Table of Contents

What is Bayes Theorem?

The Bayes theorem, named after 18th-century British mathematician Thomas Bayes, is a mathematical formula for calculating conditional probability. Conditional probability describes the likelihood of an outcome happening, depending on the possibility of a primary outcome occurring. It’s often used in finance to update risk evaluation.

The Bayes theorem, also known as Bayes' Rule or Bayes' Law, is the cornerstone of Bayesian statistics. Apart from statistics, the Bayes' theorem is used in various fields, the most important of which are medicine and pharmacology. Besides that, the theorem is widely used in various fields of finance. Modelling the risk of lending money to investors or estimating the likelihood of an investment's success are examples of applications.

Bayes Theorem Formula

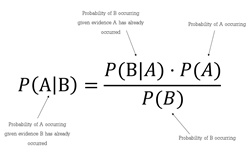

The Bayes Theorem is calculated by using the following formula:

P(A|B) = P(A).P(B|A) / P(B)

Where;

- P(A) - Probability of occurrence of event A

- P(B) - Probability of occurrence of event B

- P(A|B) - The probability of event A occurring if event B occurs

- P(B|A) - The probability of event B occurring if event A occurs

While calculating the probability, you must keep these factors in mind:

- A & B must be different events (Independent events), meaning the probability of event A occurring should not depend on the probability of event B

- P(A) & P(B) are also known as the marginal probability or prior probability

- P(A|B) & P(B|A) are conditional probability

- P(B) does not equal zero

Talk to our investment specialist

Interpretation of Bayes Theorem

The two main interpretations are:

Bayesian Interpretation

Probability is used to calculate a "degree of belief" in the Bayesian (or epistemological) interpretation. The Bayes theorem connects the degree of belief in a hypothesis before and after proof is taken into account. Assume that a coin is half as likely to Land heads than tails, with a 50% chance of landing heads. If the coin is flipped several times and the effects are observed, the degree of belief can rise, fall, or remain constant based on the outcomes.

Frequentist Interpretation

According to frequentist interpretation, data is a repeatable random sample with a fixed frequency and probability (which is defined as the relative frequency of an event as the number of trials approaches infinity). During this repeatable process, the Underlying parameters and probabilities remain constant.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.