Table of Contents

Sale

Sale can be defined as the transaction between two or multiple parties. In the given transaction, the buyer is known to receive intangible or tangible goods & services along with assets in return for money. In some typical cases, other assets might be paid to the respective sellers. In a typical financial Market, a sale can also be referred to as the form of agreement between the buyer and the seller with respect to the price of some security.

Irrespective of the given context, a sale can referred to as a contract between the seller and the buyer of the specific product or service that might be in question.

How does a Sale Work?

A sale is known to determine the fact that the given seller will be providing the buyer with some goods or service in return for a specific amount of money or particular assets. For completing a sale, both the buyers as well as the sellers are expected to be competent enough for making the transaction. Moreover, they are also expected to be in agreement with respect to the given terms of the transaction.

Additionally, the product or service that is being offered has to be made available for the purchase. In such a case, the seller has the authority to transfer some item or service to the respective buyers.

To be regarded as a proper sale, a transaction should involve the exchange of goods, payments, or services between the buyer & the seller. If one party goes ahead with transferring the goods or services to some other without receiving anything in return, the transaction will be treated as a donation or a gift –especially from the perspective of income tax.

Every single day, millions of individuals will take part in innumerable transactions throughout the globe. This helps in the creation of constant flow of assets while forming the backbone of the linked economies. The sale of product or services within the given retail market are regarded as the common types of sales transactions. The sales of high-end investment vehicles in the respective financial markets are regarded as value exchanges that are highly refined.

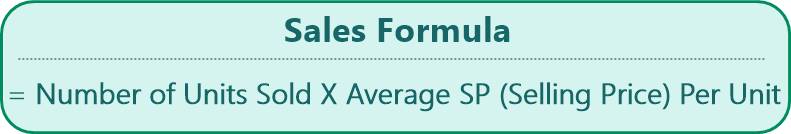

Sales Formula

As per the Sales formula, this important parameter can be calculated as:

Sales = Number of Units Sold X Average SP (Selling Price) Per Unit

Example:

Let us consider a toy-making company selling 10 million toys during a year. Out of the given total, 3 million were sold at the average price of Rs. 30 per unit, another 4 million were sold out at Rs. 50 per unit, and the remaining 3 million toys were sold for Rs. 80 per unit.

The sales can be calculated as:

Number of units sold X Average SP per unit

= 30,00,000 X 30 + 40,00,000 X 50 + 30,00,000 X 80

= 530 Million

A sale is known to be completed as a portion of operation of the business –within a clothing retailer or a grocery store –and between individuals as well. Items that are purchased through the Yard sale would be regarded as a sale between individuals during the purchase of some personal vehicle from the car dealership. This would represent the sale between a business and an individual.

Sale is also known to be completed between multiple businesses –like when one raw material provider would be selling available materials to some business utilizing the materials for producing consumer goods.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.