Table of Contents

ई-गोल्ड विरुद्ध गोल्ड ईटीएफ- कोणता चांगला पर्याय आहे?

ई-गोल्ड वि गोल्ड ईटीएफ? जे अधिक चांगले आहेसोन्याची गुंतवणूक पर्याय? कोणत्या मार्गावर जास्त उत्पन्न आहे? हे नेहमी विचारले जाणारे काही सामान्य प्रश्न आहेतगुंतवणूकदार या गैर-भौतिक सोन्यात गुंतवणूक करू इच्छित आहे. बरं, दोन्ही फॉर्म ट्रेडिंगमध्ये अद्वितीय आहेत आणि प्रत्येकाचे रिटर्न्स, कर आकारणी, होल्डिंग पीरियड इ. यासारख्या अत्यावश्यक बाबींमध्ये स्वतःचे फायदे आहेत. म्हणून, आपण पाहू या दोन्ही- गोल्ड ईटीएफ आणि ई-गोल्ड एकमेकांपासून कसे वेगळे आहेत आणि कोणते फॉर्म बनवतात. सोने गुंतवणुकीचा उत्तम पर्याय!

ई- सोने

ई-गोल्ड हे नॅशनल स्पॉट एक्सचेंज लिमिटेड (NSEL) द्वारे लॉन्च केलेले एक अद्वितीय सोने गुंतवणूक उत्पादन आहे. हे उत्पादन गुंतवणूकदारांना सक्षम करतेसोने खरेदी करा एनएसईच्या ट्रेडिंग प्लॅटफॉर्मवर इलेक्ट्रॉनिक स्वरूपात आणि तुम्ही खरेदी केलेले सोने तुमच्यामध्ये प्रतिबिंबित होईलडीमॅट खाते.

ई-गोल्ड ही अशीच एक गुंतवणूक आहे जी गुंतवणूकदारांना 1gm, 2gm, 3gm इत्यादी सारख्या लहान मूल्यांमध्ये सोने खरेदी करण्यास अनुमती देते. तुम्ही येथे खरेदी कराल ती सोन्याची युनिट्स T+2 दिवसांत तुमच्या डीमॅट खात्यात जमा केली जातील. त्याचप्रमाणे, उदाहरणार्थ, जर तुम्ही आज विक्री केली असेल, तर ते तुमच्या डीमॅट खात्यातून 2 दिवसांत (विक्रीच्या तारखेपासून) डेबिट होईल.

गोल्ड ईटीएफच्या तुलनेत ई-गोल्ड कमी महाग आहे कारण नंतरचे विविध शुल्क जसे की मालमत्ता व्यवस्थापन शुल्क, सुरक्षा सेवा शुल्क इ.नाही त्या निधीचे परंतु ई-गोल्डच्या बाबतीत, मूल्य प्रचलित सोन्याच्या किमतीचे असते.

गोल्ड ईटीएफ

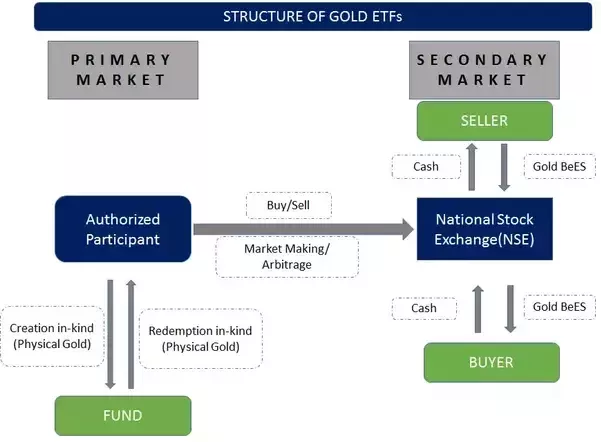

गोल्ड ईटीएफ हे सोन्याच्या गुंतवणुकीच्या सर्वात लोकप्रिय पद्धतींपैकी एक बनले आहे. गोल्ड ईटीएफ देखील आहेतअंतर्निहित ओपन-एंडेड सोन्याचेम्युच्युअल फंड जे तुम्हाला तुमचे पैसे सोन्यात गुंतवण्यास मदत करतात. अंतर्निहित सोन्याची शुद्धता 99.5% आहे. गोल्ड ईटीएफला पेपर गोल्ड असेही म्हणतात. हे प्रमुख स्टॉक एक्स्चेंजमध्ये सूचीबद्ध आणि व्यापार केले जातात आणि गुंतवणूकदारांना युनिट नियुक्त केले जातात जेथे प्रत्येक युनिट सामान्यतः एक ग्रॅम सोन्याचे प्रतिनिधित्व करते.

गोल्ड ईटीएफमध्ये, गुंतवणूकदार त्यांच्या विद्यमान डीमॅट खात्यात व्यापार करू शकतात. गोल्ड ईटीएफ गुंतवणूकदारांना सोने मिळवण्याचा सुरक्षित मार्ग देतातबाजार. चा लाभ देखील देताततरलता कारण ट्रेडिंग कालावधी दरम्यान कधीही त्याचा व्यवहार केला जाऊ शकतो.

Talk to our investment specialist

ई-गोल्ड वि गोल्ड ईटीएफ: मुख्य फरक जाणून घ्या

ट्रेडिंग वेळ

आठवड्याच्या दिवशी सकाळी 9:00 ते दुपारी 3:30 या वेळेत गोल्ड ETF चे व्यवहार करता येतात. तर, आठवड्याच्या दिवशी सकाळी 10:00 ते रात्री 11:30 पर्यंत ई-गोल्डचा व्यवहार करता येईल.

भौतिक स्वरूपात रूपांतरण

दोन्ही रूपे भौतिक सोन्यात रूपांतरित केली जाऊ शकतात, परंतु प्रत्येकासाठी किमान प्रमाण बदलते. ई-गोल्डसाठी किमान प्रमाण 8 ग्रॅम आहे, तर सोन्यात-ईटीएफ, जेव्हा ते 500gm ते 1Kg च्या विशिष्ट आकारापेक्षा जास्त असेल तेव्हाच रूपांतरित करू शकते.

ई-गोल्ड ही सर्वात जास्त किंमत आहे

कार्यक्षम स्वरूप आणि सोन्याच्या ETF पेक्षा सोन्याच्या किमती अधिक जवळून शोधण्यात सक्षम आहे. तथापि, कर आकारणीच्या बाबतीत ई-गोल्ड गोल्ड ईटीएफला गमावते.

परंतु, आता, जेव्हा तुम्हाला या दोन स्वरूपांमधील मुख्य फरक माहित असेल, तेव्हा चांगल्या परताव्यासह सुरक्षित गुंतवणूक ऑफर करणार्या मार्गामध्ये गुंतवणूक करा!

| पॅरामीटर्स | गोल्ड ईटीएफ | ई-गोल्ड |

|---|---|---|

| वेगळे डिमॅट खाते | नाही | होय |

| होल्डिंग्ज | च्या मालकीचेAMCs | होय |

| भौतिक सोन्यामध्ये रूपांतरण | किमान 0.5-1 किलो | गुंतवणूकदार थेट डीमॅट खात्यात सोने ठेवतात |

| अल्पकालीनभांडवल फायदा होतो | 1 वर्षापेक्षा कमी- रिटर्नवर 20% कर | 3 वर्षांपेक्षा कमी- रिटर्नवर 20% कर |

| दीर्घकालीनभांडवली नफा | 1 वर्षानंतर- 10% कर परतावा | 3 वर्षानंतर- रिटर्नवर 10% कर |

| आवर्ती खर्च | ०.४०% | 1% |

| परतावा | सर्वात जास्त ते सर्वात किफायतशीर आहे | पेक्षा किंचित कमीसोने ETF |

| किंमत | आंतरराष्ट्रीय सोन्याच्या किमतीशी जोडलेले | भारतीय सोन्याच्या किमतीशी जोडलेले |

| दागिन्यांमध्ये रूपांतरित करा | उपलब्ध नाही | निवडक ज्वेलर्सकडे उपलब्ध |

2022 मध्ये गुंतवणूक करण्यासाठी सर्वोत्तम गोल्ड ETF

गुंतवणूक करण्यासाठी काही सर्वोत्तम अंतर्निहित गोल्ड ईटीएफ खालीलप्रमाणे आहेत:

An Open ended Fund of Funds Scheme with the investment objective to provide returns that tracks returns provided by Birla Sun Life Gold ETF (BSL Gold ETF). Aditya Birla Sun Life Gold Fund is a Gold - Gold fund was launched on 20 Mar 12. It is a fund with Moderately High risk and has given a Below is the key information for Aditya Birla Sun Life Gold Fund Returns up to 1 year are on The scheme seeks to provide returns that closely correspond to returns provided by SBI - ETF Gold (Previously known as SBI GETS). SBI Gold Fund is a Gold - Gold fund was launched on 12 Sep 11. It is a fund with Moderately High risk and has given a Below is the key information for SBI Gold Fund Returns up to 1 year are on The investment objective of the Scheme is to seek to provide returns that closely correspond to returns provided by Reliance ETF Gold BeES. Nippon India Gold Savings Fund is a Gold - Gold fund was launched on 7 Mar 11. It is a fund with Moderately High risk and has given a Below is the key information for Nippon India Gold Savings Fund Returns up to 1 year are on ICICI Prudential Regular Gold Savings Fund (the Scheme) is a fund of funds scheme with the primary objective to generate returns by investing in units of ICICI Prudential Gold Exchange Traded Fund (IPru Gold ETF).

However, there can be no assurance that the investment objectives of the Scheme will be realized. ICICI Prudential Regular Gold Savings Fund is a Gold - Gold fund was launched on 11 Oct 11. It is a fund with Moderately High risk and has given a Below is the key information for ICICI Prudential Regular Gold Savings Fund Returns up to 1 year are on To generate returns that closely correspond to returns generated by Axis Gold ETF. Axis Gold Fund is a Gold - Gold fund was launched on 20 Oct 11. It is a fund with Moderately High risk and has given a Below is the key information for Axis Gold Fund Returns up to 1 year are on 1. Aditya Birla Sun Life Gold Fund

CAGR/Annualized return of 8.5% since its launch. Return for 2024 was 18.7% , 2023 was 14.5% and 2022 was 12.3% . Aditya Birla Sun Life Gold Fund

Growth Launch Date 20 Mar 12 NAV (22 Apr 25) ₹29.0362 ↑ 0.42 (1.47 %) Net Assets (Cr) ₹555 on 31 Mar 25 Category Gold - Gold AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 0.51 Sharpe Ratio 1.65 Information Ratio 0 Alpha Ratio 0 Min Investment 100 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹9,940 31 Mar 22 ₹11,371 31 Mar 23 ₹13,025 31 Mar 24 ₹14,416 31 Mar 25 ₹18,985 Returns for Aditya Birla Sun Life Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month 12% 3 Month 22.2% 6 Month 25.9% 1 Year 35% 3 Year 21.9% 5 Year 14.3% 10 Year 15 Year Since launch 8.5% Historical performance (Yearly) on absolute basis

Year Returns 2023 18.7% 2022 14.5% 2021 12.3% 2020 -5% 2019 26% 2018 21.3% 2017 6.8% 2016 1.6% 2015 11.5% 2014 -7.2% Fund Manager information for Aditya Birla Sun Life Gold Fund

Name Since Tenure Priya Sridhar 31 Dec 24 0.16 Yr. Data below for Aditya Birla Sun Life Gold Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 1.87% Other 98.13% Top Securities Holdings / Portfolio

Name Holding Value Quantity Aditya BSL Gold ETF

- | -100% ₹511 Cr 67,773,270

↑ 3,265,683 Clearing Corporation Of India Limited

CBLO/Reverse Repo | -1% ₹3 Cr Net Receivables / (Payables)

Net Current Assets | -0% -₹2 Cr 2. SBI Gold Fund

CAGR/Annualized return of 8.2% since its launch. Return for 2024 was 19.6% , 2023 was 14.1% and 2022 was 12.6% . SBI Gold Fund

Growth Launch Date 12 Sep 11 NAV (22 Apr 25) ₹29.1833 ↑ 0.61 (2.12 %) Net Assets (Cr) ₹3,582 on 31 Mar 25 Category Gold - Gold AMC SBI Funds Management Private Limited Rating ☆☆ Risk Moderately High Expense Ratio 0.29 Sharpe Ratio 1.59 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹9,722 31 Mar 22 ₹11,159 31 Mar 23 ₹12,913 31 Mar 24 ₹14,265 31 Mar 25 ₹18,680 Returns for SBI Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month 11.8% 3 Month 22.2% 6 Month 25.8% 1 Year 34% 3 Year 21.9% 5 Year 14.2% 10 Year 15 Year Since launch 8.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 19.6% 2022 14.1% 2021 12.6% 2020 -5.7% 2019 27.4% 2018 22.8% 2017 6.4% 2016 3.5% 2015 10% 2014 -8.1% Fund Manager information for SBI Gold Fund

Name Since Tenure Raj gandhi 1 Jan 13 12.17 Yr. Data below for SBI Gold Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 1.34% Other 98.66% Top Securities Holdings / Portfolio

Name Holding Value Quantity SBI Gold ETF

- | -100% ₹3,232 Cr 439,902,410

↑ 29,358,199 Net Receivable / Payable

CBLO | -1% -₹27 Cr Treps

CBLO/Reverse Repo | -1% ₹20 Cr 3. Nippon India Gold Savings Fund

CAGR/Annualized return of 10% since its launch. Return for 2024 was 19% , 2023 was 14.3% and 2022 was 12.3% . Nippon India Gold Savings Fund

Growth Launch Date 7 Mar 11 NAV (22 Apr 25) ₹38.308 ↑ 0.84 (2.25 %) Net Assets (Cr) ₹2,744 on 31 Mar 25 Category Gold - Gold AMC Nippon Life Asset Management Ltd. Rating ☆☆ Risk Moderately High Expense Ratio 0.34 Sharpe Ratio 1.55 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (2%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹9,956 31 Mar 22 ₹11,456 31 Mar 23 ₹13,213 31 Mar 24 ₹14,599 31 Mar 25 ₹19,055 Returns for Nippon India Gold Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month 12.1% 3 Month 22.5% 6 Month 25.9% 1 Year 33.8% 3 Year 21.9% 5 Year 13.8% 10 Year 15 Year Since launch 10% Historical performance (Yearly) on absolute basis

Year Returns 2023 19% 2022 14.3% 2021 12.3% 2020 -5.5% 2019 26.6% 2018 22.5% 2017 6% 2016 1.7% 2015 11.6% 2014 -8.1% Fund Manager information for Nippon India Gold Savings Fund

Name Since Tenure Himanshu Mange 23 Dec 23 1.19 Yr. Data below for Nippon India Gold Savings Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 3.07% Other 96.93% Top Securities Holdings / Portfolio

Name Holding Value Quantity Nippon India ETF Gold BeES

- | -98% ₹2,580 Cr 362,884,792

↑ 9,655,000 Net Current Assets

Net Current Assets | -1% ₹31 Cr Triparty Repo

CBLO/Reverse Repo | -0% ₹12 Cr Cash Margin - Ccil

CBLO | -0% ₹0 Cr 4. ICICI Prudential Regular Gold Savings Fund

CAGR/Annualized return of 8.7% since its launch. Return for 2024 was 19.5% , 2023 was 13.5% and 2022 was 12.7% . ICICI Prudential Regular Gold Savings Fund

Growth Launch Date 11 Oct 11 NAV (22 Apr 25) ₹30.8865 ↑ 0.62 (2.04 %) Net Assets (Cr) ₹1,909 on 31 Mar 25 Category Gold - Gold AMC ICICI Prudential Asset Management Company Limited Rating ☆ Risk Moderately High Expense Ratio 0.4 Sharpe Ratio 1.56 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-15 Months (2%),15 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,050 31 Mar 22 ₹11,473 31 Mar 23 ₹13,247 31 Mar 24 ₹14,669 31 Mar 25 ₹19,133 Returns for ICICI Prudential Regular Gold Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month 11.7% 3 Month 21.8% 6 Month 25.6% 1 Year 33.7% 3 Year 21.8% 5 Year 13.4% 10 Year 15 Year Since launch 8.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 19.5% 2022 13.5% 2021 12.7% 2020 -5.4% 2019 26.6% 2018 22.7% 2017 7.4% 2016 0.8% 2015 8.9% 2014 -5.1% Fund Manager information for ICICI Prudential Regular Gold Savings Fund

Name Since Tenure Manish Banthia 27 Sep 12 12.43 Yr. Nishit Patel 29 Dec 20 4.17 Yr. Data below for ICICI Prudential Regular Gold Savings Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 1.73% Other 98.27% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Pru Gold ETF

- | -100% ₹1,740 Cr 236,566,280

↑ 16,326,224 Treps

CBLO/Reverse Repo | -1% ₹16 Cr Net Current Assets

Net Current Assets | -1% -₹15 Cr 5. Axis Gold Fund

CAGR/Annualized return of 8.2% since its launch. Return for 2024 was 19.2% , 2023 was 14.7% and 2022 was 12.5% . Axis Gold Fund

Growth Launch Date 20 Oct 11 NAV (22 Apr 25) ₹29.1295 ↑ 0.53 (1.85 %) Net Assets (Cr) ₹944 on 31 Mar 25 Category Gold - Gold AMC Axis Asset Management Company Limited Rating ☆ Risk Moderately High Expense Ratio 0.24 Sharpe Ratio 1.58 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,025 31 Mar 22 ₹11,437 31 Mar 23 ₹13,264 31 Mar 24 ₹14,661 31 Mar 25 ₹19,150 Returns for Axis Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month 11.8% 3 Month 21.7% 6 Month 25.6% 1 Year 33.5% 3 Year 21.8% 5 Year 14.5% 10 Year 15 Year Since launch 8.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 19.2% 2022 14.7% 2021 12.5% 2020 -4.7% 2019 26.9% 2018 23.1% 2017 8.3% 2016 0.7% 2015 10.7% 2014 -11.9% Fund Manager information for Axis Gold Fund

Name Since Tenure Aditya Pagaria 9 Nov 21 3.31 Yr. Pratik Tibrewal 1 Feb 25 0.08 Yr. Data below for Axis Gold Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 2.87% Other 97.13% Top Securities Holdings / Portfolio

Name Holding Value Quantity Axis Gold ETF

- | -99% ₹857 Cr 119,827,570

↑ 8,979,678 Clearing Corporation Of India Ltd

CBLO/Reverse Repo | -2% ₹16 Cr Net Receivables / (Payables)

Net Current Assets | -0% -₹4 Cr

गोल्ड म्युच्युअल फंडात ऑनलाइन गुंतवणूक कशी करावी?

Fincash.com वर आजीवन मोफत गुंतवणूक खाते उघडा.

तुमची नोंदणी आणि KYC प्रक्रिया पूर्ण करा

दस्तऐवज अपलोड करा (PAN, आधार इ.).आणि, तुम्ही गुंतवणूक करण्यास तयार आहात!

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.