Table of Contents

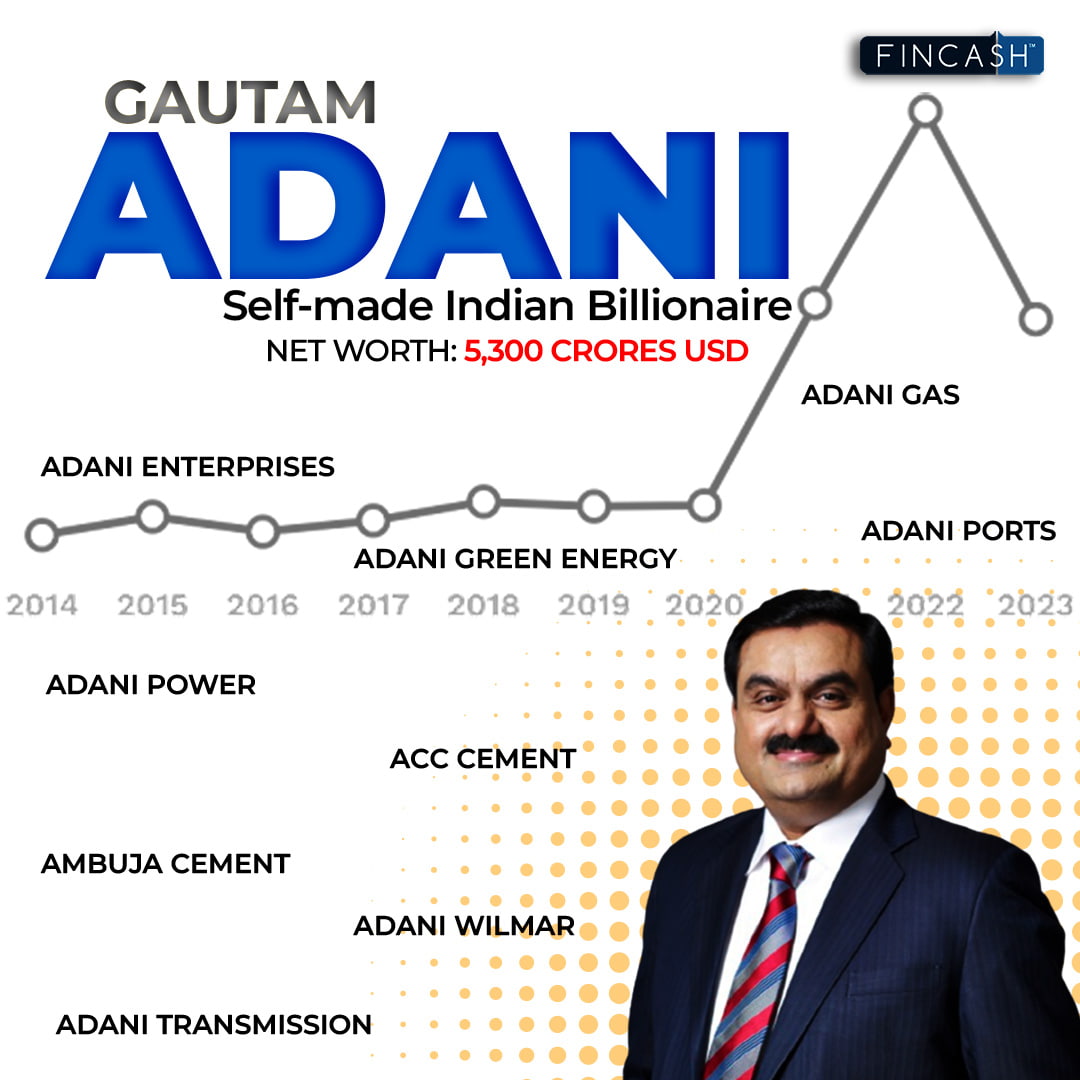

Gautam Adani - The Rise & Fall of Wealth

When talking about billionaires coming from the Land of India, Gautam Shantilal Adani is one such name that cannot be overlooked. Born on 24 June 1962, Gautam is a well-known industrialist and the founder as well as the chairman of Adani Group, which is a multinational conglomerate. This organisation is indulged in port development as well as operations in the country. Lately, according to the news, Adani is extremely close to the Prime Minister of India, Narendra Modi, and his ruling party. This closeness has somehow raised cronyism allegations as the said businessman bagged several infrastructure and energy contracts both in India and abroad post Modi took the seat.

As of March 2023, the fortune of Adani and his family has plummeted by almost 50% to an approximation of $50.2 billion. Now the question that comes into the limelight is - how did Adani become so rich? Let’s have a glance over it in this post.

Unknown Fact: Gautam Adani was kidnapped at gunpoint in 1997 and was released for a ransom worth $1.5 million.

Adani’s Re-entry into the Top 20 Billionaires

Gautam Adani has re-entered the list of top 20 billionaires in the world by Bloomberg. Currently, he is in the 18th position with a Net worth of $64.2 billion. Owing to an increase in the stock prices of the Adani Group, the business tycoon’s net worth shot up by $4.38 billion in just a day. This increase in stocks happened when GQG Partners, the most recent investor of the Adani Group, increased the holdings by approximately 10% on May 23 2023. In March 2023, the GQG Partners acquired a share in Adani Transmission, Adani Green Energy, Adani Ports and Adani Enterprises for Rs. 15,446.35 crores.

Talk to our investment specialist

Gautam Adani & His Beginning

Adani tasted business at his home, considering his father was a textile merchant, but he worked on a small scale. After dropping out of the bachelor’s degree in commerce, Gautam was intrigued by business but not his father’s. In his teenage years, Gautam shifted to Mumbai and started working for Mahendra Brothers as a diamond sorter in 1978. Later in 1981, his elder brother purchased a plastics unit in Ahmedabad and invited Gautam to Handle the operations. This venture created a gateway for Adani to global trading via Polyvinyl Chloride (PVC) imports.

In 1985, Gautam began importing essential polymers to small-scale industries. After three years, he founded Adani Exports, which is currently known as Adani Enterprises. Originally, this company indulged in power and agricultural commodities.

In 1991, Adani began expanding his businesses and stepped into trading agro, textile, and metal products. Later, the Gujarat government declared the outsourcing of the Mundra Port in 1994. After working towards it for a year, Adani got this contract in 1995. In the same year, Gautam set up his first-ever jetty. Originally, this project was regulated by Mundra Port & Special Economic Zone; the operations were transferred to Adani Ports & SEZ (APSEZ), which is the largest private multi-port operator at the present time.

In 1996, Gautam founded Adani Power which is currently holding thermal power plants with a maximum capacity of 4620 MW and is regarded as the largest thermal power producer in India in the private sector. In 2006, Gautam stepped into the business of power generation. From the time period of 2009 to 2012, he acquired Carmichael coal mine situated in Queensland and Abbot Point port located in Australia.

Back in May 2020, Gautam bagged the largest solar bid in the world by the Solar Energy Corporation of India (SECI) which was worth $6 billion. In September same year, he acquired a 74% stake in Mumbai International Airport, which is the second busiest airport in India. In May 2022, the business tycoon acquired Ambuja Cements along with its subsidiary ACC for a whopping amount of $10.5 billion.

Fun Fact: Gautam Adani was present at the Taj Hotel situated in Mumbai when Pakistani terrorists attacked the same place on November 26, 2008.

Adani Group: The Current Situation

Currently, the Adani Group owns almost half a dozen organisations working in varying areas, like transportation, mining, and energy. The group also regulates several airports and ports. Gautam and his family members run this conglomerate. As per a report by the New York Times in 2022, a majority of Adani’s fortune comes from burning coal, shipping, and mining. However, he has also pledged approximately billions of dollars to the development of renewable energy in the country.

The shares of Adani’s firms have been increasing over the last few years. However, it has raised several eyebrows. A lot of trading activity in the Adani group is traced to holding firms in tax havens, increasing speculations that there are manipulations running in the background.

Whether it is about introducing dependable electricity to citizens, upgrading data centers, or building expressways, the strategy of Adani is majorly centered on providing the Indian government with what is required to develop a rapidly thriving Economy. Regardless, the game plan seems to be working nicely for the businessman. Over the last few years, the share prices of the Adani group have skyrocketed, making Gautam Adani one of the richest people.

Here is the list of companies owned by the Adani Group as of May 2023:

- Adani Green Energy Ltd.

- Adani Enterprises Ltd.

- Adani Transmission Ltd.

- Adani Total Gas Ltd.

- Adani Power Ltd.

- Adani Ports & SEZ Ltd.

Fraud Allegations

The rapid ascent of Gautam Adani has not been free of investigation. Over the last decades, this business tycoon has faced several damaging accusations.

Allegations by Hindenburg Research

Back in January 2023, Hindenburg Research - a New York-based investment company - accused Adani and his firms of stock manipulation in a report called “Adani Group: How The World’s 3rd Richest Man is Pulling The Largest Con in Corporate History.” After this report, the stocks of Adani Group fell by $45 billion. This loss resulted in the plummet of Adani from being the 3rd richest person to the 22nd billionaire in the world. As per this report, there were accusations that the group has significant debt and it is operating on a “precarious financial footing.” With this, the stocks of seven Adani companies fell by 3-7%.

Considering the report was released before the follow-on public Offering of Adani Enterprises, as per the CFO of Adani Group, the report was released only to damage the offering. Thereafter, the offering got cancelled on 1st February 2023. In response to the claims made by Hindenburg Research, the Adani Group released a rebuttal that consisted of 413 pages.

The Dodgy Balance Sheet

Even before the Hindenburg Research was published, the magnificent Price-to-Earnings (P/E) ratios of the company attracted the interest of many analysts, and so has the Balance Sheet of the enterprise. Now, for those who are unaware of this term. The PE ratio is a metric that explains the amount of money investors are ready to pay for each Rs. 1 that the organisation is earning per share. For example, a 100 PE ratio simply means that investors are ready to pay Rs. 100 for each Rs. 1 earned per share. Now, for example, let’s look at the PE ratios of Adani Total Gas and Adani Green. The PE ratio of Adani Total Gas is 521, while the sector’s PE ratio is 23.48. While the PE ratio of Adani Green is showcased at 702, the sector in which it is operating has an average 12.79 PE ratio. In the same way, the Adani enterprise has overvalued the remaining firms as compared to their sectors.

A huge point of dispute is the massive borrowing binge that comes with the quick expansion of the Adani group. A research company owned by Fitch Group - CreditSights - put light on the same back in August 2022. Thus, issuing a warning that the business group is “deeply overleveraged.”

Gautam Adani and His Political Relations

Personally, Gautam Adani does not maintain any media presence. However, he is extensively known to be in close proximity to Narendra Modi and his ruling party, as both of them come from the same part of the nation. This has resulted in cronyism allegations as Adani companies have managed to get several infrastructure and energy contracts in the country. As per the critics, Adani gets preferential, special treatment from the government. In fact, back in 2012, an Indian government auditor had also accused Modi of giving low-cost fuel to Adani from a Gujarat state-run gas organisation. However, it is to be noted that both Modi and Adani have denied these allegations.

Adani Group’s Involvement in Philanthropy

Priti Adani, the wife of Gautam Adani, launched Adani Foundation in 1996 and is the chairperson of this firm today. This is the philanthropy (corporate social responsibility) arm of the Adani enterprise and is well-established in 18 Indian states. In March 2020, Adani gave Rs. 100 crores ($13 million) to the PM Care Fund through this philanthropy arm as his contribution against COVID-19. Later, he also contributed Rs. 5 crore ($630,000) to Gujarat CM Relief Fund and Rs. 1 crore ($130,000) to the Maharashtra CM Relief Fund. In June 2022, Adani made a commitment to donate Rs. 60,000 crores ($7.7 billion) to varying social causes.

Wrapping Up

The rise of Gautam Adani, from the son of a regular textile merchant to one of the richest people in the world - is extremely impressive. Seemingly, it is a good example of the proverb - “hard work pays off.” However, early 2023 brought a massive hit to the reputation of this business tycoon. All of a sudden, the image of this industrialist came out as a con and fraud artist whose greed is bringing risks to the Indian economy. Despite all the controversies, the Indian government has given a clean cit to Adani. Now, the world is eagerly waiting to find out which of the tales is going to be true. Is Gautam Adani the fraud as per the claims made, or is he a deserving billionaire helping India transform into a modernised country?

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.