Income from Operations (IFO)

What is Income from Operations (IFO)?

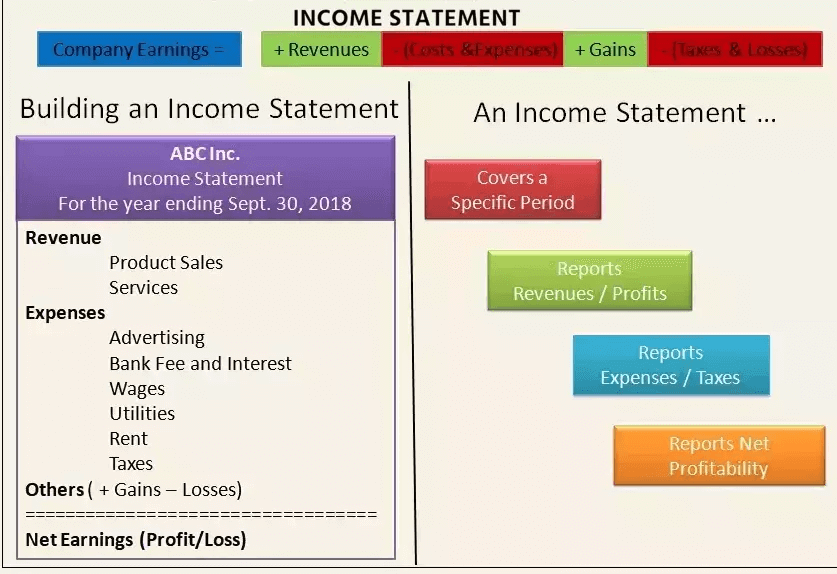

Income from operation refers to the profit a business makes from its own operations. This income is generated from running the main business. It does not include income from other sources. Income from operations is also known as operating income or EBIT.

When one looks at the profit generated in a business, it is easier to understand how successful the company will be in the future. In order to calculate operating income, start from operations revenue and subtract the cost of goods sold and other operating expenses. Interest earned or paid should not be included in this as well as Taxes paid should not be deducted. Remember to not include gains or losses from investment or buying and selling of business assets. Income from operation only includes the earning and spending involved in day to day working of the business.

Example of Income from Operations

Example 1: A firm XYZ buys an office space for Rs. 1 crore. The company then sells the same office space for Rs. 1.5 crores. The Rs. 50 Lakhs earned by the company is income from operations. Since this income is from normal operations, investors in the company can assume that similar income can be generated as long as operations continue.

Talk to our investment specialist

Example 2: Richard sells onions. He will now take the revenue earned from selling the onions and subtract costs incurred for caring for the onions and paying others to take care of it. The amount left would be the operation income from Richard’s onion business.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.