Table of Contents

Defining Pump and Dump

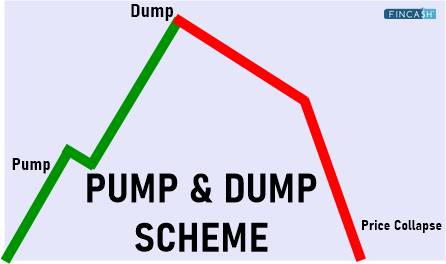

Pump and dump is an illegal scheme to boost vulnerable stocks' prices using misleading promotions or false statements. There are two parts to this scheme:

Pump: Scammers or fraudsters promote by posting messages online which encourages traders to buy shares quickly by claiming they have access to confidential data.

Dump: Once the prices of the shares increase, the perpetrators sell at a high rate. New traders then lose their money if the prices drop dramatically after the traders sell their shares.

Such a scheme, after voluminous selling, share’s price dips sharply, leaving many investors in heavy loss.

Pump and Dump Scam

Pump-and-dump was traditionally done through cold calling. With the advent of technologies, traders use social media,messaging apps, investment newsletters, online advertisement, email, direct mail, magazines, radio, etc., to spread misinformation or rumours about a company’s stock price. When the share price has been raised, the promoters sell at high prices.

small-cap and microcap companies are more vulnerable to pump and dump schemes because there are low trading volumes and limited corporate information. Also this scheme is increasingly found in the cryptocurrency Industry.

This scam is a type of economic bubble where the intention is to deliberately perpetuate unlawful activity. The Securities and Exchange Board of India (SEBI) has a robust system in place to track pump and dump scams. It has set up a separate vigilance cell, called Corporation Finance Investigation Department, to tackle such frauds and cases.

Talk to our investment specialist

How to Spot Pump and Dump Scheme?

Often the regulatory bodies come up with tips to prevent being conned. But, as a trader it is essential to sharpen your research from time to time so you don’t get caught in the net of scammers.

When you get an unsolicited investment email, it means that they don’t have any idea about your personal trading objectives and risk tolerance. They are simply enticing as many as possible into buying a security. Such mails come with forceful language where words like ‘BUY NOW’, ‘Can’t miss an opportunity., etc. are highlighted. The best way to deal with such mails is to ignore and not pay attention.

Whenever there is a hot piece of information regarding a stock, try learning about it, do your thorough research, and double check before making any trading decisions.

Try to collect official announcements of the company, along with public information.

Timely educate yourself about stock markets, watch videos and read news about companies, Market trends, etc.

Strictly keep yourself from noisy trends and spammy communications.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.