Table of Contents

What is Risk Profile?

A risk profile is one of the most important things to analyse before making an investment. Ideally, experienced investors would know their risk ability, but a newbie would have a very little idea about the risk involved with Mutual Funds or the right mutual fund as per their risk appetite.

In many certains, most of the investors were overconfident at the time of Investing and they turn extremely nervous as the Market becomes volatile. Hence, knowing your risk profile remains at the center stage of any investment.

Especially in the case of mutual fund investment, the suitability of a product largely depends upon the characteristics of the investor. Investors should know their investment objective, how long they wish to invest, ability to tolerate risk, minimum investment amount, etc.

Risk Profiling Procedure

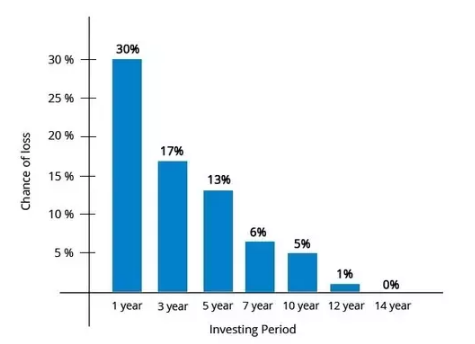

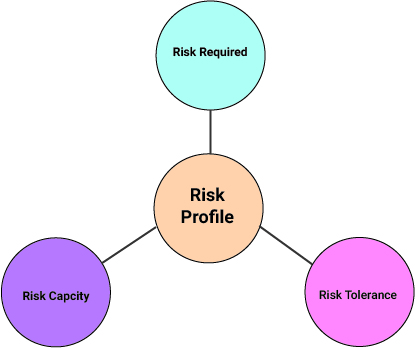

Risk– with respect to investing– is the Volatility or the fluctuation of the prices and/or investment returns. So risk assessment or risk profiling is the systematic evaluation of all the potential risks involved in the investment activity. Risk profiling gives you a clear picture of your risk appetite, i.e. evaluating your risk capacity, your required risk, and your risk tolerance. We will elaborate each term separately.

When an investor conducts their risk profiling, they have to answer a set of questions designed specifically for the purpose. The set of questions differs for different Mutual Fund Houses or distributors. The score of investor after answering the questions determines their Range of taking a risk. An investor can be a high-risk taker, mid-risk taker or can be a low-risk taker.

Risk Identification and Risk Analysis

Once the risk is identified by the risk assessment procedure, that risk is then analysed. It is divided into three broad categories -

Risk Capacity

Risk capacity is the quantitative measure of taking a risk. It maps your current and future financial position which includes factors like Income, savings, expenses, and liabilities. With these factors evaluated, the rate of returns required to reach your Financial goals is determined. In simple words, it is the level of the Financial Risk you can think of affording.

Risk Required

Risk required is determined by your risk capacity. It is the risk associated with the returns needed to reach your financial targets with available resources. Risk required educates you about what you could potentially be taking on with a certain investment. It gives you an honest perception and a clear picture about the type of the risk you are about to take.

Risk Tolerance

Risk tolerance is the level of risk you are comfortable with. It is simply your willingness to accept the fluctuations in the market that may or may not occur in order to achieve your financial objectives. Risk tolerance can be broadly divided three types

- High-Risk Tolerance

- Mid-Risk Tolerance

- Low-Risk Tolerance

Talk to our investment specialist

Risk Assessment Methodology- Factors & Influence

To determine the category in which you fall there are certain parameters considered

| Factor | Influence on Risk Profile |

|---|---|

| Family Information | |

| Earning Members | Risk appetite increases as the number of earning members increases |

| Dependent Members | Risk appetite decreases as the number of dependent members increases |

| Life expectancy | Risk appetite is higher when life expectancy is longer |

| Personal Information | |

| Age | Lower the age, higher the risk that can be taken |

| Employability | Those with steady jobs are better positioned to take risk |

| Psyche | Daring and adventurous people are better positioned mentally, to accept the downsides that come with risk |

| Financial Information | |

| Capital base | Higher the capital base, better the ability to financially take the downsides that come with risk |

| Regularity of Income | People earning regular income can take more risk than those with unpredictable income streams |

Best Mutual Funds As Per Risk Appetite

Mutual Funds for Conservative Investors

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Sub Cat. Franklin India Ultra Short Bond Fund - Super Institutional Plan Growth ₹34.9131

↑ 0.04 ₹297 1.3 5.9 13.7 8.8 0% 1Y 15D Ultrashort Bond Aditya Birla Sun Life Savings Fund Growth ₹550.329

↑ 0.08 ₹18,981 2.1 4.2 8.1 7.4 7.9 6.92% 4M 13D 5M 8D Ultrashort Bond ICICI Prudential Ultra Short Term Fund Growth ₹27.7879

↑ 0.00 ₹16,269 1.9 4 7.6 7.1 7.5 6.88% 5M 12D 8M 8D Ultrashort Bond SBI Magnum Ultra Short Duration Fund Growth ₹5,992.45

↑ 0.54 ₹16,434 1.8 3.9 7.6 7.1 7.4 0.49% 5M 16D 6M 25D Ultrashort Bond Invesco India Ultra Short Term Fund Growth ₹2,705.23

↑ 0.15 ₹1,227 1.8 4 7.5 6.9 7.5 6.59% 5M 16D 5M 24D Ultrashort Bond Kotak Savings Fund Growth ₹43.009

↑ 0.00 ₹15,401 1.8 3.9 7.4 6.9 7.2 6.63% 5M 23D 6M Ultrashort Bond Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 7 Aug 22

Mutual Funds for Low to Moderate Risk Takers

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Sub Cat. HDFC Corporate Bond Fund Growth ₹32.7504

↓ 0.00 ₹35,493 2.1 5 9.4 8 8.6 6.83% 4Y 2M 5D 6Y 3M 18D Corporate Bond Aditya Birla Sun Life Corporate Bond Fund Growth ₹113.561

↓ -0.02 ₹28,436 1.9 4.9 9.3 8 8.5 6.84% 4Y 18D 6Y 1M 20D Corporate Bond HDFC Banking and PSU Debt Fund Growth ₹23.159

↓ 0.00 ₹6,114 2.2 5.1 9.1 7.5 7.9 6.72% 3Y 10M 17D 5Y 5M 16D Banking & PSU Debt UTI Banking & PSU Debt Fund Growth ₹22.0671

↓ 0.00 ₹800 2.4 5 9 7.5 7.6 6.44% 1Y 11M 12D 2Y 2M 23D Banking & PSU Debt PGIM India Short Maturity Fund Growth ₹39.3202

↓ 0.00 ₹28 1.2 3.1 6.1 4.2 7.18% 1Y 7M 28D 1Y 11M 1D Short term Bond Nippon India Prime Debt Fund Growth ₹60.4531

↓ -0.01 ₹8,771 2.4 5.4 9.9 8.1 8.4 6.84% 3Y 9M 25D 5Y 7D Corporate Bond Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 9 Jul 25

Mutual Funds for Moderate to High Risk Takers

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Sub Cat. Aditya Birla Sun Life Medium Term Plan Growth ₹40.0846

↓ 0.00 ₹2,504 2.5 7.6 14 14.9 12.3 10.5 Medium term Bond ICICI Prudential Gilt Fund Growth ₹103.44

↓ -0.02 ₹7,347 1.7 5.3 9.5 8.9 6.3 8.2 Government Bond Nippon India Strategic Debt Fund Growth ₹15.8621

↓ 0.00 ₹103 4 6.9 11.4 8.3 8.3 8.3 Medium term Bond SBI Magnum Gilt Fund Growth ₹66.1449

↓ -0.02 ₹12,573 0.3 4 8 8.2 6 8.9 Government Bond Axis Strategic Bond Fund Growth ₹28.1723

↓ 0.00 ₹1,945 2.2 5.3 9.6 8.1 7 8.7 Medium term Bond Axis Gilt Fund Growth ₹25.6449

↓ -0.01 ₹770 0.6 4.4 8.9 8.1 6 10 Government Bond Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 9 Jul 25

Mutual Funds for High Risk Takers

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Sub Cat. Nippon India Small Cap Fund Growth ₹173.528

↑ 0.81 ₹63,007 20 2 -1.5 29 37.2 26.1 Small Cap Motilal Oswal Midcap 30 Fund Growth ₹102.825

↓ -0.24 ₹30,401 18.5 -4.3 6 32.6 35.6 57.1 Mid Cap L&T Emerging Businesses Fund Growth ₹83.9103

↑ 0.18 ₹16,061 22.8 -2.1 -2.9 25.7 34.6 28.5 Small Cap Franklin India Smaller Companies Fund Growth ₹176.97

↑ 0.76 ₹13,545 20.4 1.7 -3.4 28.9 34.1 23.2 Small Cap HDFC Small Cap Fund Growth ₹142.057

↑ 0.59 ₹34,032 23 4.1 3.8 28 33.7 20.4 Small Cap Edelweiss Mid Cap Fund Growth ₹102.577

↓ -0.16 ₹10,028 20 4.9 8.1 29.7 32.6 38.9 Mid Cap Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 9 Jul 25

The Importance of Risk Profiling

Risk profiling gives you the clear picture of all the risk and returns expectations from an investment. It helps you create a focused strategy to invest in a manner that will help you reach your financial goals. Your financial advisor is expected to give you all the necessary information regarding risk assessment and help you carry out the same. Securities and Exchange Board of India (SEBI) and The Association of Mutual Funds of India (AMFI) both have stated the guidelines and norms for carrying out a detailed risk assessment of the investor and then suggest them the appropriate schemes. Such approach helps in reducing the losses that might occur if an investor invests in a scheme that is out of their risk appetite.

How to Invest in Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.