Table of Contents

- Health Insurance

- Factors to Consider Before Buying Health Insurance Plans

- Best Health Insurance Plans

- FAQs

- 1. Will health insurance help you claim insurance benefits?

- 2. Can health insurance effectively reduce your medical expense?

- 3. Can I upgrade my health insurance plan?

- 4. Can senior citizens apply for health insurances?

- 5. Will the premiums payable change for senior citizens?

- 6. Do health plans differ from company to company?

- 7. Are there floater health plans?

- 8. Do health care plans cover major surgeries?

- 9. Health care plans cover day care expenses?

- 10. Do health care plans cover maternity expenses?

- 11. Do I need separate health care plans for my family members?

- 12. What is no claim bonus?

- Conclusion

Best Health Insurance Plans

Looking for health insurance plans? Though Health insurance is very popular among people, many of us still do not know how it works and the various health insurance benefits. Apart from providing healthcare benefits, medical insurance is an efficient Tax Saving Investment as well. It is advised to look for best health insurance quotes and the list of best medical insurance plans before buying.

So, before moving to health insurance plans let’s first understand what is health insurance and the factors to consider before buying cheap health insurance.

Health Insurance

Health Insurance is a type of Insurance Coverage that compensates you for various medical and surgical expenses incurred. It is a coverage provided by the Insurance companies to protect you from unforeseen medical expenses that might occur in the future. With rising healthcare costs, the need for health insurance plans is increasing as well. The health Insurance Claim can be settled in two ways. It is either reimbursed to the insurer or is paid to the care provider directly. Also, the benefits received on health insurance premiums are tax-free.

Factors to Consider Before Buying Health Insurance Plans

With the changing lifestyle of people, medical insurance is becoming a necessity. The rising medical costs day by day further shoots up the need of getting a health insurance policy. To safeguard your health and attain financial help for medical expenses, you need to buy a health insurance plan. There are various types of health insurance policies available in the Market that offer different health quotes, coverage and features. So you must consider certain factors before buying a medical insurance plan.

Some of those factors are mentioned below.

Co-Pay of the Health Insurance Policy

Before buying a health insurance policy it is important to understand its term and terminologies. Co-Pay is one such term you must know beforehand. Co-Pay is a certain fixed percentage of the total hospital bill that a person needs to pay when they make a health insurance claim while the remaining amount is paid by the health insurance company. For example, if your policy has a clause of 10% co-pay, it implies that for a claim of INR 10,000 you have to pay INR 1000 while the insurer will pay the rest amount of INR 9000. However, it is suggested to opt for health policies with “no co-pay”.

Duration of the Medical Insurance

One of the most important Factor to consider before buying a medical insurance plan is the duration of its coverage. As a matter of fact, our health deteriorates with the passing years so one must ensure that the medical insurance policy has a lifelong coverage and is not just for a few years. Make sure you choose a plan that can be renewed lifelong.

Cooling period of Pre-existing Diseases

There are some diseases that a person might have had before buying a health insurance plan. Those diseases are referred to as pre-existing diseases. All these pre-existing diseases are not covered in the health policy from the day one of buying. The cover period of your pre-existing diseases varies from time-to-time. So, it is advised to confirm the time taken to cover pre-existing diseases before opting for a plan.

Hospital Room Rent in the Policy Clause

The cost of getting a room in hospitals is different for different rooms. A costlier room will definitely increase the cost of treatment and hospitalisation. So, it’s better to have a higher room rent limit in your health plan.

Talk to our investment specialist

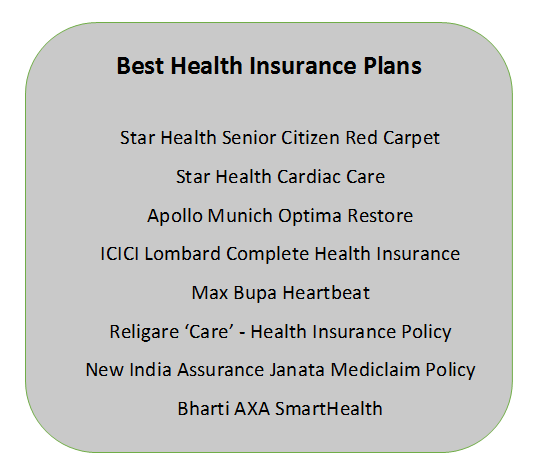

Best Health Insurance Plans

Now that you know how to choose a health insurance plan, you must find out the best health insurance plans to buy. We have listed some of the best health insurance plans offered by the health insurance companies in India. Have a look!

FAQs

1. Will health insurance help you claim insurance benefits?

A: Yes, it helps you claiming insurance benefits under section 80D of the income tax Act of 1961. For example, after the budget of 2018, senior citizens could claim cash benefits of up to Rs. 50,000 on the premiums payable on their medical insurances.

2. Can health insurance effectively reduce your medical expense?

A: Yes, health insurance can effectively reduce your medical insurance. In case of a medical emergency, you will have to pay for everything from ambulance, hospitalization, surgery, medicines, and all other associated expenses. Without proper medical insurance, these expenses can prove to be quite extensive and reduce your savings significantly. But with medical insurance, you can claim the benefit, and your savings will remain untouched.

3. Can I upgrade my health insurance plan?

A: Yes, you can always upgrade your health insurance plan. For example, you can upgrade the plan from single coverage to a family healthcare plan. But you will have to get in touch with the insurance company to understand the process of upgrading medical insurance plans.

4. Can senior citizens apply for health insurances?

A: Yes, senior citizens can apply for health insurance. However, they might have to submit fit certificates to get the insurances and get a reasonable premium rate in some instances.

5. Will the premiums payable change for senior citizens?

A: Usually, the insurance premiums that a senior citizen has to pay for medical insurance are higher than the average individual.

6. Do health plans differ from company to company?

A: Yes, health care plans differ from company to company. The premiums payable differ from company to company, as does the individual insurance companies' coverage.

7. Are there floater health plans?

A: A floater health plan is often known as a family floater health insurance plan. Such a plan covers all members of your family under a single mediclaim policy. Moreover, you do not have to pay different premiums as a single annual premium covers all your family members' medical requirements.

8. Do health care plans cover major surgeries?

A: As per the Insurance Regulatory and Development Authority of India (IRDAI), certain surgeries are covered under health care plans. But while purchasing a health care plan, you have got to know which type of surgeries will be covered. For example, if a surgery is required because the policyholder tried to commit suicide, it will not be covered by the mediclaim policy.

9. Health care plans cover day care expenses?

A: Yes, most mediclaim policies cover day care expenses. Say if a policy holder is hospitalized for a day for an operation like a cataract, then he can claim insurance coverage for a single day's hospitalization.

10. Do health care plans cover maternity expenses?

A: Yes, most health care plans cover maternity expenses. However, there is a ceiling limit up to which the insurance policy will cover the expenses. Beyond the ceiling limit, the expenses have to be borne by the policyholder.

11. Do I need separate health care plans for my family members?

A: You usually do not need to purchase separate health care plans for your family members. You can opt for a comprehensive family health care plan in which even your parents can be covered. However, here the premiums will differ compared to a single health care plan. For that, you will have to get in touch with your insurance company to understand the difference in premiums for individual mediclaim policies and a comprehensive family health care plan.

12. What is no claim bonus?

A: No Claim Bonus (NCB) is a benefit that a policyholder is given by the insurance company to the policyholder if he does not claim benefit every year. The insurance company adds a bonus amount to the policy, which is the NCB.

Conclusion

As you know, prevention is better than cure. Therefore, before any unforeseen medical emergency occurs, safeguard your health with an appropriate health insurance plan. Consider the above-mentioned factors and medical plans before you buy health insurance. Invest wisely, live peacefully!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.