Table of Contents

- Services of UAN EPFO e Sewa

- Manage

- Online Services

- How to Create Account on the UAN Member Portal?

- UAN Member Portal for Employees

- UAN Member Portal for Employers

- Benefits of UAN

- Know the Status of your UAN

- Steps to Change Password on the UAN Member Portal

- How to change personal information on the UAN portal?

- Customer Service at UAN

- Conclusion

UAN Member Portal

Every employee contributing to the EPF gets a 12-digit Universal account number (UAN) by the Employee Provident Fund Organisation (EPFO). The Employment of the Government of India and Ministry of Labour is responsible for authenticating the process. The employees' UAN remains the same throughout their career, regardless of how many jobs they change.

EPFO provides a new member identification number, also known as EPF Account (ID), to every employee changing a job. This number is linked with the UAN. As an employee, you can also submit a request to your latest employer for a new member ID by submitting your UAN. After the member ID gets generated, it is linked to the UAN.

When changing a job, the person must use a different member ID. To make EPF transfers and withdrawals easier, all of these member IDs are connected to the employee's UAN.

Services of UAN EPFO e Sewa

The UAN Login Member Portal provides various services relating to your EPF account. Let's have a look at all of them.

EPF Profile

Your complete EPF profile can be found on the UAN employee site. This part contains information about you, such as your UAN, DOB, name, gender, etc. Some of the fields are modifiable, and this can be done by logging in with an OTP.

Services History

This category contains the history of your working companies. You will be able to see the following information:

- Organization Names

- Member IDs

- Joining and Termination dates

- Other details regarding the Employee Pension Scheme.

UAN Card

You can view and download your UAN Card from this page. It is helpful for EPF-related work that needs to be done offline.

EPF Passbook

The amount of employees' and employers' contributions to the fund can be seen here. The contribution of funds to the pension system is also available.

Manage

Basic Information

This area is for revising the introductory information, updating new details, including education, etc.

KYC

This part allows you to update your Know Your Customer information (KYC). These may include Bank account details, PAN, driver's licence number, passport number, etc. With the KYC information, you must attach supporting papers, which the employer will check. Details will be modified immediately once they have been confirmed.

Talk to our investment specialist

Online Services

Claim (Form 31, 19, and 10C)

The EPFO has introduced claim forms to make it easier to withdraw PF funds in whole or in part. The three forms in this claim section are Form 31, Form 19, and Form 10C. However, your Aadhaar must be linked to your UAN to claim full or partial withdrawal through Composite Claim Form.

Transfers

You can also request a transfer of your PF balance from an older account to your current one. Make sure your KYC details are up-to-date before requesting a PF transfer. EPF Claim Status tracking: You can check the status of your EPF claim on the UAN Login Portal.

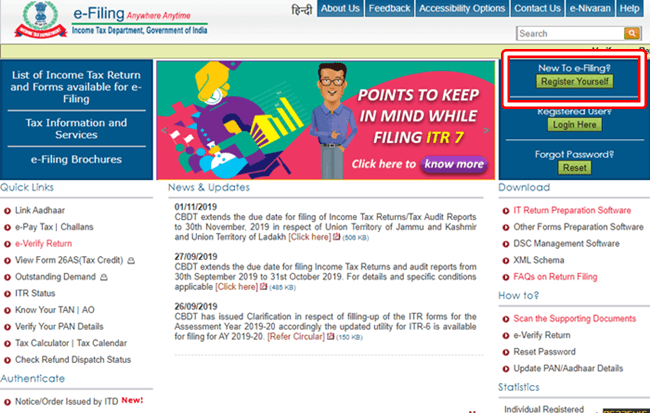

How to Create Account on the UAN Member Portal?

Before using the portal, you must first activate your UAN. You can follow the instructions below to do so:

- Go to the EPF Member Portal.

- In the "Important Links" area, click the "Activate UAN" link.

- Click "Get Authorization PIN" after entering your information.

- Your EPFO-registered cellphone number will receive a PIN.

- To activate your UAN account, enter this PIN.

- You will receive an SMS containing a password generated by the system.

- Using your UAN and password, you can now access your EPF account.

UAN Member Portal for Employees

First, you must have an active UAN. To do so, go to the EPFO Member Portal and click on 'Activate UAN'. Now enter your UAN, mobile number, member id, PAN, Aadhaar, name, DOB, and email id. To get the PIN delivered to the registered mobile number, click "Get Authorization PIN". To authenticate your request, enter this PIN and create a username and password for the UAN portal.

The following are the methods for UAN Member login as an employee:

- Go to the EPFO website.

- Select 'For Employees' from the 'Services' menu.

- Go to 'Member UAN/Online Services.'

- Fill out all relevant information on the redirected page, including your UAN, password, as well as captcha code.

- Select 'Sign in' from the drop-down menu.

UAN Member Portal for Employers

Employers follow a somewhat similar procedure as employees while logging into the EPFO portal. However, the login pages for them are different.

The steps are as follows:

- The employer must go to the EPFO Employer Login page, displaying the Establishment Panel.

- Sign in with your username and password on the right-hand side.

- The next page will be the main page of the employer's EPFO portal, where the employer can approve the employee's KYC details.

Benefits of UAN

Employees get benefits from UAN in a variety of ways, as listed below:

- With UAN, the former organization's PF is transferred to the new PF account.

- The employee must provide his UAN and KYC to the new employer, and the previous PF account will be moved to the new PF account once the verification is completed.

- Employees receive SMS alerts anytime their employer adds funds after registering at the UAN portal.

Know the Status of your UAN

An employee with an EPF account can find out their UAN status by following these steps:

- Go to the UAN site

- Select 'Know your UAN Status' from the drop-down menu.

- You can use your Member ID, PF number, Aadhaar, or PAN.

- If you select the member ID option, you will be prompted to enter additional information, including your state of residence and your place of business.

- Other required information includes your DOB, contact details, name, and captcha code.

- Select 'Get Authorization Pin' from the drop-down menu.

- You will get a One-Time Password (OTP) on your registered mobile number. After entering the OTP, click on the 'Validate OTP and get UAN' option.

- Your UAN number, as well as the status of your application, will be visible on the dashboard.

Steps to Change Password on the UAN Member Portal

Using the methods below, you can reset or update your password on the UAN Member Portal:

- In the EPF UAN login section of the portal, click Forgot Password.

- Now, type in your UAN and the captcha code.

- Enter the OTP sent to your registered mobile number.

- Submit the form by clicking the Submit option.

- For EPFO UAN login, enter your new password.

How to change personal information on the UAN portal?

You can update your personal information, such as your phone number and email address, in the UAN employee portal by following these steps:

- Log in to the UAN portal.

- Change Contact Information can be found under the Manage tab on the UAN member home page.

- To change your information, enter the Authorization PIN issued to your registered phone number in the box provided.

Customer Service at UAN

If you need assistance with your EPF account, you can contact UAN e Sewa customer service using the following contact information:

- Phone Number:

1800 11 8005(available from 9:15 a.m. to 5:45 p.m) - Email:

employeefeedback@epfindia.gov.in - Official website: www[dot]epfindia[dot]gov[dot]in

Conclusion

Having an account in the UAN portal and having an EPF account is highly beneficial for the employees in terms of guaranteeing a secure deposit and providing the pension scheme. The details on this account can easily be accessed and edited by anyone, and it also ensures transparency in terms of saved funds.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.