Table of Contents

What is Year-Over-Year (YOY)?

Year-Over-Year (YOY) is referred to as a frequently used financial comparison that helps to compare two or multiple measurable events on an annual Basis. By looking at the YOY performance, you get to evaluate whether the Financial Performance of a company is worsening, static or improving.

For instance, in financial reports, you may get to read that a specific business stated that its revenues decreased for the third quarter. On the basis of YOY, it means that the company is facing a decline for the last three years.

Explaining Year-Over-Year (YOY)

YOY comparison is an effective and popular method to gauge the financial performance of a company along with the investments’ performance. Basically, a YOY basis can help compare any measurable event that is repeated annually. Some of the common YOY comparisons include monthly, quarterly, and annual performances.

Advantages of Year-Over-Year (YOY)

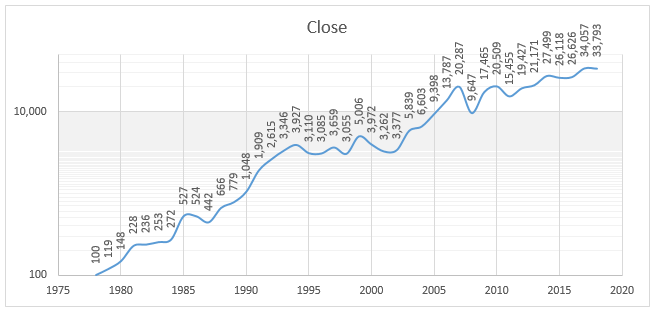

YOY measurements simplify the cross-comparison of data sets. Using YOY data for the first-quarter revenue of a company, an investor or a financial analyst get to compare data stating years of first-quarter revenue and ascertain whether the revenue for the company is decreasing or increasing.

For instance, suppose for the third quarter of 2020, XYZ company reported a net loss of Rs. 10 million, year-over-year. Moreover, the company also reported net Earnings of Rs. 170 million in the third quarter of 2019, which signifies a decrease in the XYZ earnings from the comparable, annualized period.

Thus, this YOY comparison is also essential for investment portfolios. Investors, once they get to examine the performance of YOY, can easily see how there will be changes in the company’s output across different time periods.

Talk to our investment specialist

Why is Year-over-Year (YOY) Important?

YOY comparisons are prevalent when it comes to analyzing the performance of a company because they assist in mitigating seasonality, which is a Factor that can easily influence a majority of businesses.

Profits, sales and other additional financial metrics continue to change during varying periods in a year as most of the businesses get to experience a low demand season and a peak season. For instance, those who have a peak demand season during holidays may fall in the other quarters of the year and vice versa.

To adequately quantify the performance of a company, it makes sense to compare profits and revenue year-over-year. Also, it is even essential to compare the fourth-quarter performance of one year to the fourth-quarter performance of other years to get a better understanding.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.