Income Smoothing

What is Income Smoothing?

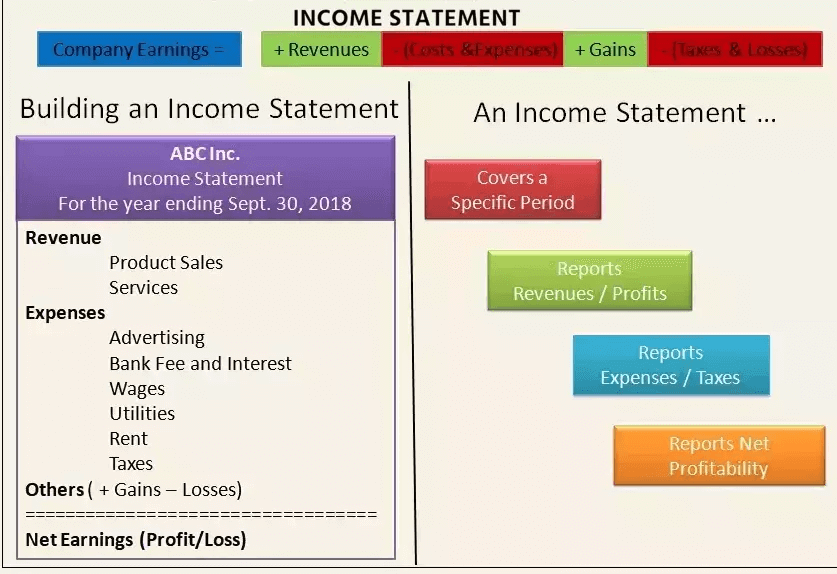

Income smoothing makes use of several Accounting techniques to level the fluctuations arising in the net income from one time period to the next. Basically, companies get indulged in this practice as investors are willing to pay a certain premium for those stocks that have a predictable and steady Earnings stream in comparison to such stocks which have volatile earnings and are considered riskier.

If the process is following the guidelines of Generally Accepted accounting principles (GAAP), income smoothing doesn’t turn out to be illegal. Competent and skilled accountants can help adjust financial books in a way that makes sure that the income smoothing is nothing but viable.

Explaining Income Smoothing

The primary objective of income smoothing is to decrease the fluctuations that may come in earnings to display that the company is acquiring a steady earning. The intention here is to smooth out periods of low income vs periods of high income or periods with low expenses vs periods with high expenses.

Accountants make this possible by moving expenses and revenues around legally. For instance, one of the income smoothing techniques is deferring revenue in a good year in case the next year is anticipated to be a challenging one or is not recognizing expenses in a difficult year, courtesy to the expected improvement in the performance in the future.

Talk to our investment specialist

Although slowing revenue recognition deliberately in good years might look counterintuitive, however, the reality is that companies with anticipated financial results basically relish a lower financing cost.

Thus, it makes sense for a business to be engaged in a certain level of accounting management. But there is always a fine line between the straightforward deception and what the revenue services allow.

Example of Income Smoothing

One income smoothing example that is cited often is the alteration of the doubtful accounts’ allowance to chance the Bad Debt Expense from one period to another. For instance, let’s suppose that a client is expecting to receive a payment for two accounting period, which is Rs. 1000 in the first period and Rs. 5000 in the second period.

If the first period is anticipated to have a high income, the entity may comprise the total amount of Rs. 6,000 as the allowance for doubtful accounts during that specific period. This will increase the Bad Debt expense by Rs. 6,000 on the income statement and will decrease the net income by the same amount. Thereby, this will smooth the period of high-income by decreasing the income.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.