Fincash » Coronavirus- A Guide to Investors » Will Lockdown End on April 14?

Table of Contents

Coronavirus Outbreak: Will Lockdown End on April 14, 2020?

Prime Minister Narendra Modi declared a nationwide lockdown on March 25, 2020. Since then there has been fear and concern regarding the economic slowdown in the country. People were spotted panic buying and drawing back investments.

PM Modi also held a video conferencing with Chief Ministers of various Indian states to submit a workable solution to undertake post-April 14, 2020.

The Central government is strategizing an exit plan and empowered 11 committees headed by the Home Secretary. The committee made of officials from railways, pharmaceutical, health, commerce, civil aviation, DEPT officials and business representatives met on April 7, 2020, to discuss and decide the course of action to undertake.

Plan of Action

The current situation indicates that the government is not going to opt for the blanket lifting of the lockdown. According to recent reports, the Centre is planning for a strategic micro-managed exit.

The empowered committee discussed a three-pronged strategy to exit the lockdown.

The government thinks that the lockdown has proved to be effective when it comes to social distancing. State governments have appeal to the Centre to extend the lockdown, however, the decision is yet to be taken.

However, the state governments have responded with feedback to the empowered committee regarding the closure of religious activities, schools and colleges till June. There will be a closure of hotel, restaurants and bars till the situation improves and public events like weddings, funerals, corporate meetings in person will be suspended.

Talk to our investment specialist

Industries Affected

Migrant factory workers are leaving the major cities to travel back to their hometown during the lockdown. This poses a big problem for the Manufacturing companies to start with the labour force once the lockdown is taken up.

The auto ancillary Industry is one of the worst-hit due to the migration. It is suspected that it will need at least 3 months to get back to normal and despite the situation turning back to normal, the production output will not be more than 30%.

The Indian auto industry contributes 2.3% of the GDP and has provided employment to 5 million people. In 2018-19, the auto industry saw a growth rate of 14.5%. A turnover of $57.10 billion was witnessed. In 2019, the exports showed a growth rate of 17.1% that is $15.16 billion.

Proposals by the Committee

The committee has come up with a few proposals to tackle the issue.

Proposal 1: The committee proposed dividing the country into three zones, namely Green, Yellow and Red. This segregation would be based on the areas’ exposure to risk to Covid-19.

Green Zone: Areas marked green will be opened up and will be the core of most economic activity.

Yellow Zone: Areas marked yellow could start with production and economic activity slowly and steadily.

Red Zone: Areas marked Red will continue with the lockdown for some more days.

Proposal 2: The committee discussed a proposal where migrant labourers could be transported back to the cities in trains, ensuring social distancing after being checked thoroughly for symptoms. Local air travel could also begin with standard operating procedures.

Proposal 3: The committee discussed another proposal that was industry-specific and that each industry should come up with their own set.

Is Another Lockdown a Good Option?

According to reports, India’s daily Gross Domestic Profit (GDP) is $8 billion. The 21-day lockdown will cause a loss of around $168 Billion and 30-day lockdown will cause a loss of $250 billion. Therefore, the government is planning a slow and strategic lifting of the lockdown.

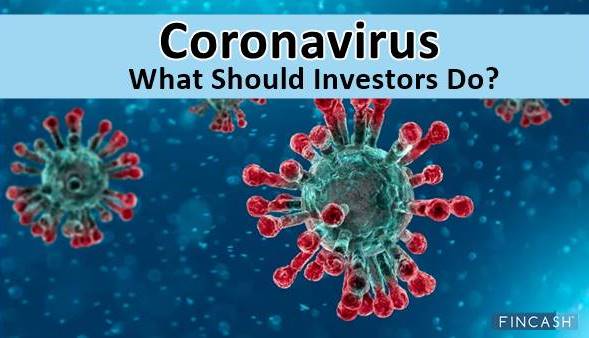

Is this a Good Time to Invest?

For investment, the current time is good since stocks are available at cheaper prices. Consider investing in Mutual Funds, government Bonds, SIPs, Gold, etc., to reap benefits in the long run. Don’t panic regarding the ongoing pandemic and withdraw investments. The global Market is taking every effort to bounce back.

Best Performing SIP Funds to Invest FY 25 - 26

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Infrastructure Fund Growth ₹167.07

↓ -1.36 ₹7,435 100 -10.8 -13.2 2.4 28.3 28.4 27.4 ICICI Prudential Technology Fund Growth ₹195.26

↓ -0.09 ₹14,101 100 -8.2 -5.5 7.8 9.1 25.9 25.4 Nippon India Power and Infra Fund Growth ₹294.956

↓ -1.46 ₹7,001 100 -15.9 -20.4 -3.7 27.3 25.5 26.9 IDFC Infrastructure Fund Growth ₹42.592

↓ -0.27 ₹1,641 100 -16.3 -24.2 0.8 24.1 25.5 39.3 ICICI Prudential Dividend Yield Equity Fund Growth ₹46.82

↓ -0.12 ₹4,835 100 -6.8 -10 5.2 21.5 25.4 21 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 25 Feb 25 200 Crore in Equity Category of Mutual Funds ordered based on 5 year CAGR returns.

Conclusion

The Government of India is undertaking every effort to free the country of Covid-19. It expects the citizens to support it in this fight by staying away from fake news and panic buying. Various initiatives have been undertaken to overcome economic slowdown and market issues. Investors should take up to extensive research regarding investment options and invest while the stocks are still easier to buy.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.