Table of Contents

- What is a Demat Account?

- Why Choose Zerodha?

- Opening a Zerodha Demat Account - Documents Required

- Additional Points to Remember

- Guide to Open Demat Account Online

- Guide To Open Demat Account Offline

- Documents Required Along with the Application Form

- Zerodha Charges

- Zerodha Account Closure

- Final Thoughts

- Frequently Asked Questions (FAQs)

- 1. Is it possible for an individual to have two Zerodha accounts with the same name?

- 2. Is it possible for a Non-Resident Indian (NRIs) to create a Zerodha account?

- 3. Can I use my joint bank account to create a Zerodha Demat and trading account?

- 4. Is it possible to change/modify bank accounts?

- 5. Is it possible to open only a trading account?

- 6. Does Zerodha have Demat Annual Maintenance Charges (AMC)?

Open a Demat Account with Zerodha

Zerodha is a Bangalore-based firm that specialises in stock and commodity trading. It’s the world's largest and most popular online discount brokerage firm, including services in equity, currency, commodities, Initial Public Offerings (IPO), and direct Mutual Funds.

In terms of daily trading volume, client base, and growth, Zerodha is India's biggest discount broker. It’s a low-cost stockbroker with cutting-edge technology. Over 1 million customers use Zerodha, which accounts for over 10% of daily retail trading volumes on the NSE, BSE, and MCX.

What is a Demat Account?

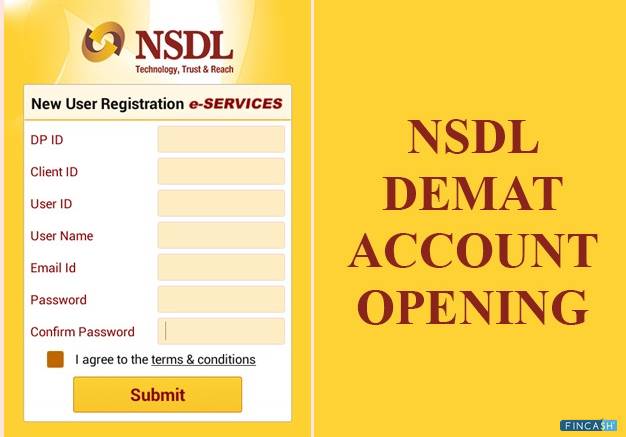

A Demat account functions similarly to a Bank account, but it keeps financial products in digital form rather than cash. National Securities Depository Limited (NSDL) and Central Depository Services Limited (CSDL) are the two depository organisations in India that Handle Demat accounts.

To trade in stock, commodity, or currency, or invest in stocks and mutual funds, you need a Trading Account and Demat account. Zerodha offers a Demat account as one of its services. The Zerodha Demat account is also available as part of a 2-in-1 account, which gives customers access to both a Demat and a trading account.

Why Choose Zerodha?

You can open trading accounts using a number of online trading applications. However, Zerodha stands out as one of India's most rapidly rising discount brokers. The number of active clients has increased significantly, from 15,000 to 600,000 over past years. Below are the benefits which Zerodha offers and the reason to choose the same:

- There is no up-front cost or turnover commitment

- Equity delivery trades costs nothing

- About Rs. 20 or 3%, whichever is lower, is charged on Intraday trading

- There is uniform pricing across all exchanges

- Z-Connect is an interactive blog and portal where you can get answers to all the queries

- Minimum contract or brokerage fees

- Safest stockbroker in India with no debt

- Dedicated support team to ensure a hassle-free experience

- Lower broker risk

- High exchange connectivity rate

- Pi, a next-generation desktop platform that combines trading, charting, and analysis into a single platform, is used

- Kite, a web-based trading platform that is minimalistic, simple, and responsive, is also available

Talk to our investment specialist

Opening a Zerodha Demat Account - Documents Required

The following are the documents needed to open a Zerodha Demat and trading account. It’s recommended to keep the soft copies on hand before applying for accounts because they’ll be required to submit during the application process.

- PAN Card copy

- Aadhar card copy

- Cancelled cheque/ recent bank statement

- Photo or scanned copy of signatures

- Income proof (Required for trading in futures and options)

Additional Points to Remember

- Your aadhaar card must be linked to an active mobile phone number. This is required to finish the eSign-in/Digilocker procedure, which includes OTP verification. If your phone number isn't linked to your Aadhaar card, visit a nearby Aadhaar Seva Kendra to get it linked.

- As proof of income, the listed documents can be used:

- Form-16

- Recent 6-month bank statement

- Recent salary slip

- Networth certificate from a CA

- Income Tax Return Acknowledgement

- Make sure the bank statement you're uploading has a legible account number, IFSC, and MICR code. Your application can be denied if these aren't legible.

- Your name must be clearly written on the cheque.

- Signatures should be done with a pen on a blank piece of paper and should be legible. Your submission will be rejected if you use pencils, sketch pens, or markers.

Guide to Open Demat Account Online

For opening Trading and Demat accounts online, the fee is Rs. 200, and for opening Trading, Demat and Commodity accounts online, the fee is Rs. 300. A step by step breakdown of the process is listed below to make online Demat account opening an easier task.

Step 1: Navigate to the Zerodha account registration page in your browser. Click on the Open Your Account' button. To get started, enter your phone number. Your phone number will receive an OTP. Alternatively, the Sign-up button can be found in the top-right corner of the page. To proceed, simply click on it.

Step 2: To continue, enter the OTP sent to the registered mobile number. You will be required to provide an active email address for additional verification when the mobile number has been successfully verified.

Step 3: Then, click continue after entering the OTP that was sent to your email address.

Step 4: Next, enter your PAN Card number along with the date of birth details in the field provided.

Step 5: Once PAN information is validated, you are required to pay an account opening fee. It costs Rs. 200 to trade in equity, while trading in both equity and commodity costs Rs.300. Proceed to payment after selecting the relevant trade section, which can be done through UPI, credit or Debit Card/net Banking.

Step 6: After successful payment, you'll receive an online Receipt with the payment's Reference Number. To continue, click close. The Aadhaar verification via Digi locker is the next step.

Step 7: Once your Aadhar verification is complete, next you need to enter your details, like father’s name, mother’s name, occupation and so on.

Step 8: After that, you need to link your bank account. Here, you must put in more details, including your bank account number, bank name, branch IFSC code, and MICR code.

Step 9: The next step is IPV (In-person-verification) through webcam/phone, which requires you to show the OTP obtained in front of the webcam.

Step 10: In this step, you are required to submit the necessary documents, such as your bank account information, PAN card, signature, and proof of income (optional).

Step 11: This is the final step, where you must sign your application documents online. By clicking the eSign button, proceed to continue.

Step 12: You need to verify your email after clicking on the eSign equity. There will be two options for logging in, either Google or email. After selection, verify the registered email address with the OTP received.

Step 13: A new page with the “Sign Now” option will pop up after your email verification is done. Click the “Sign Now” button visible at the end of the page. It will redirect you to the National Securities Depository Limited (NSDL) website.

Step 14: Toggle the checkbox to the upper left that says "I hereby..." Then enter your Aadhar number and click send OTP at the bottom of the page. Finally, enter the OTP and verify it.

Step 15: When the previous step is completed and verified, the entire page will have a green backdrop and the text "You have successfully signed the document" will display.

Step 16: After that, you can notice a tick mark will appear on the equity segment, indicating that you've successfully signed up for it. On this page, you will also be able to download the eSigned document.

Step 17: Click on the eSign commodity. It will redirect you to the National Securities Depository Limited (NSDL) website. Then, in the upper left corner, click the checkbox and enter your Aadhar number. An OTP will be sent to your Aadhar-linked mobile number. The documents for the commodity section will also be eSigned after the OTP is entered and confirmed.

(Note: This step is only for applicants who wish to trade in commodity)

Step 18: After the sign up is complete, documents will be verified by the Zerodha team. Once done, you'll receive an email from Zerodha confirming the successful verification. The login credentials will be sent to you in less than 24 hours of receiving this email.

Guide To Open Demat Account Offline

Zerodha offers an option to open Demat accounts offline as well. However, the charges differ when compared to online. For opening Trading and Demat accounts, the fee is Rs. 400, and for opening Trading, Demat and Commodity accounts, the fee is Rs. 600.

Note: For the NRIs account, only Trading and Demat accounts can be opened with a fee of Rs.500. Also, for Partnership, LLP, HUF, or corporate accounts, the fee is Rs. 500 for opening Trading and Demat accounts and Rs. 800 for opening Trading, Demat and Commodity accounts.

Visit the Zerodha website to download the application form. Take a printout, fill it up, sign it and then courier it to Zerodha’s head office address located in Bangalore.

153/154 4th Cross Dollars Colony, Opp. Clarence Public School, J.P Nagar 4th Phase, Bangalore – 560078

Here is the list of application form to open a Demat account offline:

- Application Form 1 - For Trading and Demat account: Equity segment, it includes Power of Attorney (POA) form.

- Application Form 2 - For the commodity segment, it includes the Electronic Contract Note (ECN) form.

- Nomination Form - If you wish to appoint a nominee for your account.

Documents Required Along with the Application Form

- Self-attested photocopy of pan card

- Self-attested address proof (Aadhar card, driving license, voter-id etc)

- Cancelled cheque/Bank statement

- Income proof

- Passport size photographs

Zerodha Charges

For Equity

| Charges | Delivery | Intraday | Futures | Options |

|---|---|---|---|---|

| Transaction Charges | 0.00325% - NSE / 0.003% - BSE | 0.00325% - NSE / 0.003% - BSE | 0.0019% - NSE | 0.05% - NSE |

| GST | 18% on Brokerage + Transaction | 18% on Brokerage + Transaction | 18% on Brokerage + Transaction | 18% on Brokerage + Transaction |

| STT | ₹ 100 per Lacs | Sell-Side, ₹ 25 per Lacs | Sell-side, ₹ 10 per Lacs | Sell-side, ₹ 50 per Lacs |

| SEBI Charges | ₹ 10 per crore | ₹ 10 per crore | ₹ 10 per crore | ₹ 10 per crore |

For Commodity

| Charges | Futures | Options |

|---|---|---|

| Transaction Charges | Group A - 0.0026% / Group B - 0.00005% | - |

| GST | 18% on Brokerage + Transaction | 18% on Brokerage + Transaction |

| STT | Sell-side, 0.01% for Non Agri | Sell-side, 0.05% |

| SEBI Charges | Agri - ₹ 1 per crore; non-Agri ₹ 10 per crore | ₹ 10 per crore |

For Currency

| Charges | Futures | Options |

|---|---|---|

| Transaction Charges | 0.0009% - NSE / 0.00022% - BSE | 0.00325% - NSE / 0.001% - BSE |

| GST | 18% on Brokerage + Transaction | 18% on Brokerage + Transaction |

| STT | - | - |

| SEBI Charges | ₹ 10 per crore | ₹ 10 per crore |

Zerodha Account Closure

To avoid Annual Maintenance Charges (AMC) and account misuse, you are requested to close their account (If not using the same). The account closure process is done manually due to regulatory constraints. A request for account closure must be submitted. Here are the steps required to be done for account closure:

- Visit the Zerodha website, download the account closure form

- Print a copy of the form, fill it out and sign it

- Along with the form, attach unused DIS (Delivery Instruction Slip)

- Send it to Zerodha’s registered office

Final Thoughts

By delivering reliable and technologically sophisticated trading services over the last decade, Zerodha has gained the confidence and trust of the trading community. It is investor-friendly because of the salient features like a user-friendly interface, an integrated Back Office (Console), and a beginner's education platform (Varsity). Zerodha is one of the finest alternatives to take into consideration if you want to create a brokerage account with a recognised company that offers inexpensive brokerages and a quick trading interface.

Frequently Asked Questions (FAQs)

1. Is it possible for an individual to have two Zerodha accounts with the same name?

A. No, SEBI laws state that a person can only have one trading or Demat account with a particular broker. However, you can establish a new trading or Demat account with another broker using the same name and PAN number.

2. Is it possible for a Non-Resident Indian (NRIs) to create a Zerodha account?

A. Yes, it provides NRIs with two-in-one account services, but they must first create an NRE/NRO bank account with HDFC Bank, Axis Bank, or Yes Bank/Indusind Bank.

3. Can I use my joint bank account to create a Zerodha Demat and trading account?

A. Yes, you can link your joint bank account to your Zerodha trading and Demat account.

4. Is it possible to change/modify bank accounts?

A. Yes, you can change the bank account linked to your Zerodha trading and Demat account. It can be done by filing an account modification request that is available only in offline mode.

5. Is it possible to open only a trading account?

A. No, Zerodha doesn’t allow you to open only a trading account. It rather asks you to open a trading and Demat account.

6. Does Zerodha have Demat Annual Maintenance Charges (AMC)?

A. Yes, it charges Rs. 300 as AMC.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like