What is a Rate-and-Term Refinance?

A rate-and-term refinance either change the term, the interest rate or both of them of a pre-existing mortgage without advancing any more money. This term is also called no Cash-Out Refinance.

Often, the rate-and-term refinance offers lower interest rates in comparison to cash-out refinances.

Explaining Rate-and-Term Refinance

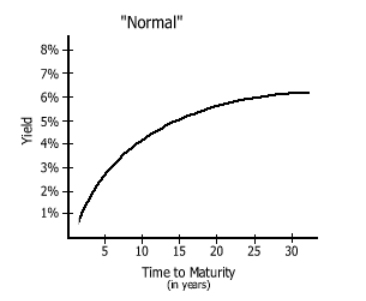

Rate-and-term financing is primarily driven by a dip in Market interest rates so as to decrease monthly payments of the mortgage. The possible advantages of rate-and-term refinancing comprise securing a lower interest rate and a favourable mortgage term; however, the principal balance gets to be the same.

This type of refinancing can decrease monthly payments. Or, it might also create a new schedule to pay the mortgage quickly. Also, there are different methods to exercise this option. Since there are several benefits and disadvantages linked to rate-and-term, it is recommended that you consider the pros and cons before making a decision.

Examples of Rate-and-Term Refinancing

Suppose it’s been 10 years since you’ve been paying the mortgage with a tenure of 30-years. Suddenly, the interest rates drop, and you may wish to take advantage. Now, one method would be to refinance the left balance on the original mortgage at a lower rate for a newer term of 30-years.

This new loan will come with lower payments, but you’d have to start from scratch. The last 10 years you spent paying the mortgage will go in vain. Again, you’d have to pay for 30-years. Between the longer term and lower interest rates, only monthly payments are going to be lesser.

However, another method you can use is the rate-and-term refinancing option to negotiate a 15-year mortgage and pay a new interest rate. While keeping everything else equal, your monthly payments will be twice.

Talk to our investment specialist

But since interest rates have decreased, your monthly payment might turn out to be lower than what you needed to pay for the remaining 20 years.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.