+91-22-48913909

+91-22-48913909

Table of Contents

- बॅलन्स्ड म्युच्युअल फंडात गुंतवणूक का करावी?

- टॉप बॅलन्स्ड फंडांचे फायदे आणि तोटे

- आर्थिक वर्ष 22 - 23 मध्ये गुंतवणुकीसाठी सर्वोत्तम कामगिरी करणारे बॅलन्स्ड फंड किंवा हायब्रिड फंड

- बॅलन्स्ड म्युच्युअल फंडामध्ये ऑनलाइन गुंतवणूक कशी करावी?

Top 11 Funds

- JM Equity Hybrid Fund

- HDFC Balanced Advantage Fund

- ICICI Prudential Equity and Debt Fund

- UTI Multi Asset Fund

- ICICI Prudential Multi-Asset Fund

- UTI Hybrid Equity Fund

- Edelweiss Multi Asset Allocation Fund

- DSP BlackRock Equity and Bond Fund

- Sundaram Equity Hybrid Fund

- BOI AXA Mid and Small Cap Equity and Debt Fund

- Nippon India Equity Hybrid Fund

बेस्ट बॅलन्स्ड म्युच्युअल फंड 2022

शीर्षस्थानीसंतुलित निधी आहेतम्युच्युअल फंड जे त्यांच्या मालमत्तेची गुंतवणूक इक्विटी आणि डेट इन्स्ट्रुमेंट या दोन्हीमध्ये चांगले एकूण परतावा देण्यासाठी करतात. बॅलन्स्ड म्युच्युअल फंड हे गुंतवणूकदारांसाठी फायदेशीर आहेत जे ए घेण्यास इच्छुक आहेतबाजार तसेच काही निश्चित परतावा शोधत असताना जोखीम.

इक्विटी आणि स्टॉक्समध्ये गुंतवलेली मालमत्ता बाजाराशी संबंधित परतावा देते तर कर्ज साधनांमध्ये गुंतवलेली मालमत्ता निश्चित परतावा देते. इक्विटी आणि डेट या दोन्हींचे मिश्रण असल्याने, गुंतवणूकदारांनी खूप सावधगिरी बाळगली पाहिजेगुंतवणूक या निधीमध्ये. बॅलन्स्ड म्युच्युअल फंडामध्ये गुंतवणूक करण्यापूर्वी गुंतवणूकदारांना टॉप बॅलन्स्ड फंड शोधण्याचा सल्ला दिला जातो. आम्ही खाली शीर्ष संतुलित म्युच्युअल फंड सूचीबद्ध केले आहेत.

बॅलन्स्ड म्युच्युअल फंडात गुंतवणूक का करावी?

साधारणपणे, गुंतवणूकदार कमी जोखमीसह कमी कालावधीत त्यांच्या गुंतवणुकीत विविधता आणण्याचे मार्ग शोधतात. इक्विटी आणि डेट या दोन्ही साधनांचे संयोजन असल्याने, संतुलित म्युच्युअल फंड या दोन्ही जगातील सर्वोत्तम ऑफर देतात. त्यामुळे, हे फंड कर्जाच्या एक्सपोजरमुळे काही मूलभूत परताव्याचे व्यवस्थापन करताना सतत बदलत्या बाजार परिस्थितीमुळे पडझडीचा धोका कमी करतात. 100% गुंतवणुकीपेक्षा किंचित कमी जोखमीसह परतावा मिळविण्याचा मध्यम मार्ग शोधणाऱ्या गुंतवणूकदारांसाठी हे संतुलित फंड हा अत्यंत योग्य गुंतवणूक पर्याय बनवतो.इक्विटी फंड.

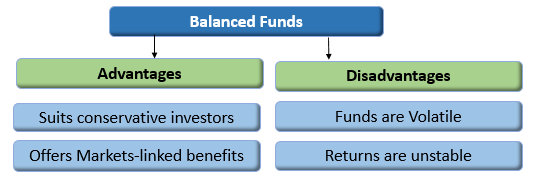

टॉप बॅलन्स्ड फंडांचे फायदे आणि तोटे

फायदे

- 35-40% मालमत्तेची स्थिर गुंतवणूक करून स्थिर परतावा देतेउत्पन्न पर्याय

- इक्विटीमध्ये 60-65% मालमत्ता गुंतवून बाजाराशी संबंधित परतावा देतात

- मध्यम जोखीम घेण्यास इच्छुक असलेल्या पुराणमतवादी गुंतवणूकदारांसाठी योग्य

तोटे

- इक्विटीमध्ये गुंतवलेले फंड अस्थिर असतात आणि त्यात उच्च-जोखीम असतेघटक

- एकत्रित परतावा (डेट आणि इक्विटी म्युच्युअल फंड या दोन्हींचा परतावा) दीर्घकाळात फार चांगला परतावा देऊ शकत नाही.

Talk to our investment specialist

आर्थिक वर्ष 22 - 23 मध्ये गुंतवणुकीसाठी सर्वोत्तम कामगिरी करणारे बॅलन्स्ड फंड किंवा हायब्रिड फंड

टॉप परफॉर्मिंग अग्रेसिव्ह हायब्रिड फंड

हा फंड त्याच्या एकूण मालमत्तेपैकी सुमारे 65 ते 85 टक्के इक्विटी-संबंधित साधनांमध्ये आणि सुमारे 20 ते 35 टक्के मालमत्ता कर्ज साधनांमध्ये गुंतवेल.म्युच्युअल फंड घरे एकतर संतुलित संकरित किंवा आक्रमक संकरित फंड देऊ शकतो, दोन्ही नाही.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) JM Equity Hybrid Fund Growth ₹116.265

↑ 0.41 ₹768 0.6 -6.6 3.5 20.7 27.8 27 ICICI Prudential Equity and Debt Fund Growth ₹381.38

↑ 3.55 ₹40,962 5.9 1.9 9.8 18.7 27.4 17.2 UTI Hybrid Equity Fund Growth ₹391.407

↑ 2.46 ₹5,910 1.9 -0.8 10.5 16.9 23.3 19.7 DSP BlackRock Equity and Bond Fund Growth ₹352.38

↑ 2.08 ₹10,425 5.6 2.5 17 16.1 20.3 17.7 Sundaram Equity Hybrid Fund Growth ₹135.137

↑ 0.78 ₹1,954 0.5 10.5 27.1 16 14.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Apr 25

टॉप परफॉर्मिंग कंझर्वेटिव्ह हायब्रिड फंड

ही योजना मुख्यत्वे कर्ज साधनांमध्ये गुंतवणूक करेल. त्यांच्या एकूण मालमत्तेपैकी सुमारे 75 ते 90 टक्के कर्ज साधनांमध्ये आणि सुमारे 10 ते 25 टक्के इक्विटी-संबंधित साधनांमध्ये गुंतवणूक केली जाईल. या योजनेला कंझर्व्हेटिव्ह असे नाव देण्यात आले आहे कारण ती जोखीम-प्रतिरोधी लोकांसाठी आहे. ज्या गुंतवणूकदारांना त्यांच्या गुंतवणुकीत जास्त धोका पत्करायचा नाही ते या योजनेत गुंतवणूक करण्यास प्राधान्य देऊ शकतात.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) HDFC Hybrid Debt Fund Growth ₹81.7245

↑ 0.24 ₹3,310 3.5 3.2 9 10.9 12.8 10.5 Kotak Debt Hybrid Fund Growth ₹57.8962

↑ 0.08 ₹3,017 2.6 2.8 9.8 10.6 12.6 11.4 UTI Regular Savings Fund Growth ₹68.4251

↑ 0.14 ₹1,648 3.2 3 11.2 9.9 12.4 11.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Apr 25

टॉप परफॉर्मिंग आर्बिट्रेज फंड

हा फंड आर्बिट्राज धोरणाचा अवलंब करेल आणि त्याच्या मालमत्तेपैकी किमान ६५ टक्के इक्विटी-संबंधित साधनांमध्ये गुंतवेल. आर्बिट्रेज फंड हे म्युच्युअल फंड आहेत जे म्युच्युअल फंड परतावा व्युत्पन्न करण्यासाठी रोख बाजार आणि डेरिव्हेटिव्ह मार्केटमधील फरक किंमतीचा फायदा घेतात. आर्बिट्राज फंडांद्वारे मिळणारा परतावा शेअर बाजाराच्या अस्थिरतेवर अवलंबून असतो. आर्बिट्रेज म्युच्युअल फंड हे संकरित स्वरूपाचे असतात आणि उच्च किंवा सततच्या अस्थिरतेच्या काळात हे फंड गुंतवणूकदारांना तुलनेने जोखीममुक्त परतावा देतात.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) UTI Arbitrage Fund Growth ₹34.6724

↓ -0.04 ₹6,614 2 3.8 7.6 6.8 5.5 7.7 Kotak Equity Arbitrage Fund Growth ₹37.0897

↓ -0.04 ₹60,373 2 3.8 7.6 7 5.7 7.8 ICICI Prudential Equity Arbitrage Fund Growth ₹33.9498

↓ -0.03 ₹25,727 1.9 3.7 7.5 6.8 5.5 7.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Apr 25

टॉप परफॉर्मिंग डायनॅमिक अॅसेट अॅलोकेशन फंड

ही योजना इक्विटी आणि कर्ज साधनांमधील त्यांची गुंतवणूक गतिशीलपणे व्यवस्थापित करेल. हे फंड कर्जाचे वाटप वाढवतात आणि बाजार महाग झाल्यावर इक्विटीचे वेटेज कमी करतात. तसेच, हे फंड कमी जोखमीवर स्थिरता प्रदान करण्यावर भर देतात.Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) HDFC Balanced Advantage Fund Growth ₹502.917

↑ 4.22 ₹90,375 2.8 0.1 7.3 19.7 25.9 16.7 Axis Dynamic Equity Fund Growth ₹20.58

↑ 0.15 ₹2,808 3 1.4 12.6 14 14.3 17.5 ICICI Prudential Balanced Advantage Fund Growth ₹71.55

↑ 0.42 ₹60,591 4 2.4 9.5 12.8 17.3 12.3 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Apr 25

टॉप परफॉर्मिंग इक्विटी सेव्हिंग्स फंड

ही योजना इक्विटी, आर्बिट्रेज आणि डेटमध्ये गुंतवणूक करेल. इक्विटी बचत एकूण मालमत्तेपैकी किमान 65 टक्के शेअर्समध्ये आणि किमान 10 टक्के कर्जामध्ये गुंतवेल. योजना माहिती दस्तऐवजात किमान हेज्ड आणि हेज्ड गुंतवणुकीचे वर्णन करेल.Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) L&T Equity Savings Fund Growth ₹31.5868

↑ 0.06 ₹624 -1.9 -2.1 6.2 11 14.6 24 Principal Equity Savings Fund Growth ₹68.6168

↑ 0.21 ₹976 2.3 1.9 8 10.9 14.8 12.6 Kotak Equity Savings Fund Growth ₹25.4239

↑ 0.10 ₹8,043 1.7 1.7 7 10.8 12.9 11.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Apr 25

टॉप परफॉर्मिंग मल्टी अॅसेट अलोकेशन फंड

ही योजना तीन मालमत्ता वर्गांमध्ये गुंतवणूक करू शकते, याचा अर्थ ते इक्विटी आणि कर्ज व्यतिरिक्त अतिरिक्त मालमत्ता वर्गात गुंतवणूक करू शकतात. फंडाने प्रत्येक मालमत्ता वर्गात किमान 10 टक्के गुंतवणूक करावी. परदेशी सिक्युरिटीजला स्वतंत्र मालमत्ता वर्ग मानले जाणार नाही. (Erstwhile JM Balanced Fund) To provide steady current income as well as long term growth of capital. JM Equity Hybrid Fund is a Hybrid - Hybrid Equity fund was launched on 1 Apr 95. It is a fund with Moderately High risk and has given a Below is the key information for JM Equity Hybrid Fund Returns up to 1 year are on (Erstwhile HDFC Growth Fund and HDFC Prudence Fund) Aims to generate long term capital appreciation from a portfolio that is invested predominantly in equity and equity related instruments. HDFC Balanced Advantage Fund is a Hybrid - Dynamic Allocation fund was launched on 11 Sep 00. It is a fund with Moderately High risk and has given a Below is the key information for HDFC Balanced Advantage Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Balanced Fund) To generate long term capital appreciation and current income from a portfolio

that is invested in equity and equity related securities as well as in fixed income

securities. ICICI Prudential Equity and Debt Fund is a Hybrid - Hybrid Equity fund was launched on 3 Nov 99. It is a fund with Moderately High risk and has given a Below is the key information for ICICI Prudential Equity and Debt Fund Returns up to 1 year are on (Erstwhile UTI Wealth Builder Fund) The objective of the Scheme is to achieve long term capital appreciation by investing predominantly in a diversified portfolio of equity and equity related instruments along with investments in Gold ETFs and Debt and Money Market Instruments. However, there can be no assurance that the investment objective of the Scheme will be achieved. UTI Multi Asset Fund is a Hybrid - Multi Asset fund was launched on 21 Oct 08. It is a fund with Moderately High risk and has given a Below is the key information for UTI Multi Asset Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Dynamic Plan) To generate capital appreciation by actively investing in equity and equity related securities. For defensive considerations, the Scheme may invest in debt, money market instruments and derivatives. The investment manager will have the discretion to take aggressive asset calls i.e. by staying 100% invested in equity market/equity related instruments at a given point of time and 0% at another, in which case, the fund may be invested in debt related instruments at its discretion. The AMC may choose to churn the portfolio of the Scheme in order to achieve the investment objective. The Scheme is suitable for investors seeking high returns and for those who are willing to take commensurate risks. ICICI Prudential Multi-Asset Fund is a Hybrid - Multi Asset fund was launched on 31 Oct 02. It is a fund with Moderately High risk and has given a Below is the key information for ICICI Prudential Multi-Asset Fund Returns up to 1 year are on (Erstwhile UTI Balanced Fund) The scheme aims to invest in a portfolio of equity/equity related securities and fixed income securities (debt and money market securities) with a view to generating regular income together with capital appreciation. UTI Hybrid Equity Fund is a Hybrid - Hybrid Equity fund was launched on 2 Jan 95. It is a fund with Moderately High risk and has given a Below is the key information for UTI Hybrid Equity Fund Returns up to 1 year are on (Erstwhile Edelweiss Prudent Advantage Fund) The objective of the Scheme is to generate returns through capital appreciation by investing in diversified portfolio of equity and equity-related securities, fixed income instruments and Gold Exchange Traded Funds.

However, there is no assurance that the investment objective of the Scheme will be realized. Edelweiss Multi Asset Allocation Fund is a Hybrid - Multi Asset fund was launched on 12 Aug 09. It is a fund with Moderately High risk and has given a Below is the key information for Edelweiss Multi Asset Allocation Fund Returns up to 1 year are on Seeks to generate long term capital appreciation and current income from a portfolio constituted of equity and equity related securities as well as fixed income securities. DSP BlackRock Equity and Bond Fund is a Hybrid - Hybrid Equity fund was launched on 27 May 99. It is a fund with Moderately High risk and has given a Below is the key information for DSP BlackRock Equity and Bond Fund Returns up to 1 year are on (Erstwhile Sundaram Balanced Fund) The scheme seeks to generate capital appreciation and current income through a judicious mix of investments in equities and fixed income securities. Sundaram Equity Hybrid Fund is a Hybrid - Hybrid Equity fund was launched on 23 Jun 00. It is a fund with Moderately High risk and has given a Below is the key information for Sundaram Equity Hybrid Fund Returns up to 1 year are on (Erstwhile BOI AXA Mid Cap Equity And Debt Fund) The scheme's objective is to provide capital appreciation and income distribution to investors from a portfolio constituting of mid cap equity and equity related securities as well as fixed income securities.However there can be no assurance that the investment objectives of the Scheme will be realized BOI AXA Mid and Small Cap Equity and Debt Fund is a Hybrid - Hybrid Equity fund was launched on 20 Jul 16. It is a fund with Moderately High risk and has given a Below is the key information for BOI AXA Mid and Small Cap Equity and Debt Fund Returns up to 1 year are on (Erstwhile Reliance Regular Savings Fund - Balanced Plan) The primary investment objective of this option is to generate consistent returns and appreciation of capital by investing in mix of securities comprising of Equity, Equity related instruments & fixed income instruments. Nippon India Equity Hybrid Fund is a Hybrid - Hybrid Equity fund was launched on 8 Jun 05. It is a fund with Moderately High risk and has given a Below is the key information for Nippon India Equity Hybrid Fund Returns up to 1 year are on Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) UTI Multi Asset Fund Growth ₹71.9927

↑ 0.26 ₹5,285 2.6 0.1 8.7 18.6 18.3 20.7 ICICI Prudential Multi-Asset Fund Growth ₹731.152

↓ -5.64 ₹55,360 4.8 3.8 11.8 18.5 26.2 16.1 Edelweiss Multi Asset Allocation Fund Growth ₹61.11

↑ 0.60 ₹2,487 2.6 -0.3 9.5 16.7 22 20.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Apr 25 AUM >= 200 कोटी & क्रमवारी लावली3 वर्षCAGR परत.1. JM Equity Hybrid Fund

CAGR/Annualized return of 12.5% since its launch. Ranked 35 in Hybrid Equity category. Return for 2024 was 27% , 2023 was 33.8% and 2022 was 8.1% . JM Equity Hybrid Fund

Growth Launch Date 1 Apr 95 NAV (28 Apr 25) ₹116.265 ↑ 0.41 (0.35 %) Net Assets (Cr) ₹768 on 31 Mar 25 Category Hybrid - Hybrid Equity AMC JM Financial Asset Management Limited Rating ☆ Risk Moderately High Expense Ratio 2.36 Sharpe Ratio 0.07 Information Ratio 1.04 Alpha Ratio 0.05 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-60 Days (1%),60 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,786 31 Mar 22 ₹20,451 31 Mar 23 ₹21,645 31 Mar 24 ₹32,246 31 Mar 25 ₹34,502 Returns for JM Equity Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Apr 25 Duration Returns 1 Month 1.8% 3 Month 0.6% 6 Month -6.6% 1 Year 3.5% 3 Year 20.7% 5 Year 27.8% 10 Year 15 Year Since launch 12.5% Historical performance (Yearly) on absolute basis

Year Returns 2023 27% 2022 33.8% 2021 8.1% 2020 22.9% 2019 30.5% 2018 -8.1% 2017 1.7% 2016 18.5% 2015 3% 2014 -0.2% Fund Manager information for JM Equity Hybrid Fund

Name Since Tenure Satish Ramanathan 1 Oct 24 0.41 Yr. Asit Bhandarkar 31 Dec 21 3.17 Yr. Chaitanya Choksi 20 Aug 21 3.53 Yr. Ruchi Fozdar 4 Oct 24 0.41 Yr. Data below for JM Equity Hybrid Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 12.53% Equity 69.26% Debt 18.22% Equity Sector Allocation

Sector Value Financial Services 22.12% Consumer Cyclical 11.89% Technology 9.76% Health Care 8.86% Consumer Defensive 4.28% Basic Materials 4.23% Communication Services 3.55% Industrials 3.18% Debt Sector Allocation

Sector Value Cash Equivalent 11.24% Government 10.52% Corporate 8.99% Credit Quality

Rating Value AA 0.7% AAA 99.3% Top Securities Holdings / Portfolio

Name Holding Value Quantity Bajaj Finance Ltd (Financial Services)

Equity, Since 31 Jan 25 | 5000346% ₹43 Cr 50,004

↑ 7,000 Infosys Ltd (Technology)

Equity, Since 30 Nov 20 | INFY5% ₹34 Cr 200,000 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Jun 24 | HDFCBANK4% ₹29 Cr 167,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 21 | ICICIBANK4% ₹29 Cr 240,114

↑ 40,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 24 | BHARTIARTL4% ₹26 Cr 165,000 6.92% Govt Stock 2039

Sovereign Bonds | -4% ₹26 Cr 2,550,000

↑ 1,000,000 Bajaj Auto Ltd (Consumer Cyclical)

Equity, Since 31 Oct 23 | 5329773% ₹25 Cr 31,280 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jan 25 | KOTAKBANK3% ₹23 Cr 120,000

↑ 60,000 Voltas Ltd (Consumer Cyclical)

Equity, Since 31 Oct 23 | VOLTAS3% ₹20 Cr 150,000

↑ 75,000 Jubilant Foodworks Ltd (Consumer Cyclical)

Equity, Since 30 Nov 24 | JUBLFOOD2% ₹18 Cr 285,000

↓ -15,000 2. HDFC Balanced Advantage Fund

CAGR/Annualized return of 18.2% since its launch. Ranked 23 in Dynamic Allocation category. Return for 2024 was 16.7% , 2023 was 31.3% and 2022 was 18.8% . HDFC Balanced Advantage Fund

Growth Launch Date 11 Sep 00 NAV (28 Apr 25) ₹502.917 ↑ 4.22 (0.85 %) Net Assets (Cr) ₹90,375 on 28 Feb 25 Category Hybrid - Dynamic Allocation AMC HDFC Asset Management Company Limited Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.43 Sharpe Ratio -0.27 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹15,696 31 Mar 22 ₹18,998 31 Mar 23 ₹21,519 31 Mar 24 ₹30,051 31 Mar 25 ₹32,636 Returns for HDFC Balanced Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Apr 25 Duration Returns 1 Month 1.5% 3 Month 2.8% 6 Month 0.1% 1 Year 7.3% 3 Year 19.7% 5 Year 25.9% 10 Year 15 Year Since launch 18.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 16.7% 2022 31.3% 2021 18.8% 2020 26.4% 2019 7.6% 2018 6.9% 2017 -3.1% 2016 27.9% 2015 9.4% 2014 0.3% Fund Manager information for HDFC Balanced Advantage Fund

Name Since Tenure Anil Bamboli 29 Jul 22 2.59 Yr. Gopal Agrawal 29 Jul 22 2.59 Yr. Arun Agarwal 6 Oct 22 2.4 Yr. Srinivasan Ramamurthy 29 Jul 22 2.59 Yr. Nirman Morakhia 15 Feb 23 2.04 Yr. Dhruv Muchhal 22 Jun 23 1.69 Yr. Data below for HDFC Balanced Advantage Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 8.45% Equity 60.71% Debt 30.84% Equity Sector Allocation

Sector Value Financial Services 21.86% Industrials 7.75% Energy 7.1% Technology 6.26% Consumer Cyclical 5.72% Utility 4.22% Health Care 4.2% Communication Services 2.69% Consumer Defensive 2.59% Basic Materials 2.04% Real Estate 1.57% Debt Sector Allocation

Sector Value Government 15.74% Corporate 14.63% Cash Equivalent 8.92% Credit Quality

Rating Value AA 0.91% AAA 99.09% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Mar 22 | HDFCBANK6% ₹5,160 Cr 29,787,551

↓ -4,127,200 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK4% ₹3,373 Cr 28,010,724

↓ -830,900 Infosys Ltd (Technology)

Equity, Since 31 Oct 09 | INFY3% ₹3,104 Cr 18,390,088

↑ 2,000,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Dec 21 | RELIANCE3% ₹2,960 Cr 24,664,288

↓ -459,500 State Bank of India (Financial Services)

Equity, Since 31 May 07 | SBIN3% ₹2,718 Cr 39,455,000 7.18% Govt Stock 2033

Sovereign Bonds | -3% ₹2,342 Cr 228,533,300 NTPC Ltd (Utilities)

Equity, Since 31 Aug 16 | 5325552% ₹2,191 Cr 70,337,915 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT2% ₹2,103 Cr 6,645,683

↓ -168,950 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Aug 20 | BHARTIARTL2% ₹2,069 Cr 13,179,354

↑ 300,000 Coal India Ltd (Energy)

Equity, Since 31 Jan 18 | COALINDIA2% ₹2,063 Cr 55,854,731 3. ICICI Prudential Equity and Debt Fund

CAGR/Annualized return of 15.3% since its launch. Ranked 7 in Hybrid Equity category. Return for 2024 was 17.2% , 2023 was 28.2% and 2022 was 11.7% . ICICI Prudential Equity and Debt Fund

Growth Launch Date 3 Nov 99 NAV (28 Apr 25) ₹381.38 ↑ 3.55 (0.94 %) Net Assets (Cr) ₹40,962 on 31 Mar 25 Category Hybrid - Hybrid Equity AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.78 Sharpe Ratio 0.26 Information Ratio 1.86 Alpha Ratio 1.98 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,015 31 Mar 22 ₹21,325 31 Mar 23 ₹22,530 31 Mar 24 ₹31,792 31 Mar 25 ₹34,795 Returns for ICICI Prudential Equity and Debt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Apr 25 Duration Returns 1 Month 2.1% 3 Month 5.9% 6 Month 1.9% 1 Year 9.8% 3 Year 18.7% 5 Year 27.4% 10 Year 15 Year Since launch 15.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 17.2% 2022 28.2% 2021 11.7% 2020 41.7% 2019 9% 2018 9.3% 2017 -1.9% 2016 24.8% 2015 13.7% 2014 2.1% Fund Manager information for ICICI Prudential Equity and Debt Fund

Name Since Tenure Sankaran Naren 7 Dec 15 9.24 Yr. Manish Banthia 19 Sep 13 11.45 Yr. Mittul Kalawadia 29 Dec 20 4.17 Yr. Akhil Kakkar 22 Jan 24 1.11 Yr. Sri Sharma 30 Apr 21 3.84 Yr. Sharmila D’mello 31 Jul 22 2.59 Yr. Nitya Mishra 4 Nov 24 0.32 Yr. Data below for ICICI Prudential Equity and Debt Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 9.94% Equity 71.65% Debt 17.89% Equity Sector Allocation

Sector Value Financial Services 22.23% Consumer Cyclical 11.05% Energy 7.13% Health Care 5.89% Utility 5.74% Industrials 5.43% Communication Services 4.64% Consumer Defensive 4.21% Technology 3.23% Basic Materials 2.53% Real Estate 1.52% Debt Sector Allocation

Sector Value Corporate 12% Cash Equivalent 8.02% Government 7.55% Securitized 0.78% Credit Quality

Rating Value A 3.59% AA 30.61% AAA 65.81% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 21 | HDFCBANK7% ₹2,643 Cr 15,255,052

↑ 500,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jul 12 | ICICIBANK6% ₹2,445 Cr 20,309,765 NTPC Ltd (Utilities)

Equity, Since 28 Feb 17 | 5325555% ₹2,115 Cr 67,916,745

↓ -1,933,121 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Jul 21 | MARUTI5% ₹1,967 Cr 1,646,589

↓ -40,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 May 16 | BHARTIARTL4% ₹1,715 Cr 10,920,680 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 May 16 | SUNPHARMA4% ₹1,605 Cr 10,075,438

↑ 445,000 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 30 Apr 17 | 5003123% ₹1,226 Cr 54,447,874

↑ 2,500,000 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 22 | RELIANCE3% ₹1,128 Cr 9,398,686

↑ 900,000 Avenue Supermarts Ltd (Consumer Defensive)

Equity, Since 31 Jan 23 | 5403763% ₹1,088 Cr 3,196,567

↑ 10,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 21 | 5322153% ₹1,028 Cr 10,125,460 4. UTI Multi Asset Fund

CAGR/Annualized return of 12.7% since its launch. Ranked 34 in Multi Asset category. Return for 2024 was 20.7% , 2023 was 29.1% and 2022 was 4.4% . UTI Multi Asset Fund

Growth Launch Date 21 Oct 08 NAV (28 Apr 25) ₹71.9927 ↑ 0.26 (0.36 %) Net Assets (Cr) ₹5,285 on 31 Mar 25 Category Hybrid - Multi Asset AMC UTI Asset Management Company Ltd Rating ☆ Risk Moderately High Expense Ratio 1.62 Sharpe Ratio 0.2 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹13,699 31 Mar 22 ₹15,067 31 Mar 23 ₹15,793 31 Mar 24 ₹22,067 31 Mar 25 ₹23,964 Returns for UTI Multi Asset Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Apr 25 Duration Returns 1 Month 2.6% 3 Month 2.6% 6 Month 0.1% 1 Year 8.7% 3 Year 18.6% 5 Year 18.3% 10 Year 15 Year Since launch 12.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 20.7% 2022 29.1% 2021 4.4% 2020 11.8% 2019 13.1% 2018 3.9% 2017 -0.5% 2016 17.1% 2015 7.3% 2014 -3.7% Fund Manager information for UTI Multi Asset Fund

Name Since Tenure Sharwan Kumar Goyal 12 Nov 21 3.3 Yr. Jaydeep Bhowal 1 Oct 24 0.41 Yr. Data below for UTI Multi Asset Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 9.27% Equity 59.76% Debt 19.3% Other 11.67% Equity Sector Allocation

Sector Value Consumer Cyclical 12.26% Technology 11.08% Financial Services 8.79% Consumer Defensive 8.36% Health Care 5.52% Industrials 5.21% Basic Materials 4.4% Energy 4.11% Communication Services 4.03% Real Estate 0.8% Utility 0.56% Debt Sector Allocation

Sector Value Government 14.26% Cash Equivalent 9.27% Corporate 5.04% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity UTI Gold ETF

- | -12% ₹587 Cr 81,477,316

↑ 103,293 7.1% Govt Stock 2034

Sovereign Bonds | -5% ₹255 Cr 2,500,000,000

↑ 500,000,000 ICICI Bank Ltd (Financial Services)

Equity, Since 29 Feb 24 | ICICIBANK4% ₹223 Cr 1,851,484

↑ 148,635 Reliance Industries Ltd (Energy)

Equity, Since 31 Jan 24 | RELIANCE3% ₹173 Cr 1,440,963

↑ 68,887 Infosys Ltd (Technology)

Equity, Since 31 Mar 24 | INFY3% ₹160 Cr 950,659

↑ 57,942 7.32% Govt Stock 2030

Sovereign Bonds | -3% ₹154 Cr 1,500,000,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 24 | BHARTIARTL3% ₹150 Cr 956,567

↑ 2,545 Tata Consultancy Services Ltd (Technology)

Equity, Since 29 Feb 24 | TCS3% ₹133 Cr 382,441

↑ 23,413 ITC Ltd (Consumer Defensive)

Equity, Since 31 Oct 22 | ITC2% ₹121 Cr 3,073,184

↑ 229,055 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 31 Oct 22 | M&M2% ₹116 Cr 447,224

↑ 54,913 5. ICICI Prudential Multi-Asset Fund

CAGR/Annualized return of 21% since its launch. Ranked 53 in Multi Asset category. Return for 2024 was 16.1% , 2023 was 24.1% and 2022 was 16.8% . ICICI Prudential Multi-Asset Fund

Growth Launch Date 31 Oct 02 NAV (25 Apr 25) ₹731.152 ↓ -5.64 (-0.77 %) Net Assets (Cr) ₹55,360 on 31 Mar 25 Category Hybrid - Multi Asset AMC ICICI Prudential Asset Management Company Limited Rating ☆☆ Risk Moderately High Expense Ratio 1.83 Sharpe Ratio 0.75 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹15,693 31 Mar 22 ₹20,573 31 Mar 23 ₹22,710 31 Mar 24 ₹30,107 31 Mar 25 ₹34,112 Returns for ICICI Prudential Multi-Asset Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Apr 25 Duration Returns 1 Month 1.7% 3 Month 4.8% 6 Month 3.8% 1 Year 11.8% 3 Year 18.5% 5 Year 26.2% 10 Year 15 Year Since launch 21% Historical performance (Yearly) on absolute basis

Year Returns 2023 16.1% 2022 24.1% 2021 16.8% 2020 34.7% 2019 9.9% 2018 7.7% 2017 -2.2% 2016 28.2% 2015 12.5% 2014 -1.4% Fund Manager information for ICICI Prudential Multi-Asset Fund

Name Since Tenure Sankaran Naren 1 Feb 12 13.09 Yr. Manish Banthia 22 Jan 24 1.11 Yr. Ihab Dalwai 3 Jun 17 7.75 Yr. Akhil Kakkar 22 Jan 24 1.11 Yr. Sri Sharma 30 Apr 21 3.84 Yr. Gaurav Chikane 2 Aug 21 3.58 Yr. Sharmila D’mello 31 Jul 22 2.59 Yr. Masoomi Jhurmarvala 4 Nov 24 0.32 Yr. Data below for ICICI Prudential Multi-Asset Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 32.53% Equity 51.72% Debt 9.25% Other 6.28% Equity Sector Allocation

Sector Value Financial Services 20.94% Consumer Cyclical 8.88% Basic Materials 6.84% Energy 5.68% Industrials 5.27% Technology 4.67% Consumer Defensive 4.63% Health Care 4.33% Utility 2.72% Communication Services 2.34% Real Estate 0.68% Debt Sector Allocation

Sector Value Cash Equivalent 31.31% Corporate 7.25% Government 2.95% Securitized 0.5% Credit Quality

Rating Value A 3.36% AA 23.82% AAA 69.16% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 May 06 | ICICIBANK4% ₹2,246 Cr 18,656,800 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Aug 21 | MARUTI4% ₹2,129 Cr 1,781,799 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 22 | HDFCBANK4% ₹1,838 Cr 10,607,299

↑ 200,000 ICICI Prudential Silver ETF

- | -3% ₹1,693 Cr 179,691,983 ICICI Pru Gold ETF

- | -3% ₹1,652 Cr 224,590,882 Reliance Industries Ltd (Energy)

Equity, Since 31 Dec 20 | RELIANCE3% ₹1,609 Cr 13,410,486

↑ 702,236 SBI Cards and Payment Services Ltd Ordinary Shares (Financial Services)

Equity, Since 30 Nov 22 | SBICARD3% ₹1,421 Cr 16,942,626

↓ -300,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 19 | LT2% ₹1,241 Cr 3,921,259

↑ 998,500 NTPC Ltd (Utilities)

Equity, Since 31 Mar 17 | 5325552% ₹1,202 Cr 38,604,423

↓ -308,740 Nifty 50 Index

Derivatives | -2% -₹975 Cr 437,775

↑ 437,775 6. UTI Hybrid Equity Fund

CAGR/Annualized return of 15.1% since its launch. Ranked 12 in Hybrid Equity category. Return for 2024 was 19.7% , 2023 was 25.5% and 2022 was 5.6% . UTI Hybrid Equity Fund

Growth Launch Date 2 Jan 95 NAV (28 Apr 25) ₹391.407 ↑ 2.46 (0.63 %) Net Assets (Cr) ₹5,910 on 31 Mar 25 Category Hybrid - Hybrid Equity AMC UTI Asset Management Company Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 1.91 Sharpe Ratio 0.35 Information Ratio 1.63 Alpha Ratio 3.16 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,141 31 Mar 22 ₹19,352 31 Mar 23 ₹20,172 31 Mar 24 ₹26,919 31 Mar 25 ₹29,806 Returns for UTI Hybrid Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Apr 25 Duration Returns 1 Month 1.9% 3 Month 1.9% 6 Month -0.8% 1 Year 10.5% 3 Year 16.9% 5 Year 23.3% 10 Year 15 Year Since launch 15.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 19.7% 2022 25.5% 2021 5.6% 2020 30.5% 2019 13.2% 2018 2.5% 2017 -5.6% 2016 25.7% 2015 8.8% 2014 2.4% Fund Manager information for UTI Hybrid Equity Fund

Name Since Tenure V Srivatsa 24 Sep 09 15.44 Yr. Sunil Patil 5 Feb 18 7.07 Yr. Data below for UTI Hybrid Equity Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 3.45% Equity 67.42% Debt 29.14% Equity Sector Allocation

Sector Value Financial Services 22.79% Consumer Cyclical 8.28% Technology 6.73% Basic Materials 6.04% Consumer Defensive 4.69% Communication Services 4.5% Industrials 4.42% Health Care 4.02% Energy 3.43% Utility 1.57% Real Estate 0.94% Debt Sector Allocation

Sector Value Government 22.58% Corporate 6.56% Cash Equivalent 3.45% Credit Quality

Rating Value AA 1.11% AAA 98.89% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 29 Feb 20 | HDFCBANK7% ₹403 Cr 2,328,702 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 10 | ICICIBANK5% ₹291 Cr 2,418,644 7.18% Govt Stock 2037

Sovereign Bonds | -5% ₹268 Cr 2,625,000,000 7.23% Govt Stock 2039

Sovereign Bonds | -5% ₹267 Cr 2,600,000,000 Infosys Ltd (Technology)

Equity, Since 31 Mar 06 | INFY4% ₹198 Cr 1,174,984

↓ -50,658 ITC Ltd (Consumer Defensive)

Equity, Since 31 Aug 06 | ITC3% ₹168 Cr 4,242,150 7.41% Govt Stock 2036

Sovereign Bonds | -2% ₹130 Cr 1,250,000,000 6.92% Govt Stock 2039

Sovereign Bonds | -2% ₹125 Cr 1,250,000,000 7.32% Govt Stock 2030

Sovereign Bonds | -2% ₹124 Cr 1,200,000,000 6.79% Govt Stock 2034

Sovereign Bonds | -2% ₹116 Cr 1,150,000,000

↑ 750,000,000 7. Edelweiss Multi Asset Allocation Fund

CAGR/Annualized return of since its launch. Ranked 71 in Multi Asset category. Return for 2024 was 20.2% , 2023 was 25.4% and 2022 was 5.3% . Edelweiss Multi Asset Allocation Fund

Growth Launch Date 12 Aug 09 NAV (28 Apr 25) ₹61.11 ↑ 0.60 (0.99 %) Net Assets (Cr) ₹2,487 on 31 Mar 25 Category Hybrid - Multi Asset AMC Edelweiss Asset Management Limited Rating ☆ Risk Moderately High Expense Ratio 2.18 Sharpe Ratio 0.3 Information Ratio 1.64 Alpha Ratio 2.87 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹15,030 31 Mar 22 ₹17,998 31 Mar 23 ₹18,861 31 Mar 24 ₹25,354 31 Mar 25 ₹27,984 Returns for Edelweiss Multi Asset Allocation Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Apr 25 Duration Returns 1 Month 1.3% 3 Month 2.6% 6 Month -0.3% 1 Year 9.5% 3 Year 16.7% 5 Year 22% 10 Year 15 Year Since launch Historical performance (Yearly) on absolute basis

Year Returns 2023 20.2% 2022 25.4% 2021 5.3% 2020 27.1% 2019 12.7% 2018 10.4% 2017 -0.1% 2016 26.1% 2015 0.2% 2014 2.2% Fund Manager information for Edelweiss Multi Asset Allocation Fund

Name Since Tenure Bhavesh Jain 14 Oct 15 9.39 Yr. Bharat Lahoti 1 Oct 21 3.42 Yr. Rahul Dedhia 1 Jul 24 0.67 Yr. Pranavi Kulkarni 1 Aug 24 0.58 Yr. Data below for Edelweiss Multi Asset Allocation Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 11.4% Equity 72.92% Debt 15.68% Equity Sector Allocation

Sector Value Financial Services 23.16% Health Care 10.35% Technology 8.42% Consumer Cyclical 7.48% Industrials 6.21% Energy 3.61% Utility 3.51% Consumer Defensive 3.04% Basic Materials 2.94% Communication Services 2.91% Real Estate 0.7% Debt Sector Allocation

Sector Value Corporate 13.46% Government 8.73% Cash Equivalent 4.87% Securitized 0.01% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 15 | ICICIBANK6% ₹141 Cr 1,167,577 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 15 | HDFCBANK5% ₹111 Cr 641,975

↑ 56,593 National Bank For Agriculture And Rural Development

Debentures | -4% ₹90 Cr 9,000,000 Hdb Financial Services Ltd.

Debentures | -3% ₹74 Cr 7,500,000 6.54% Govt Stock 2032

Sovereign Bonds | -3% ₹74 Cr 7,500,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 19 | BHARTIARTL3% ₹67 Cr 423,781

↑ 29,775 Infosys Ltd (Technology)

Equity, Since 31 May 15 | INFY3% ₹58 Cr 340,862

↑ 114,430 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 Oct 19 | SUNPHARMA2% ₹55 Cr 343,006

↑ 20,348 NTPC Ltd (Utilities)

Equity, Since 30 Nov 21 | 5325552% ₹53 Cr 1,714,490 Tata Consultancy Services Ltd (Technology)

Equity, Since 31 May 15 | TCS2% ₹45 Cr 129,421

↑ 52,575 8. DSP BlackRock Equity and Bond Fund

CAGR/Annualized return of 14.7% since its launch. Ranked 9 in Hybrid Equity category. Return for 2024 was 17.7% , 2023 was 25.3% and 2022 was -2.7% . DSP BlackRock Equity and Bond Fund

Growth Launch Date 27 May 99 NAV (28 Apr 25) ₹352.38 ↑ 2.08 (0.59 %) Net Assets (Cr) ₹10,425 on 31 Mar 25 Category Hybrid - Hybrid Equity AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.79 Sharpe Ratio 0.82 Information Ratio 0.71 Alpha Ratio 8.68 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹15,199 31 Mar 22 ₹17,138 31 Mar 23 ₹17,023 31 Mar 24 ₹21,867 31 Mar 25 ₹25,577 Returns for DSP BlackRock Equity and Bond Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Apr 25 Duration Returns 1 Month 2.7% 3 Month 5.6% 6 Month 2.5% 1 Year 17% 3 Year 16.1% 5 Year 20.3% 10 Year 15 Year Since launch 14.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 17.7% 2022 25.3% 2021 -2.7% 2020 24.2% 2019 17% 2018 14.2% 2017 -5.1% 2016 27.6% 2015 8.3% 2014 4.8% Fund Manager information for DSP BlackRock Equity and Bond Fund

Name Since Tenure Abhishek Singh 1 Mar 24 1 Yr. Shantanu Godambe 1 Aug 24 0.58 Yr. Data below for DSP BlackRock Equity and Bond Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 6.04% Equity 68.79% Debt 25.17% Equity Sector Allocation

Sector Value Financial Services 31.37% Consumer Cyclical 8.45% Health Care 7.7% Consumer Defensive 6.17% Basic Materials 4.71% Technology 3.74% Industrials 2.87% Communication Services 1.45% Utility 1.35% Energy 1% Debt Sector Allocation

Sector Value Government 16.63% Corporate 8.54% Cash Equivalent 6.04% Credit Quality

Rating Value AA 9.93% AAA 90.07% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 14 | HDFCBANK8% ₹740 Cr 4,270,582 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Nov 15 | ICICIBANK5% ₹444 Cr 3,688,426 7.34% Govt Stock 2064

Sovereign Bonds | -4% ₹363 Cr 34,500,000

↑ 5,000,000 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 31 Mar 24 | M&M3% ₹341 Cr 1,317,286

↑ 96,216 Axis Bank Ltd (Financial Services)

Equity, Since 30 Sep 18 | 5322153% ₹328 Cr 3,227,520

↑ 504,984 Cipla Ltd (Healthcare)

Equity, Since 31 May 24 | 5000873% ₹304 Cr 2,156,479 SBI Life Insurance Co Ltd (Financial Services)

Equity, Since 30 Apr 24 | SBILIFE3% ₹284 Cr 1,984,938

↑ 145,622 7.14% Madhya Pradesh SDL 2043

Sovereign Bonds | -3% ₹258 Cr 25,000,000 ITC Ltd (Consumer Defensive)

Equity, Since 31 Mar 24 | ITC3% ₹250 Cr 6,335,914

↑ 889,196 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jul 24 | KOTAKBANK2% ₹241 Cr 1,268,082 9. Sundaram Equity Hybrid Fund

CAGR/Annualized return of 12.8% since its launch. Ranked 25 in Hybrid Equity category. . Sundaram Equity Hybrid Fund

Growth Launch Date 23 Jun 00 NAV (31 Dec 21) ₹135.137 ↑ 0.78 (0.58 %) Net Assets (Cr) ₹1,954 on 30 Nov 21 Category Hybrid - Hybrid Equity AMC Sundaram Asset Management Company Ltd Rating ☆☆ Risk Moderately High Expense Ratio 2.18 Sharpe Ratio 2.64 Information Ratio -0.12 Alpha Ratio 5.81 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹14,627 Returns for Sundaram Equity Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Apr 25 Duration Returns 1 Month 1.8% 3 Month 0.5% 6 Month 10.5% 1 Year 27.1% 3 Year 16% 5 Year 14.2% 10 Year 15 Year Since launch 12.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for Sundaram Equity Hybrid Fund

Name Since Tenure Data below for Sundaram Equity Hybrid Fund as on 30 Nov 21

Asset Allocation

Asset Class Value Equity Sector Allocation

Sector Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 10. BOI AXA Mid and Small Cap Equity and Debt Fund

CAGR/Annualized return of 15.6% since its launch. Return for 2024 was 25.8% , 2023 was 33.7% and 2022 was -4.8% . BOI AXA Mid and Small Cap Equity and Debt Fund

Growth Launch Date 20 Jul 16 NAV (28 Apr 25) ₹35.66 ↑ 0.21 (0.59 %) Net Assets (Cr) ₹1,068 on 31 Mar 25 Category Hybrid - Hybrid Equity AMC BOI AXA Investment Mngrs Private Ltd Rating Risk Moderately High Expense Ratio 2.68 Sharpe Ratio 0.08 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,955 31 Mar 22 ₹22,790 31 Mar 23 ₹21,965 31 Mar 24 ₹32,073 31 Mar 25 ₹34,204 Returns for BOI AXA Mid and Small Cap Equity and Debt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Apr 25 Duration Returns 1 Month 2.4% 3 Month 3.7% 6 Month -4.2% 1 Year 3.1% 3 Year 15.8% 5 Year 26.3% 10 Year 15 Year Since launch 15.6% Historical performance (Yearly) on absolute basis

Year Returns 2023 25.8% 2022 33.7% 2021 -4.8% 2020 54.5% 2019 31.1% 2018 -4.7% 2017 -14.2% 2016 47.1% 2015 2014 Fund Manager information for BOI AXA Mid and Small Cap Equity and Debt Fund

Name Since Tenure Alok Singh 16 Feb 17 8.04 Yr. Data below for BOI AXA Mid and Small Cap Equity and Debt Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 8.67% Equity 74.88% Debt 16.46% Equity Sector Allocation

Sector Value Financial Services 14.83% Basic Materials 13.96% Technology 10.93% Consumer Cyclical 10.29% Industrials 10.02% Health Care 7.86% Consumer Defensive 3.62% Energy 2.18% Utility 1.17% Debt Sector Allocation

Sector Value Government 11.53% Corporate 7.39% Cash Equivalent 6.2% Credit Quality

Rating Value AA 2.14% AAA 97.86% Top Securities Holdings / Portfolio

Name Holding Value Quantity Coforge Ltd (Technology)

Equity, Since 31 May 20 | COFORGE4% ₹39 Cr 52,800

↑ 1,800 Jindal Stainless Ltd (Basic Materials)

Equity, Since 30 Sep 21 | JSL3% ₹32 Cr 542,000

↑ 92,000 Dixon Technologies (India) Ltd (Technology)

Equity, Since 31 Dec 23 | DIXON3% ₹29 Cr 21,000

↑ 2,000 Housing & Urban Development Corp Ltd (Financial Services)

Equity, Since 31 May 24 | HUDCO3% ₹25 Cr 1,500,000

↑ 200,000 Castrol India Ltd (Energy)

Equity, Since 31 Jan 24 | 5008702% ₹21 Cr 1,001,000 PB Fintech Ltd (Financial Services)

Equity, Since 29 Feb 24 | 5433902% ₹21 Cr 145,000 BSE Ltd (Financial Services)

Equity, Since 31 Aug 23 | BSE2% ₹20 Cr 43,500

↑ 10,000 Indian Railway Finance Corporation Limited

Debentures | -2% ₹20 Cr 2,000,000 National Bank For Agriculture And Rural Development

Debentures | -2% ₹20 Cr 2,000,000 Swan Energy Ltd (Industrials)

Equity, Since 31 Dec 23 | SWANENERGY2% ₹19 Cr 475,000 11. Nippon India Equity Hybrid Fund

CAGR/Annualized return of 12.3% since its launch. Ranked 8 in Hybrid Equity category. Return for 2024 was 16.1% , 2023 was 24.1% and 2022 was 6.6% . Nippon India Equity Hybrid Fund

Growth Launch Date 8 Jun 05 NAV (28 Apr 25) ₹100.696 ↑ 1.00 (1.00 %) Net Assets (Cr) ₹3,688 on 31 Mar 25 Category Hybrid - Hybrid Equity AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 2.02 Sharpe Ratio 0.06 Information Ratio 0.99 Alpha Ratio -0.23 Min Investment 500 Min SIP Investment 100 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹15,960 31 Mar 22 ₹18,761 31 Mar 23 ₹19,596 31 Mar 24 ₹25,750 31 Mar 25 ₹27,569 Returns for Nippon India Equity Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Apr 25 Duration Returns 1 Month 2% 3 Month 3% 6 Month -1.3% 1 Year 7.3% 3 Year 15.1% 5 Year 21.7% 10 Year 15 Year Since launch 12.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 16.1% 2022 24.1% 2021 6.6% 2020 27.8% 2019 -5.3% 2018 3% 2017 -4.9% 2016 29.5% 2015 4.2% 2014 8.7% Fund Manager information for Nippon India Equity Hybrid Fund

Name Since Tenure Meenakshi Dawar 10 Sep 21 3.56 Yr. Kinjal Desai 25 May 18 6.86 Yr. Sushil Budhia 1 Feb 20 5.16 Yr. Data below for Nippon India Equity Hybrid Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 3.49% Equity 74.11% Debt 22.41% Equity Sector Allocation

Sector Value Financial Services 24.19% Industrials 8.85% Consumer Cyclical 8.17% Technology 7.87% Health Care 5.77% Consumer Defensive 3.96% Energy 3.67% Utility 3.51% Communication Services 3.41% Basic Materials 2.75% Real Estate 1.95% Debt Sector Allocation

Sector Value Corporate 14.36% Government 6.94% Cash Equivalent 3.49% Securitized 1.11% Credit Quality

Rating Value A 2.93% AA 44.98% AAA 52.09% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 10 | HDFCBANK6% ₹205 Cr 1,182,356 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Apr 12 | ICICIBANK5% ₹189 Cr 1,570,000 Infosys Ltd (Technology)

Equity, Since 28 Feb 11 | INFY3% ₹123 Cr 730,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 28 Feb 13 | LT3% ₹112 Cr 354,838 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Dec 19 | BHARTIARTL3% ₹104 Cr 665,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 14 | RELIANCE3% ₹97 Cr 806,000 Axis Bank Ltd (Financial Services)

Equity, Since 30 Sep 18 | 5322153% ₹95 Cr 933,200 NTPC Ltd (Utilities)

Equity, Since 31 Aug 20 | 5325552% ₹87 Cr 2,800,620 7.23% Government Of India (15/04/2039)

Sovereign Bonds | -2% ₹77 Cr 7,500,000 State Bank of India (Financial Services)

Equity, Since 31 Jul 16 | SBIN2% ₹70 Cr 1,010,000

बॅलन्स्ड म्युच्युअल फंडामध्ये ऑनलाइन गुंतवणूक कशी करावी?

Fincash.com वर आजीवन मोफत गुंतवणूक खाते उघडा.

तुमची नोंदणी आणि KYC प्रक्रिया पूर्ण करा

दस्तऐवज अपलोड करा (PAN, आधार इ.).आणि, तुम्ही गुंतवणूक करण्यास तयार आहात!

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.