Table of Contents

Top Down Investing

An investor always aims to pick the right stock for maximum returns. And, to haunt the potential asset one has to use various qualitative and quantitative analysis tools. The two main such tools used by investors/ fund managers are top-down and bottom-up approach.

Top-down Investing is a macro level approach to an investment, where factors like the Economy, Gross Domestic Product (GDP), taxation, interest rates, etc., are examined. The fund manager also looks at the global markets, politics, industries, social and cultural situation of the country to finalize the Industry or a sector’s position. Following which the manager analyses the performance of various companies and then picks stocks that look promising.

As the entire approach is at the macro level, where the Market is first analysed and then drilled down to picking stocks, this method is known as top-down investing.

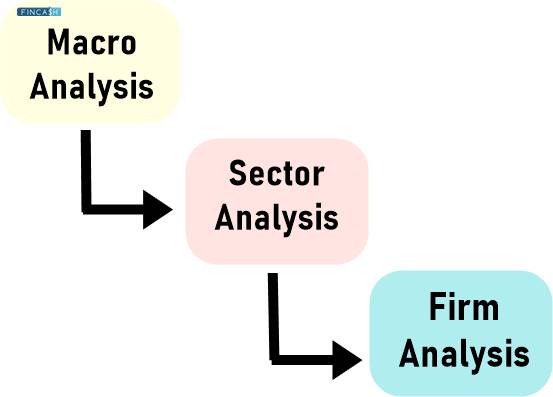

Order of Top Down Analysis

The top down approach goes with the following order:

| Orders | Details |

|---|---|

| Macro | Analysis induced factors related to the country's economy, GDP, Inflation, interest rates, geopolitical risk. |

| Sector | In the second approach investors compare the performance of different sectors within the country. Then, the potential sectors are picked where studies of current market performances, future opportunities, challenges, government activities, etc., are undertaken. |

| Firm | The last step is to assess the potential of a company where the stocks are to be purchased. The fundamental and technical aspects of the asset are studied. |

Talk to our investment specialist

Top-Down Vs Bottom-Up Investing

The bottom-up approach is the opposite of the top-down approach, where the focus is on a micro level. The bottom-up fund manager focuses on the company and its fundamentals. These factors include analysis of financial statements, product & services offered along with supply and demand. Basically, this approach assumes individual companies can perform well even if an industry/sector is not doing well, at least on a relative Basis.

Advantages of Top-Down Investing

The risk is minimal because top-down analysis includes research at the macro level. With such in-depth research right from global markets to individual companies' stock, probability of investing in wrong stock is low.

It gives the investors an overview about the market trends, hence it prevents them from investing in stocks when the market is declining. Top-down approach also encourages diversification with detailed research & knowledge about the foreign markets and assets.

Bottom Line

Just as the two sides of a coin, the top-down investing approach has certain drawbacks to consider. An error in the analysis can prevent from earning substantial profits. Therefore, solely relying on one strategy is not good advice, take into account all the approaches and go for what best suits you.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.