മികച്ച ലാഭവിഹിതം നൽകുന്ന ബാലൻസ്ഡ് മ്യൂച്വൽ ഫണ്ടുകൾ 2022

ബാലൻസ്ഡ് ഫണ്ട് ആകുന്നുമ്യൂച്വൽ ഫണ്ടുകൾ മൊത്തത്തിൽ നല്ല വരുമാനം ലഭിക്കുന്നതിന് അവരുടെ ആസ്തിയുടെ 65% ഇക്വിറ്റികളിലും ശേഷിക്കുന്ന ആസ്തികൾ ഡെറ്റ് ഉപകരണങ്ങളിലും നിക്ഷേപിക്കുന്നു. ഒരു എടുക്കാൻ തയ്യാറുള്ള നിക്ഷേപകർക്ക് ബാലൻസ്ഡ് മ്യൂച്വൽ ഫണ്ടുകൾ പ്രയോജനകരമാണ്വിപണി ചില ഫിക്സഡ് റിട്ടേണുകൾക്കായി നോക്കുമ്പോൾ റിസ്ക്. ഇക്വിറ്റികളിലും സ്റ്റോക്കുകളിലും നിക്ഷേപിച്ച ആസ്തികൾ മാർക്കറ്റ്-ലിങ്ക്ഡ് റിട്ടേൺ വാഗ്ദാനം ചെയ്യുമ്പോൾ ഡെറ്റ് ഉപകരണങ്ങളിൽ നിക്ഷേപിച്ച ആസ്തികൾ സ്ഥിരമായ റിട്ടേൺ വാഗ്ദാനം ചെയ്യുന്നു. ഇക്വിറ്റി, ഡെറ്റ് എന്നിവയുടെ സംയോജനമായതിനാൽ, നിക്ഷേപകർ വളരെ ശ്രദ്ധാലുവായിരിക്കണംനിക്ഷേപിക്കുന്നു ഈ ഫണ്ടുകളിൽ. ഈ തരത്തിലുള്ള മ്യൂച്വൽ ഫണ്ടുകളിലെ ഡിവിഡന്റ് ഓപ്ഷൻ യഥാർത്ഥത്തിൽ നല്ലതായിരിക്കും, കാരണം അവ വരുമാനം സൃഷ്ടിക്കുകയും മിച്ചം ഉണ്ടാകുമ്പോൾ പണം നൽകുകയും ചെയ്യുന്നു, ഈ രീതിയിൽ സ്ഥിരതയുള്ള നിക്ഷേപകർക്ക് ഇത്തരത്തിലുള്ള ഓപ്ഷൻ നല്ലതാണ്.വരുമാനം അവരുടെ നിക്ഷേപങ്ങളിൽ നിന്ന്. 2022 വർഷത്തേക്ക് ബാലൻസ്ഡ് മ്യൂച്വൽ ഫണ്ടുകൾ നൽകുന്ന ചില മികച്ച ലാഭവിഹിതം ചുവടെയുണ്ട്

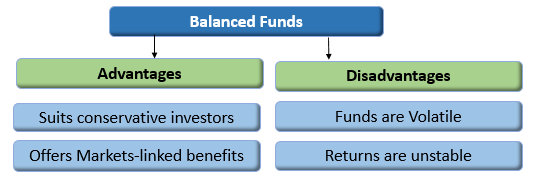

മികച്ച ബാലൻസ്ഡ് ഫണ്ടുകളുടെ ഗുണങ്ങളും ദോഷങ്ങളും

പ്രയോജനങ്ങൾ

- ആസ്തിയുടെ 35-40% നിക്ഷേപിച്ച് സ്ഥിരമായ വരുമാനം നൽകുന്നുസ്ഥിര വരുമാനം ഓപ്ഷനുകൾ.

- ആസ്തിയുടെ 60-65% ഇക്വിറ്റികളിൽ നിക്ഷേപിക്കുന്നതിലൂടെ വിപണി-ലിങ്ക്ഡ് റിട്ടേൺ വാഗ്ദാനം ചെയ്യുന്നു.

- മിതമായ റിസ്ക് എടുക്കാൻ തയ്യാറുള്ള യാഥാസ്ഥിതിക നിക്ഷേപകർക്ക് അനുയോജ്യം.

ദോഷങ്ങൾ

- ഇക്വിറ്റികളിൽ നിക്ഷേപിക്കുന്ന ഫണ്ടുകൾ അസ്ഥിരവും ഉയർന്ന അപകടസാധ്യതയുള്ളതുമാണ്ഘടകം.

- സംയോജിത റിട്ടേണുകൾ (കടത്തിന്റെ റിട്ടേണുകളുംഇക്വിറ്റി മ്യൂച്വൽ ഫണ്ടുകൾ) ദീർഘകാലാടിസ്ഥാനത്തിൽ വളരെ നല്ല വരുമാനം നൽകിയേക്കില്ല.

Talk to our investment specialist

സ്ഥിരമായ വരുമാനത്തിനായി ബാലൻസ്ഡ് മ്യൂച്വൽ ഫണ്ടുകൾ നൽകുന്ന മികച്ച 6 ഡിവിഡന്റ്

Fund NAV Net Assets (Cr) Rating 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) UTI Multi Asset Fund Normal Dividend, Payout ₹30.218

↓ -0.13 ₹6,720 ☆ 1 5 12.5 19.2 14.4 10.1 ICICI Prudential Multi-Asset Fund Normal Dividend, Payout ₹35.7343

↑ 0.14 ₹78,179 ☆☆ 1.5 6.8 16.7 19.1 20.9 18.6 Edelweiss Multi Asset Allocation Fund Normal Dividend, Payout ₹63.69

↑ 0.49 ₹3,480 ☆ -3.8 -1.8 5.8 18.2 19.1 6 JM Equity Hybrid Fund Normal Dividend, Payout ₹32.6755

↑ 0.24 ₹785 ☆ -5 -4.7 1 17.2 16 -3.1 BOI AXA Mid and Small Cap Equity and Debt Fund Normal Dividend, Payout ₹31.41

↑ 0.34 ₹1,349 -3.7 -5.7 0.4 16.8 18 -0.9 HDFC Balanced Advantage Fund Normal Dividend, Payout ₹38.13

↑ 0.24 ₹108,205 ☆☆☆☆ -2.3 -0.6 6.1 16.5 18.1 6.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Jan 26 Research Highlights & Commentary of 6 Funds showcased

Commentary UTI Multi Asset Fund ICICI Prudential Multi-Asset Fund Edelweiss Multi Asset Allocation Fund JM Equity Hybrid Fund BOI AXA Mid and Small Cap Equity and Debt Fund HDFC Balanced Advantage Fund Point 1 Upper mid AUM (₹6,720 Cr). Upper mid AUM (₹78,179 Cr). Lower mid AUM (₹3,480 Cr). Bottom quartile AUM (₹785 Cr). Bottom quartile AUM (₹1,349 Cr). Highest AUM (₹108,205 Cr). Point 2 Established history (17+ yrs). Established history (22+ yrs). Established history (16+ yrs). Oldest track record among peers (30 yrs). Established history (9+ yrs). Established history (25+ yrs). Point 3 Rating: 1★ (upper mid). Rating: 2★ (upper mid). Rating: 1★ (lower mid). Rating: 1★ (bottom quartile). Not Rated. Top rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 14.40% (bottom quartile). 5Y return: 20.87% (top quartile). 5Y return: 19.13% (upper mid). 5Y return: 15.96% (bottom quartile). 5Y return: 17.97% (lower mid). 5Y return: 18.12% (upper mid). Point 6 3Y return: 19.15% (top quartile). 3Y return: 19.09% (upper mid). 3Y return: 18.24% (upper mid). 3Y return: 17.22% (lower mid). 3Y return: 16.76% (bottom quartile). 3Y return: 16.50% (bottom quartile). Point 7 1Y return: 12.51% (upper mid). 1Y return: 16.70% (top quartile). 1Y return: 5.76% (lower mid). 1Y return: 1.04% (bottom quartile). 1Y return: 0.39% (bottom quartile). 1Y return: 6.13% (upper mid). Point 8 1M return: 0.07% (top quartile). 1M return: -0.11% (upper mid). 1M return: -3.01% (bottom quartile). 1M return: -3.28% (bottom quartile). 1M return: -2.54% (upper mid). 1M return: -2.62% (lower mid). Point 9 Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: -2.76 (bottom quartile). Alpha: -11.83 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Point 10 Sharpe: 0.46 (upper mid). Sharpe: 1.86 (top quartile). Sharpe: 0.04 (lower mid). Sharpe: -0.65 (bottom quartile). Sharpe: -0.29 (bottom quartile). Sharpe: 0.09 (upper mid). UTI Multi Asset Fund

ICICI Prudential Multi-Asset Fund

Edelweiss Multi Asset Allocation Fund

JM Equity Hybrid Fund

BOI AXA Mid and Small Cap Equity and Debt Fund

HDFC Balanced Advantage Fund

ലാഭവിഹിതം നൽകൽ ബാലൻസ്ഡ് മുകളിൽ AUM/നെറ്റ് അസറ്റുകൾ ഉള്ള ഫണ്ടുകൾ100 കോടി. ക്രമീകരിച്ചുകഴിഞ്ഞ 1 വർഷത്തെ റിട്ടേൺ.

(Erstwhile UTI Wealth Builder Fund) The objective of the Scheme is to achieve long term capital appreciation by investing predominantly in a diversified portfolio of equity and equity related instruments along with investments in Gold ETFs and Debt and Money Market Instruments. However, there can be no assurance that the investment objective of the Scheme will be achieved. Below is the key information for UTI Multi Asset Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Dynamic Plan) To generate capital appreciation by actively investing in equity and equity related securities. For defensive considerations, the Scheme may invest in debt, money market instruments and derivatives. The investment manager will have the discretion to take aggressive asset calls i.e. by staying 100% invested in equity market/equity related instruments at a given point of time and 0% at another, in which case, the fund may be invested in debt related instruments at its discretion. The AMC may choose to churn the portfolio of the Scheme in order to achieve the investment objective. The Scheme is suitable for investors seeking high returns and for those who are willing to take commensurate risks. Research Highlights for ICICI Prudential Multi-Asset Fund Below is the key information for ICICI Prudential Multi-Asset Fund Returns up to 1 year are on (Erstwhile Edelweiss Prudent Advantage Fund) The objective of the Scheme is to generate returns through capital appreciation by investing in diversified portfolio of equity and equity-related securities, fixed income instruments and Gold Exchange Traded Funds.

However, there is no assurance that the investment objective of the Scheme will be realized. Research Highlights for Edelweiss Multi Asset Allocation Fund Below is the key information for Edelweiss Multi Asset Allocation Fund Returns up to 1 year are on (Erstwhile JM Balanced Fund) To provide steady current income as well as long term growth of capital. Research Highlights for JM Equity Hybrid Fund Below is the key information for JM Equity Hybrid Fund Returns up to 1 year are on (Erstwhile BOI AXA Mid Cap Equity And Debt Fund) The scheme's objective is to provide capital appreciation and income distribution to investors from a portfolio constituting of mid cap equity and equity related securities as well as fixed income securities.However there can be no assurance that the investment objectives of the Scheme will be realized Research Highlights for BOI AXA Mid and Small Cap Equity and Debt Fund Below is the key information for BOI AXA Mid and Small Cap Equity and Debt Fund Returns up to 1 year are on (Erstwhile HDFC Growth Fund and HDFC Prudence Fund) Aims to generate long term capital appreciation from a portfolio that is invested predominantly in equity and equity related instruments. Research Highlights for HDFC Balanced Advantage Fund Below is the key information for HDFC Balanced Advantage Fund Returns up to 1 year are on 1. UTI Multi Asset Fund

UTI Multi Asset Fund

Normal Dividend, Payout Launch Date 21 Oct 08 NAV (22 Jan 26) ₹30.218 ↓ -0.13 (-0.44 %) Net Assets (Cr) ₹6,720 on 31 Dec 25 Category Hybrid - Multi Asset AMC UTI Asset Management Company Ltd Rating ☆ Risk Moderately High Expense Ratio 1.79 Sharpe Ratio 0.46 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Dec 20 ₹10,000 31 Dec 21 ₹11,178 31 Dec 22 ₹11,664 31 Dec 23 ₹15,055 31 Dec 24 ₹18,165 31 Dec 25 ₹20,001 Returns for UTI Multi Asset Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Jan 26 Duration Returns 1 Month 0.1% 3 Month 1% 6 Month 5% 1 Year 12.5% 3 Year 19.2% 5 Year 14.4% 10 Year 15 Year Since launch 12.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 10.1% 2023 20.7% 2022 29.1% 2021 4.4% 2020 11.8% 2019 12.9% 2018 2.7% 2017 -1.1% 2016 17.1% 2015 7.3% Fund Manager information for UTI Multi Asset Fund

Name Since Tenure Sharwan Kumar Goyal 12 Nov 21 4.14 Yr. Jaydeep Bhowal 1 Oct 24 1.25 Yr. Data below for UTI Multi Asset Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 7.62% Equity 69.13% Debt 10.27% Other 12.98% Equity Sector Allocation

Sector Value Financial Services 15.92% Technology 11.06% Consumer Defensive 9.19% Consumer Cyclical 9.07% Industrials 5.46% Basic Materials 5.35% Health Care 4.35% Real Estate 3.77% Energy 3.13% Communication Services 3.04% Debt Sector Allocation

Sector Value Government 7.85% Cash Equivalent 7.61% Corporate 2.43% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity UTI Gold ETF

- | -13% ₹880 Cr 76,018,936 Asian Paints Ltd (Basic Materials)

Equity, Since 31 Oct 24 | 5008203% ₹180 Cr 650,377

↑ 125,386 ITC Ltd (Consumer Defensive)

Equity, Since 31 Oct 22 | ITC3% ₹171 Cr 4,253,690 Infosys Ltd (Technology)

Equity, Since 31 Mar 24 | INFY3% ₹171 Cr 1,055,798

↓ -76,394 State Bank of India (Financial Services)

Equity, Since 31 Oct 25 | SBIN3% ₹169 Cr 1,716,730

↑ 196,803 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Oct 23 | MARUTI2% ₹144 Cr 86,404

↑ 11,417 Nestle India Ltd (Consumer Defensive)

Equity, Since 29 Feb 24 | NESTLEIND2% ₹144 Cr 1,119,520 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 24 | BHARTIARTL2% ₹143 Cr 677,566 Tata Consultancy Services Ltd (Technology)

Equity, Since 29 Feb 24 | TCS2% ₹138 Cr 431,841 Coal India Ltd (Energy)

Equity, Since 31 Oct 22 | COALINDIA2% ₹133 Cr 3,341,545 2. ICICI Prudential Multi-Asset Fund

ICICI Prudential Multi-Asset Fund

Normal Dividend, Payout Launch Date 9 Jan 04 NAV (21 Jan 26) ₹35.7343 ↑ 0.14 (0.38 %) Net Assets (Cr) ₹78,179 on 31 Dec 25 Category Hybrid - Multi Asset AMC ICICI Prudential Asset Management Company Limited Rating ☆☆ Risk Moderately High Expense Ratio 1.47 Sharpe Ratio 1.86 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Dec 20 ₹10,000 31 Dec 21 ₹13,467 31 Dec 22 ₹15,730 31 Dec 23 ₹19,521 31 Dec 24 ₹22,669 31 Dec 25 ₹26,880 Returns for ICICI Prudential Multi-Asset Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Jan 26 Duration Returns 1 Month -0.1% 3 Month 1.5% 6 Month 6.8% 1 Year 16.7% 3 Year 19.1% 5 Year 20.9% 10 Year 15 Year Since launch 17.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 18.6% 2023 16.1% 2022 24.1% 2021 16.8% 2020 34.7% 2019 9.4% 2018 5.9% 2017 -4.3% 2016 28.1% 2015 12.5% Fund Manager information for ICICI Prudential Multi-Asset Fund

Name Since Tenure Sankaran Naren 1 Feb 12 13.92 Yr. Manish Banthia 22 Jan 24 1.94 Yr. Ihab Dalwai 3 Jun 17 8.58 Yr. Akhil Kakkar 22 Jan 24 1.94 Yr. Sri Sharma 30 Apr 21 4.68 Yr. Gaurav Chikane 2 Aug 21 4.42 Yr. Sharmila D'Silva 31 Jul 22 3.42 Yr. Masoomi Jhurmarvala 4 Nov 24 1.16 Yr. Data below for ICICI Prudential Multi-Asset Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 18.84% Equity 64.99% Debt 6.49% Other 9.67% Equity Sector Allocation

Sector Value Financial Services 21.15% Consumer Cyclical 11.33% Consumer Defensive 6.77% Basic Materials 6.33% Industrials 5.88% Technology 5.88% Energy 4.96% Health Care 4.01% Utility 2.25% Communication Services 2.17% Real Estate 1.58% Debt Sector Allocation

Sector Value Cash Equivalent 15.41% Corporate 5.02% Government 4.91% Credit Quality

Rating Value A 1.28% AA 17.26% AAA 81.46% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Pru Gold ETF

- | -7% ₹5,594 Cr 489,470,882

↑ 177,210,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 May 06 | 5321744% ₹3,125 Cr 23,271,875 Reliance Industries Ltd (Energy)

Equity, Since 31 Dec 20 | RELIANCE3% ₹2,411 Cr 15,349,805 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 22 | HDFCBANK3% ₹2,299 Cr 23,194,083 Axis Bank Ltd (Financial Services)

Equity, Since 31 Dec 20 | 5322153% ₹2,244 Cr 17,676,017 ITC Ltd (Consumer Defensive)

Equity, Since 31 Mar 24 | ITC3% ₹1,983 Cr 49,218,026

↑ 19,913,362 Infosys Ltd (Technology)

Equity, Since 31 Oct 19 | INFY2% ₹1,844 Cr 11,413,639

↓ -861,234 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Aug 21 | MARUTI2% ₹1,534 Cr 918,654

↓ -99,000 SBI Cards and Payment Services Ltd Ordinary Shares (Financial Services)

Equity, Since 30 Nov 22 | 5430662% ₹1,510 Cr 17,529,181

↓ -54,400 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 19 | LT2% ₹1,409 Cr 3,450,617 3. Edelweiss Multi Asset Allocation Fund

Edelweiss Multi Asset Allocation Fund

Normal Dividend, Payout Launch Date 16 Jun 09 NAV (22 Jan 26) ₹63.69 ↑ 0.49 (0.78 %) Net Assets (Cr) ₹3,480 on 31 Dec 25 Category Hybrid - Multi Asset AMC Edelweiss Asset Management Limited Rating ☆ Risk Moderately High Expense Ratio 1.98 Sharpe Ratio 0.04 Information Ratio 2.14 Alpha Ratio -2.76 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Dec 20 ₹10,000 31 Dec 21 ₹13,467 31 Dec 22 ₹14,874 31 Dec 23 ₹19,507 31 Dec 24 ₹24,137 31 Dec 25 ₹25,577

Purchase not allowed Returns for Edelweiss Multi Asset Allocation Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Jan 26 Duration Returns 1 Month -3% 3 Month -3.8% 6 Month -1.8% 1 Year 5.8% 3 Year 18.2% 5 Year 19.1% 10 Year 15 Year Since launch 14.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 6% 2023 23.7% 2022 31.2% 2021 10.4% 2020 34.7% 2019 22.7% 2018 14% 2017 1.1% 2016 33% 2015 6.5% Fund Manager information for Edelweiss Multi Asset Allocation Fund

Name Since Tenure Kedar Karnik 15 Jan 26 0 Yr. Bhavesh Jain 14 Oct 15 10.22 Yr. Bharat Lahoti 1 Oct 21 4.25 Yr. Rahul Dedhia 1 Jul 24 1.5 Yr. Data below for Edelweiss Multi Asset Allocation Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 10.62% Equity 76.79% Debt 12.58% Other 0% Equity Sector Allocation

Sector Value Financial Services 24.14% Consumer Cyclical 11.75% Health Care 8.32% Technology 6.25% Basic Materials 5.11% Energy 5.04% Communication Services 4.55% Industrials 4.14% Consumer Defensive 3.28% Utility 2.37% Real Estate 0.72% Debt Sector Allocation

Sector Value Cash Equivalent 10.5% Corporate 7.76% Government 4.94% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 15 | HDFCBANK5% ₹160 Cr 1,613,634

↑ 43,698 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 15 | 5321744% ₹149 Cr 1,110,789

↓ -263,196 National Bank For Agriculture And Rural Development

Debentures | -4% ₹142 Cr 14,000,000

↑ 14,000,000 State Bank of India (Financial Services)

Equity, Since 30 Jun 15 | SBIN4% ₹124 Cr 1,264,882

↑ 148,642 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 19 | BHARTIARTL4% ₹123 Cr 583,607 Reliance Industries Ltd (Energy)

Equity, Since 31 Aug 20 | RELIANCE3% ₹102 Cr 647,748

↑ 46,564 Infosys Ltd (Technology)

Equity, Since 31 May 15 | INFY3% ₹91 Cr 566,220

↓ -49,883 NTPC Ltd (Utilities)

Equity, Since 30 Nov 21 | 5325552% ₹82 Cr 2,497,975 Aditya Birla Capital Limited

Debentures | -2% ₹76 Cr 7,500,000 Hdb Financial Services Limited

Debentures | -2% ₹76 Cr 7,500,000 4. JM Equity Hybrid Fund

JM Equity Hybrid Fund

Normal Dividend, Payout Launch Date 1 Apr 95 NAV (22 Jan 26) ₹32.6755 ↑ 0.24 (0.74 %) Net Assets (Cr) ₹785 on 31 Dec 25 Category Hybrid - Hybrid Equity AMC JM Financial Asset Management Limited Rating ☆ Risk Moderately High Expense Ratio 2.3 Sharpe Ratio -0.65 Information Ratio 0.64 Alpha Ratio -11.83 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-60 Days (1%),60 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Dec 20 ₹10,000 31 Dec 21 ₹12,294 31 Dec 22 ₹13,284 31 Dec 23 ₹17,781 31 Dec 24 ₹22,579 31 Dec 25 ₹21,873 Returns for JM Equity Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Jan 26 Duration Returns 1 Month -3.3% 3 Month -5% 6 Month -4.7% 1 Year 1% 3 Year 17.2% 5 Year 16% 10 Year 15 Year Since launch 11.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 -3.1% 2023 27% 2022 33.8% 2021 8.1% 2020 22.9% 2019 30.5% 2018 -8.1% 2017 1.7% 2016 18.5% 2015 3% Fund Manager information for JM Equity Hybrid Fund

Name Since Tenure Satish Ramanathan 1 Oct 24 1.25 Yr. Asit Bhandarkar 31 Dec 21 4 Yr. Ruchi Fozdar 4 Oct 24 1.24 Yr. Deepak Gupta 11 Apr 25 0.72 Yr. Data below for JM Equity Hybrid Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 1.48% Equity 77.34% Debt 21.18% Equity Sector Allocation

Sector Value Financial Services 24.87% Technology 16.01% Industrials 12.55% Consumer Cyclical 9.05% Health Care 4.48% Basic Materials 4.15% Communication Services 3.89% Consumer Defensive 2.3% Real Estate 0.04% Debt Sector Allocation

Sector Value Corporate 11.22% Government 9.96% Cash Equivalent 1.48% Credit Quality

Rating Value AA 9.56% AAA 90.44% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Jun 24 | HDFCBANK4% ₹35 Cr 350,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 May 21 | LT4% ₹32 Cr 78,000 Ujjivan Small Finance Bank Ltd Ordinary Shares (Financial Services)

Equity, Since 31 Jan 25 | UJJIVANSFB4% ₹32 Cr 5,974,365 Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 31 May 25 | MCX4% ₹31 Cr 27,876

↓ -1,800 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 24 | BHARTIARTL4% ₹31 Cr 145,246 Bajaj Finance Ltd (Financial Services)

Equity, Since 31 Jan 25 | 5000344% ₹28 Cr 285,040

↑ 20,000 Waaree Energies Ltd (Technology)

Equity, Since 31 May 25 | 5442773% ₹23 Cr 77,000 6.48% Govt Stock 2035

Sovereign Bonds | -3% ₹23 Cr 2,275,000 One97 Communications Ltd (Technology)

Equity, Since 30 Jun 25 | 5433963% ₹22 Cr 170,000 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 May 25 | MARUTI3% ₹21 Cr 12,500 5. BOI AXA Mid and Small Cap Equity and Debt Fund

BOI AXA Mid and Small Cap Equity and Debt Fund

Normal Dividend, Payout Launch Date 20 Jul 16 NAV (22 Jan 26) ₹31.41 ↑ 0.34 (1.09 %) Net Assets (Cr) ₹1,349 on 31 Dec 25 Category Hybrid - Hybrid Equity AMC BOI AXA Investment Mngrs Private Ltd Rating Risk Moderately High Expense Ratio 2.27 Sharpe Ratio -0.29 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Dec 20 ₹10,000 31 Dec 21 ₹15,423 31 Dec 22 ₹14,690 31 Dec 23 ₹19,642 31 Dec 24 ₹24,706 31 Dec 25 ₹24,482 Returns for BOI AXA Mid and Small Cap Equity and Debt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Jan 26 Duration Returns 1 Month -2.5% 3 Month -3.7% 6 Month -5.7% 1 Year 0.4% 3 Year 16.8% 5 Year 18% 10 Year 15 Year Since launch 14.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 -0.9% 2023 25.8% 2022 33.7% 2021 -4.8% 2020 54.2% 2019 31.1% 2018 -4.7% 2017 -14.4% 2016 47.3% 2015 Fund Manager information for BOI AXA Mid and Small Cap Equity and Debt Fund

Name Since Tenure Alok Singh 16 Feb 17 8.88 Yr. Data below for BOI AXA Mid and Small Cap Equity and Debt Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 10.89% Equity 76.22% Debt 12.88% Equity Sector Allocation

Sector Value Basic Materials 18.8% Financial Services 16.46% Industrials 14% Consumer Cyclical 9.26% Health Care 8.19% Consumer Defensive 3.88% Technology 3.87% Utility 0.87% Energy 0.49% Real Estate 0.4% Debt Sector Allocation

Sector Value Government 9.94% Corporate 7.09% Cash Equivalent 6.75% Credit Quality

Rating Value AA 2.3% AAA 97.7% Top Securities Holdings / Portfolio

Name Holding Value Quantity Hindustan Copper Ltd (Basic Materials)

Equity, Since 31 Oct 24 | HINDCOPPER4% ₹57 Cr 1,101,000

↑ 51,000 Jindal Stainless Ltd (Basic Materials)

Equity, Since 30 Sep 21 | JSL4% ₹48 Cr 566,000 Indian Bank (Financial Services)

Equity, Since 31 Aug 23 | 5328143% ₹42 Cr 505,000 UNO Minda Ltd (Consumer Cyclical)

Equity, Since 31 Jul 19 | UNOMINDA3% ₹40 Cr 314,000 PB Fintech Ltd (Financial Services)

Equity, Since 29 Feb 24 | 5433903% ₹37 Cr 202,000

↑ 22,000 Housing & Urban Development Corp Ltd (Financial Services)

Equity, Since 31 May 24 | HUDCO3% ₹36 Cr 1,580,000 TD Power Systems Ltd (Industrials)

Equity, Since 31 Jul 24 | TDPOWERSYS2% ₹34 Cr 480,000

↑ 100,000 Lloyds Metals & Energy Ltd (Basic Materials)

Equity, Since 28 Feb 25 | 5124552% ₹32 Cr 242,000

↑ 20,000 Eris Lifesciences Ltd Registered Shs (Healthcare)

Equity, Since 31 Jul 23 | ERIS2% ₹31 Cr 202,783 Glenmark Pharmaceuticals Ltd (Healthcare)

Equity, Since 31 Jul 25 | 5322962% ₹31 Cr 150,000 6. HDFC Balanced Advantage Fund

HDFC Balanced Advantage Fund

Normal Dividend, Payout Launch Date 11 Sep 00 NAV (22 Jan 26) ₹38.13 ↑ 0.24 (0.63 %) Net Assets (Cr) ₹108,205 on 31 Dec 25 Category Hybrid - Dynamic Allocation AMC HDFC Asset Management Company Limited Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.36 Sharpe Ratio 0.09 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Dec 20 ₹10,000 31 Dec 21 ₹12,637 31 Dec 22 ₹15,003 31 Dec 23 ₹19,697 31 Dec 24 ₹22,986 31 Dec 25 ₹24,491 Returns for HDFC Balanced Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Jan 26 Duration Returns 1 Month -2.6% 3 Month -2.3% 6 Month -0.6% 1 Year 6.1% 3 Year 16.5% 5 Year 18.1% 10 Year 15 Year Since launch 6.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.5% 2023 16.7% 2022 31.3% 2021 18.7% 2020 26.4% 2019 7% 2018 5% 2017 -11.7% 2016 22.6% 2015 -3.7% Fund Manager information for HDFC Balanced Advantage Fund

Name Since Tenure Anil Bamboli 29 Jul 22 3.43 Yr. Gopal Agrawal 29 Jul 22 3.43 Yr. Arun Agarwal 6 Oct 22 3.24 Yr. Srinivasan Ramamurthy 29 Jul 22 3.43 Yr. Dhruv Muchhal 22 Jun 23 2.53 Yr. Nandita Menezes 29 Mar 25 0.76 Yr. Data below for HDFC Balanced Advantage Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 6.55% Equity 67.51% Debt 25.94% Equity Sector Allocation

Sector Value Financial Services 23.72% Industrials 8.05% Energy 7.8% Consumer Cyclical 6.99% Technology 6.48% Health Care 4.22% Utility 3.94% Communication Services 3.63% Consumer Defensive 2.5% Basic Materials 2.21% Real Estate 1.83% Debt Sector Allocation

Sector Value Corporate 12.87% Government 12.84% Cash Equivalent 6.77% Credit Quality

Rating Value AA 0.88% AAA 97.59% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Mar 22 | HDFCBANK5% ₹5,730 Cr 57,808,702

↑ 2,000,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | 5321744% ₹4,668 Cr 34,763,763 Reliance Industries Ltd (Energy)

Equity, Since 31 Dec 21 | RELIANCE4% ₹4,393 Cr 27,972,742

↑ 67,108 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Aug 20 | BHARTIARTL3% ₹3,528 Cr 16,754,354 State Bank of India (Financial Services)

Equity, Since 31 May 07 | SBIN3% ₹3,438 Cr 35,000,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT2% ₹2,687 Cr 6,579,083 Infosys Ltd (Technology)

Equity, Since 31 Oct 09 | INFY2% ₹2,628 Cr 16,266,004

↓ -497,799 Axis Bank Ltd (Financial Services)

Equity, Since 31 Aug 17 | 5322152% ₹2,517 Cr 19,827,457 7.18% Govt Stock 2033

Sovereign Bonds | -2% ₹2,255 Cr 218,533,300 NTPC Ltd (Utilities)

Equity, Since 31 Aug 16 | 5325552% ₹2,206 Cr 66,937,415

↓ -1,648,500

ഇവിടെ നൽകിയിരിക്കുന്ന വിവരങ്ങൾ കൃത്യമാണെന്ന് ഉറപ്പാക്കാൻ എല്ലാ ശ്രമങ്ങളും നടത്തിയിട്ടുണ്ട്. എന്നിരുന്നാലും, ഡാറ്റയുടെ കൃത്യത സംബന്ധിച്ച് യാതൊരു ഉറപ്പും നൽകുന്നില്ല. എന്തെങ്കിലും നിക്ഷേപം നടത്തുന്നതിന് മുമ്പ് സ്കീം വിവര രേഖ ഉപയോഗിച്ച് പരിശോധിക്കുക.

Research Highlights for UTI Multi Asset Fund