Table of Contents

Lagging Indicator

What is a Lagging Indicator?

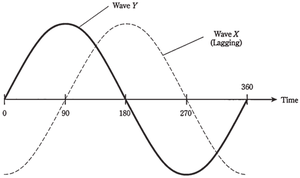

A lagging indicator is a measurable or observable Factor that changes for some time following the changes in a business, financial or economic variable to which it is correlated. Lagging indicators, basically, confirm the changes and trends.

These can be quite useful for evaluating the trend of an Economy, as signals to sell or buy assets in the financial Market or as tools in a business strategy and operations

Explaining Lagging Indicators

In simple words, a lagging indicator is a financial sign that turns apparent after a massive shift that takes place. Thus, these indicators confirm long-term trends; however, they don’t work to predict them.

Also, a lagging indicator is useful because several other leading indicators could be more volatile or the short-term fluctuations in them could be so obscure that they may lead to wrong signals. Thus, assessing lagging indicators is one of the ways to confirm if an economy shift has taken place or not.

Economic Lagging Indicators

In terms of economic, lagging indicators include the average prime rate that is charged by banks, average employment duration, and alterations in the Consumer Price Index for Services. Some of the general lagging indicators examples are corporate profits, unemployment rate, labour cost per unit of output, and more. Others could be Consumer Price Index (CPI), Gross Domestic Product (GDP), and the balance of trade.

Talk to our investment specialist

Technical Lagging Indicators

Another lagging indicator type is the technical indicator that lags the asset’s current price, which occurs following a specific price move has already taken place. One of the technical lagging indicators examples is a Moving Average crossover. Unlike other indicators that are useful in comparing varying economic variables, a technical lagging indicator compares a given variable’s value to its moving average over a specific interval or any historical characteristics.

Business Lagging Indicators

In business, lagging indicators are a type of Key Performance Indicators (KPI) that evaluate business performance, such as revenue churn, customer satisfaction or sales. They can be impossible or difficult to influence directly.

Since these are at least half the results of business operations or decisions, these indicators offer insight into the outcome achieved by how a business is being operated. Companies and organizations can also keep a track on leading indicators that gauge internal performance, like employee satisfaction or customer engagement that can be influenced directly and result in lagging indicator changes.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.