Accumulation/Distribution Indicator

What is the Accumulation/Distribution Indicator?

The Accumulation/Distribution indicates how the volume and price is employed to assess whether a stock is being accumulated or distributed. It seeks to identify and measure the differences between stock price and the flow of volume. This helps in gaining an insight into how strong or weak a trend is when it comes to stocks.

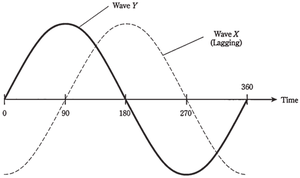

If you see a rising A/D line, it means that there’s a rising price trend, But if you see a falling A/D line shows a falling price trend.

The A/D line seeks to help you see and understand how supply and demand are influencing the price Factor. A/D can move in the same direction as there is a change in price or it may move in the opposite direction.

In simple words, if you see the price rise, but see the indicator failing, it means that the accumulated volume is not strong enough to support the rise in price. Therefore, one can expect a price decline to arrive. The direction of the line may indicate the trend to identify.

Formula for A/D Indicator

A/D= Previous A/D+CMFV

CMFV= (PC-PL)-(PH-PC)/PH-PL*V

Here,

- CMFV- Current money flow volume

- PC- Closing Price

- PL- Low price for the period

- PH- High Price for the period

- V- Volume for the period

Limitations

It is important to remember that the A/D indicator only shows where the price closes within the current period’s Range. It does not show the price change from one period to another.

Talk to our investment specialist

Difference Between A/D indicator and OBV Indicator

Both indicators use price and volume to assess stocks.

Listed below is the difference between an A/D indicator and On-Balance Volume (OBV).

| A/D Indicator | OBV Indicator |

|---|---|

| Does not consider prior close. | Considers prior close |

| Uses multiplier based on where within the period’s range the price closed. | Looks at the closing price as to whether it is higher or lower tat the prior close. |

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.