Table of Contents

What is Hedonic Pricing?

Hedonic pricing is a pricing model that finds price determinants based on the idea that price is determined by internal and external aspects of the sold object.

Hedonic pricing models are frequently employed to assess quantitative values for environmental or ecosystem services that directly impact property prices. Following a data collection period, this type of valuation may necessitate a high level of statistical skill and model formulation.

Briefly Understanding Hedonic Pricing

The primary application of the hedonic pricing method is in the Real Estate Market. Here, the price of a building or piece of Land is determined by internal and external factors such as the size, appearance, features such as solar panels or state-of-the-art faucet fixtures, condition of the property, and the surrounding environment.

The hedonic pricing model is used to calculate the impact of each aspect on the property's market price. If non-environmental elements are adjusted for (kept constant) in this type of model, any remaining price variances will represent differences in the good's external surroundings. A hedonic pricing model for valuing assets is reasonably simple because it is based on actual market prices and complete, publicly available data sets.

Models of Hedonic Regression and Analysis

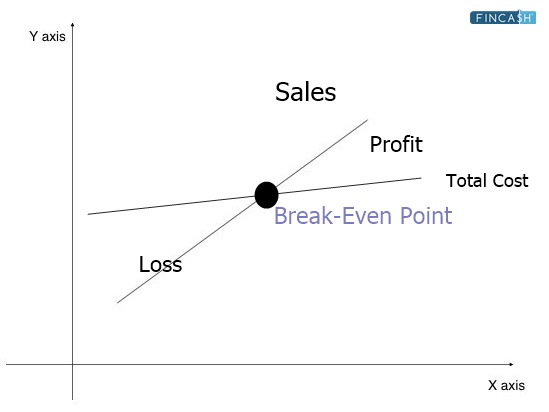

Hedonic regression analysis is divided into two components.

The first stage establishes a link between an asset's worth or price (which would be the dependent variable in the analysis) and the independent explanatory variables (which include the property's features, location features, and environmental qualities).

The hedonic price is the price variation that occurs due to changes in any of the item or asset's qualities. The asset's additional cost is the hedonic price, based on the additional benefit gained from the property's qualities.

The second component of hedonic regression is examining the households' willingness to pay, taking into account their Income and preferences. The willingness to pay is determined by the size of the property, the household's income, and preferences based on personal traits such as age, family size, race, and social background, among others.

Talk to our investment specialist

Hedonic Pricing Method's Advantages

The hedonic pricing approach can be used to calculate values and draw conclusions depending on specific options. The fundamental premise supports the model's Efficiency and dependability that property markets evolve and respond to new or existing information. The model is flexible and may be set up to account for a variety of possible links between an asset or property and environmental quality and other external factors.

Overall, the hedonic pricing approach provides for the calculation of a property's Fair Value because it accounts for a variety of external factors that may impact the asset's price and a more straightforward rationale for price changes due. The model is popular in the housing market because of its ability to accommodate many circumstances, flexibility, and features in evaluating a fair property price.

Hedonic Pricing Models' Limitations

The use of hedonic pricing systems has five significant disadvantages. They may include information availability and knowledge, measurement validation, market restrictions, co-linearity, and price Volatility.

Hedonic models imply and necessitate the necessity for all concerned persons to have information about all positive and negative property attributes that may influence the acquisition of a property regarding information and knowledge. In actuality, this isn't always the case.

When it comes to measurement validation, it's critical that the independent variable measures be superior and not based on proxy measures, as this might lead to model result inaccuracies – i.e., incorrect coefficient generation.

Furthermore, market constraints are seen as a disadvantage of the hedonic pricing model, which presupposes that there are various properties accessible and that consumers can choose their favourite property based on their desired attributes. It isn't always the case, though. Because it might be difficult to separate certain variables in hedonic pricing models, multicollinearity can emerge.

Furthermore, hedonic pricing models assume that market prices vary in response to changes in attributes; nevertheless, prices may lag in practice.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.