 30 quality mid-cap companies having long-term competitive advantages and potential for growth. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved. Motilal Oswal Midcap 30 Fund is a Equity - Mid Cap fund was launched on 24 Feb 14. It is a fund with Moderately High risk and has given a Below is the key information for Motilal Oswal Midcap 30 Fund Returns up to 1 year are on The investment objective of the scheme is to seek to generate long-term capital growth through an active diversified portfolio of predominantly equity and equity related instruments of companies that are participating in and benefiting from growth in Indian infrastructure and infrastructural related activities. However, there can be no assurance that the investment objective of the scheme will be realized. IDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 8 Mar 11. It is a fund with High risk and has given a Below is the key information for IDFC Infrastructure Fund Returns up to 1 year are on To generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity related securities, including equity derivatives, in the Indian markets with key theme focus being emerging companies (small cap stocks). The Scheme could also additionally invest in Foreign Securities. L&T Emerging Businesses Fund is a Equity - Small Cap fund was launched on 12 May 14. It is a fund with High risk and has given a Below is the key information for L&T Emerging Businesses Fund Returns up to 1 year are on 1. Nippon India Small Cap Fund

CAGR/Annualized return of 20.8% since its launch. Ranked 6 in Small Cap category. Return for 2024 was 26.1% , 2023 was 48.9% and 2022 was 6.5% . Nippon India Small Cap Fund

Growth Launch Date 16 Sep 10 NAV (24 Apr 25) ₹158.434 ↑ 0.05 (0.03 %) Net Assets (Cr) ₹55,491 on 31 Mar 25 Category Equity - Small Cap AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.55 Sharpe Ratio 0.07 Information Ratio 0.53 Alpha Ratio -0.23 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹21,742 31 Mar 22 ₹31,334 31 Mar 23 ₹33,418 31 Mar 24 ₹51,907 31 Mar 25 ₹55,076 Returns for Nippon India Small Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 25 Duration Returns 1 Month 4.4% 3 Month -2.4% 6 Month -9.2% 1 Year 5.6% 3 Year 21.7% 5 Year 39% 10 Year 15 Year Since launch 20.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 26.1% 2023 48.9% 2022 6.5% 2021 74.3% 2020 29.2% 2019 -2.5% 2018 -16.7% 2017 63% 2016 5.6% 2015 15.1% Fund Manager information for Nippon India Small Cap Fund

Name Since Tenure Samir Rachh 2 Jan 17 8.16 Yr. Kinjal Desai 25 May 18 6.77 Yr. Data below for Nippon India Small Cap Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Industrials 22.17% Consumer Cyclical 13.91% Financial Services 13.54% Basic Materials 12.14% Consumer Defensive 8.89% Technology 8.65% Health Care 8.16% Energy 2.03% Utility 1.98% Communication Services 1.54% Real Estate 0.54% Asset Allocation

Asset Class Value Cash 6.04% Equity 93.96% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 22 | HDFCBANK2% ₹1,152 Cr 6,650,000 Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 28 Feb 21 | MCX2% ₹924 Cr 1,851,010 Kirloskar Brothers Ltd (Industrials)

Equity, Since 31 Oct 12 | KIRLOSBROS1% ₹714 Cr 4,472,130 Dixon Technologies (India) Ltd (Technology)

Equity, Since 30 Nov 18 | DIXON1% ₹655 Cr 470,144 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 28 Feb 17 | 5900031% ₹639 Cr 31,784,062 State Bank of India (Financial Services)

Equity, Since 31 Oct 19 | SBIN1% ₹627 Cr 9,100,000 Tube Investments of India Ltd Ordinary Shares (Industrials)

Equity, Since 30 Apr 18 | TIINDIA1% ₹615 Cr 2,499,222 NLC India Ltd (Utilities)

Equity, Since 31 Oct 22 | NLCINDIA1% ₹563 Cr 27,190,940 Adani Wilmar Ltd (Consumer Defensive)

Equity, Since 31 Jan 25 | 5434581% ₹553 Cr 22,483,343

↑ 183,343 Apar Industries Ltd (Industrials)

Equity, Since 31 Mar 17 | APARINDS1% ₹521 Cr 899,271 2. ICICI Prudential Infrastructure Fund

CAGR/Annualized return of 15.9% since its launch. Ranked 27 in Sectoral category. Return for 2024 was 27.4% , 2023 was 44.6% and 2022 was 28.8% . ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (24 Apr 25) ₹182.84 ↑ 0.07 (0.04 %) Net Assets (Cr) ₹7,214 on 31 Mar 25 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.22 Sharpe Ratio 0.14 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,670 31 Mar 22 ₹25,304 31 Mar 23 ₹30,899 31 Mar 24 ₹50,465 31 Mar 25 ₹54,540 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 25 Duration Returns 1 Month 3.1% 3 Month 2.6% 6 Month -3.8% 1 Year 7.1% 3 Year 28.1% 5 Year 38.9% 10 Year 15 Year Since launch 15.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 27.4% 2023 44.6% 2022 28.8% 2021 50.1% 2020 3.6% 2019 2.6% 2018 -14% 2017 40.8% 2016 2% 2015 -3.4% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 7.75 Yr. Sharmila D’mello 30 Jun 22 2.67 Yr. Data below for ICICI Prudential Infrastructure Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Industrials 36.49% Basic Materials 21.39% Financial Services 16.91% Utility 8.65% Energy 7.09% Communication Services 1.63% Consumer Cyclical 0.89% Real Estate 0.35% Asset Allocation

Asset Class Value Cash 5.98% Equity 93.39% Debt 0.62% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT9% ₹649 Cr 2,052,790

↑ 126,940 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 May 24 | ADANIPORTS4% ₹288 Cr 2,695,324 Shree Cement Ltd (Basic Materials)

Equity, Since 30 Apr 24 | 5003874% ₹268 Cr 98,408

↓ -10,339 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 16 | ICICIBANK3% ₹240 Cr 1,990,000 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | 5325553% ₹226 Cr 7,260,775 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 22 | HDFCBANK3% ₹212 Cr 1,225,000 NCC Ltd (Industrials)

Equity, Since 31 Aug 21 | NCC3% ₹210 Cr 12,006,117

↑ 1,500,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 23 | RELIANCE3% ₹205 Cr 1,709,486

↑ 100,000 Vedanta Ltd (Basic Materials)

Equity, Since 31 Jul 24 | 5002953% ₹194 Cr 4,923,662

↑ 100,000 Cummins India Ltd (Industrials)

Equity, Since 31 May 17 | 5004803% ₹173 Cr 635,000 3. Motilal Oswal Midcap 30 Fund

CAGR/Annualized return of 22.3% since its launch. Ranked 27 in Mid Cap category. Return for 2024 was 57.1% , 2023 was 41.7% and 2022 was 10.7% . Motilal Oswal Midcap 30 Fund

Growth Launch Date 24 Feb 14 NAV (24 Apr 25) ₹93.7774 ↓ -0.75 (-0.79 %) Net Assets (Cr) ₹26,028 on 31 Mar 25 Category Equity - Mid Cap AMC Motilal Oswal Asset Management Co. Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 0.66 Sharpe Ratio 0.47 Information Ratio 0.63 Alpha Ratio 8.9 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,888 31 Mar 22 ₹23,342 31 Mar 23 ₹25,677 31 Mar 24 ₹41,172 31 Mar 25 ₹48,151 Returns for Motilal Oswal Midcap 30 Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 25 Duration Returns 1 Month 2.9% 3 Month -4.3% 6 Month -10.9% 1 Year 14.9% 3 Year 27% 5 Year 36.9% 10 Year 15 Year Since launch 22.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 57.1% 2023 41.7% 2022 10.7% 2021 55.8% 2020 9.3% 2019 9.7% 2018 -12.7% 2017 30.8% 2016 5.2% 2015 16.5% Fund Manager information for Motilal Oswal Midcap 30 Fund

Name Since Tenure Ajay Khandelwal 1 Oct 24 0.41 Yr. Niket Shah 1 Jul 20 4.67 Yr. Rakesh Shetty 22 Nov 22 2.27 Yr. Sunil Sawant 1 Jul 24 0.67 Yr. Data below for Motilal Oswal Midcap 30 Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Technology 34.02% Consumer Cyclical 16.09% Industrials 11.09% Health Care 5% Communication Services 3.44% Real Estate 2.8% Basic Materials 2.32% Utility 2.06% Financial Services 0.09% Asset Allocation

Asset Class Value Cash 28.33% Equity 71.67% Top Securities Holdings / Portfolio

Name Holding Value Quantity Coforge Ltd (Technology)

Equity, Since 31 Mar 23 | COFORGE10% ₹2,349 Cr 3,190,000

↑ 340,000 Persistent Systems Ltd (Technology)

Equity, Since 31 Jan 23 | PERSISTENT10% ₹2,254 Cr 4,249,800

↑ 249,800 Kalyan Jewellers India Ltd (Consumer Cyclical)

Equity, Since 29 Feb 24 | KALYANKJIL7% ₹1,619 Cr 35,027,075

↑ 26,975 Dixon Technologies (India) Ltd (Technology)

Equity, Since 31 Mar 23 | DIXON7% ₹1,581 Cr 1,134,324

↑ 134,324 Max Healthcare Institute Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Mar 24 | MAXHEALTH4% ₹975 Cr 9,969,361

↑ 1,913,231 One97 Communications Ltd (Technology)

Equity, Since 30 Sep 24 | 5433964% ₹934 Cr 13,066,359

↑ 3,065,359 Trent Ltd (Consumer Cyclical)

Equity, Since 30 Nov 24 | 5002514% ₹873 Cr 1,800,000

↓ -820,200 Polycab India Ltd (Industrials)

Equity, Since 30 Sep 23 | POLYCAB3% ₹825 Cr 1,750,000

↓ -100,000 Bharti Hexacom Ltd (Communication Services)

Equity, Since 31 Oct 24 | BHARTIHEXA3% ₹815 Cr 6,250,000

↑ 174,429 KEI Industries Ltd (Industrials)

Equity, Since 30 Nov 24 | KEI3% ₹768 Cr 2,500,000

↑ 1,250,000 4. IDFC Infrastructure Fund

CAGR/Annualized return of 11.8% since its launch. Ranked 1 in Sectoral category. Return for 2024 was 39.3% , 2023 was 50.3% and 2022 was 1.7% . IDFC Infrastructure Fund

Growth Launch Date 8 Mar 11 NAV (24 Apr 25) ₹48.021 ↓ -0.02 (-0.05 %) Net Assets (Cr) ₹1,563 on 31 Mar 25 Category Equity - Sectoral AMC IDFC Asset Management Company Limited Rating ☆☆☆☆☆ Risk High Expense Ratio 2.33 Sharpe Ratio 0.11 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹20,153 31 Mar 22 ₹24,848 31 Mar 23 ₹27,324 31 Mar 24 ₹47,064 31 Mar 25 ₹50,038 Returns for IDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 25 Duration Returns 1 Month 4.9% 3 Month 0.9% 6 Month -6.6% 1 Year 5.3% 3 Year 25.9% 5 Year 36.1% 10 Year 15 Year Since launch 11.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 39.3% 2023 50.3% 2022 1.7% 2021 64.8% 2020 6.3% 2019 -5.3% 2018 -25.9% 2017 58.7% 2016 10.7% 2015 -0.2% Fund Manager information for IDFC Infrastructure Fund

Name Since Tenure Vishal Biraia 24 Jan 24 1.1 Yr. Ritika Behera 7 Oct 23 1.4 Yr. Gaurav Satra 7 Jun 24 0.73 Yr. Data below for IDFC Infrastructure Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Industrials 54.7% Utility 13.22% Basic Materials 10.84% Communication Services 4.49% Energy 3.88% Consumer Cyclical 3.46% Financial Services 2.99% Technology 2.07% Health Care 1.9% Asset Allocation

Asset Class Value Cash 2.43% Equity 97.57% Top Securities Holdings / Portfolio

Name Holding Value Quantity Kirloskar Brothers Ltd (Industrials)

Equity, Since 31 Dec 17 | KIRLOSBROS5% ₹71 Cr 443,385 Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 12 | LT4% ₹58 Cr 183,173

↑ 11,726 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 24 | RELIANCE4% ₹54 Cr 452,706 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 19 | BHARTIARTL4% ₹52 Cr 330,018

↑ 40,855 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Mar 14 | 5325384% ₹51 Cr 50,452

↑ 3,476 GPT Infraprojects Ltd (Industrials)

Equity, Since 30 Nov 17 | GPTINFRA3% ₹45 Cr 4,797,143 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 Dec 23 | ADANIPORTS3% ₹39 Cr 365,137

↓ -69,842 PTC India Financial Services Ltd (Financial Services)

Equity, Since 31 Dec 23 | PFS3% ₹39 Cr 12,400,122 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Oct 19 | BEL3% ₹35 Cr 1,431,700 KEC International Ltd (Industrials)

Equity, Since 30 Jun 24 | 5327143% ₹35 Cr 512,915 5. L&T Emerging Businesses Fund

CAGR/Annualized return of 20.3% since its launch. Ranked 2 in Small Cap category. Return for 2024 was 28.5% , 2023 was 46.1% and 2022 was 1% . L&T Emerging Businesses Fund

Growth Launch Date 12 May 14 NAV (24 Apr 25) ₹75.5889 ↓ -0.36 (-0.48 %) Net Assets (Cr) ₹13,334 on 28 Feb 25 Category Equity - Small Cap AMC L&T Investment Management Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 1.73 Sharpe Ratio -0.4 Information Ratio -0.11 Alpha Ratio 1.44 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹20,010 31 Mar 22 ₹29,870 31 Mar 23 ₹31,289 31 Mar 24 ₹46,026 31 Mar 25 ₹48,026 Returns for L&T Emerging Businesses Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 25 Duration Returns 1 Month 3.5% 3 Month -5.3% 6 Month -12.2% 1 Year 3.3% 3 Year 18.4% 5 Year 35.7% 10 Year 15 Year Since launch 20.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 28.5% 2023 46.1% 2022 1% 2021 77.4% 2020 15.5% 2019 -8.1% 2018 -13.7% 2017 66.5% 2016 10.2% 2015 12.3% Fund Manager information for L&T Emerging Businesses Fund

Name Since Tenure Venugopal Manghat 17 Dec 19 5.21 Yr. Cheenu Gupta 1 Oct 23 1.42 Yr. Sonal Gupta 1 Oct 23 1.42 Yr. Data below for L&T Emerging Businesses Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 24.78% Consumer Cyclical 15.58% Financial Services 14.01% Basic Materials 10.75% Technology 9.78% Health Care 5.55% Real Estate 4.98% Consumer Defensive 4.06% Energy 1.26% Asset Allocation

Asset Class Value Cash 6.91% Equity 93.09% Top Securities Holdings / Portfolio

Name Holding Value Quantity Neuland Laboratories Limited

Equity, Since 31 Jan 24 | -2% ₹310 Cr 292,479

↓ -6,521 Aditya Birla Real Estate Ltd (Basic Materials)

Equity, Since 30 Sep 22 | 5000402% ₹297 Cr 1,595,574 Suven Pharmaceuticals Ltd (Healthcare)

Equity, Since 31 Mar 20 | SUVENPHAR2% ₹279 Cr 2,298,085 K.P.R. Mill Ltd (Consumer Cyclical)

Equity, Since 28 Feb 15 | KPRMILL2% ₹263 Cr 3,286,897 BSE Ltd (Financial Services)

Equity, Since 29 Feb 24 | BSE2% ₹257 Cr 555,021

↓ -297,579 Time Technoplast Ltd (Consumer Cyclical)

Equity, Since 31 Jan 24 | TIMETECHNO2% ₹243 Cr 6,810,500 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 31 Oct 22 | 5900032% ₹240 Cr 11,912,400 Brigade Enterprises Ltd (Real Estate)

Equity, Since 31 Jul 19 | 5329292% ₹237 Cr 2,499,622 The Federal Bank Ltd (Financial Services)

Equity, Since 30 Sep 22 | FEDERALBNK2% ₹236 Cr 13,286,579 Sumitomo Chemical India Ltd Ordinary Shares (Basic Materials)

Equity, Since 31 Oct 20 | SUMICHEM2% ₹215 Cr 4,672,221

કોઈપણ વધુ પ્રશ્નોના કિસ્સામાં, તમે અમારો 8451864111 પર કોઈપણ કામકાજના દિવસે સવારે 9.30 થી સાંજના 6.30 વાગ્યાની વચ્ચે સંપર્ક કરી શકો છો અથવા કોઈપણ સમયે અમને મેઈલ લખી શકો છો.support@fincash.com અથવા અમારી વેબસાઇટ પર લૉગ ઇન કરીને અમારી સાથે ચેટ કરોwww.fincash.com.

અહીં આપેલી માહિતી સચોટ છે તેની ખાતરી કરવા માટેના તમામ પ્રયાસો કરવામાં આવ્યા છે. જો કે, ડેટાની શુદ્ધતા અંગે કોઈ ગેરંટી આપવામાં આવતી નથી. કોઈપણ રોકાણ કરતા પહેલા કૃપા કરીને સ્કીમ માહિતી દસ્તાવેજ સાથે ચકાસો.