Table of Contents

What is a Wash Sale?

A Wash sale is a transaction wherein an investor looks forward to maximizing the benefits of tax by selling losing security at the end of a year so as to claim a Capital Loss on Taxes.

The intention of the investor is to repurchase the security once the new year is started, if possible, at a lower cost than what he sold at. Thus, this was sale is a method that has been considered by investors since ages to discover a tax loss without restricting the exposure to chances they anticipate in owning specific security.

Explaining a Wash Sale

A wash sale works out when the tax laws of a country allow tax deductions for losses incurred on securities held in a specific ta year. With no such incentives, there wouldn’t be any requirement of wash sales.

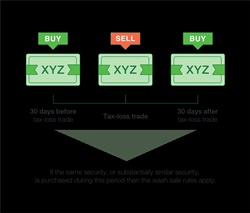

But wherever these incentives exist, wash sales inevitably are used. Basically, a wash sale is divided into three different parts.

- First: When investors begin noticing their loss at the end of the tax year and close the position near or at the year’s end.

- Second: The sale enables them to take the loss and claim it on the Tax Return in a legal fashion; thus, paying a smaller tax amount.

- Third: Once the new year starts, the investor gets to buy the same security below or at the price that it was sold at.

Talk to our investment specialist

The Rules of Wash-Sale

The rule signifies that in case any investor purchases security before or within 30 days of selling the same, any losses made from this sale will not be counted against the reported Income. Effectively, this eliminates any incentive to be received in a short-term wash sale.

For instance, suppose you get Rs. 20,00,000 Capital gains by selling ABC stocks. This way, you will belong to the highest tax bracket. Thus, you will either have to pay 30% tax or Rs. 187500 to the government.

However, let’s say you sold XYZ security and incurred a loss of Rs. 10,00,000. Now, your net Capital Gain for tax will be:

Rs. 20,00,000 – Rs. 10,00,000 = Rs. 10,00,000

This means that you will only have to pay 15% in the taxes. It is evident how the loss on XYZ decreased ABC's gain; thus, it reduced your tax bill. However, if you repurchase the XYZ stock or anything substantially similar, within 30 days of the sale, the outlined transaction will be considered as a wash sale.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.