Table of Contents

How to Determine Net Worth?

Wondering what is net worth? Net worth is a benchmark that needs to be in the centre of all your Financial plan. It is the single most significant measure of personal wealth.

As a term, it’s the difference between the assets and the liabilities. It is a concept equally applicable to both types of entities namely- individuals and businesses. Let us proceed by analysing it in-depth.

What is Net Worth?

In its simplest form, it is the value of what you own (assets), minus what you owe (liabilities). The difference between your assets and liabilities makes your personal net worth. But, many people still today don’t know their net worth. Knowing it is extremely important mainly for three reasons-

- To evaluate and understand the current financial state,

- For determining your Financial goals,

- To make an Investment plan.

- Now, what makes a positive and a negative net-worth? Ideally, if you have more assets than liabilities you have positive net worth. But, if your liabilities exceed your assets, you are on the negative side.

Maintaining it positively is very important for every individual. In order to maintain that, one should pay off all their debts; which aren’t a necessity at the earliest. People should cut off their unnecessary expenditures and save more. Having well-thought financial goals and a strong investment plan steers you in direction of positive net worth!

How to Calculate Net Worth?

The basic and first step to calculate personal Net Worth (NW) is by creating a simple list of Current Assets (CA) and Current Liabilities (CL).

Assets

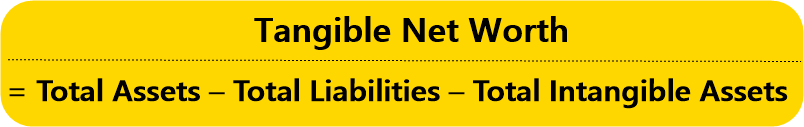

Create a list of what you own (assets). Estimate the value of each asset and then add, to sum up, the total value. Assets can be classified into various categories, such as tangible/ intangible and personal. Each of these terms defines certain kind of assets, as mentioned below-

Tangible assets

These are assets that are in physical form. For example- Bonds, stocks, Land, cash on deposits, cash on hand, corporate bonds, Money market funds, Savings Account, inventory, equipment etc.

Intangible assets

It is an asset that you cannot touch. For example- Blueprints, bonds, brand, website, trademark, copyright, contracts etc.

Personal assets

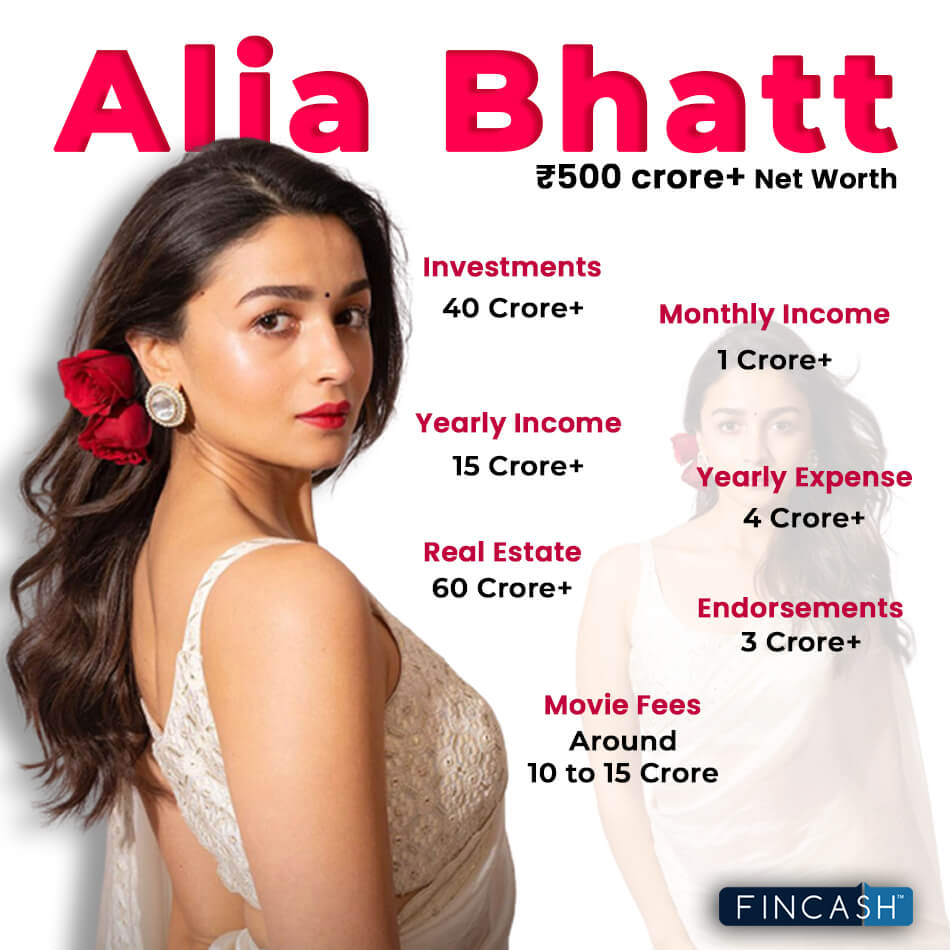

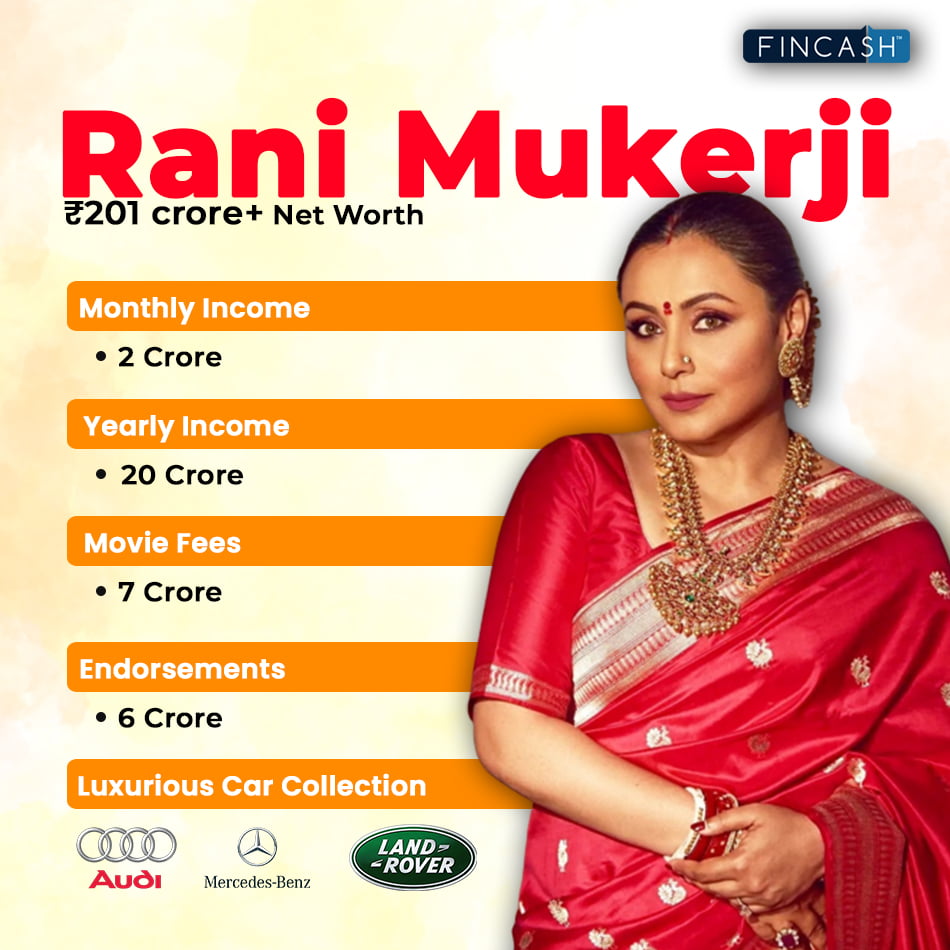

These are the assets owned by the person. Jewellery, investment accounts, retirement account, personal characteristics (comedian, singer, public speaker, actor, artist etc.), Real Estate, artwork, automobile etc.

Talk to our investment specialist

Liabilities

Follow the same method here, as you did to calculate your current assets. Liabilities are legal obligations that are payable to another person or an entity. These are debts which have to be paid off in future or in a certain period of time. Liabilities could be as follows- mortgages, personal loans, student loans, credit card balance, Bank loans, other loans, miscellaneous debts etc.

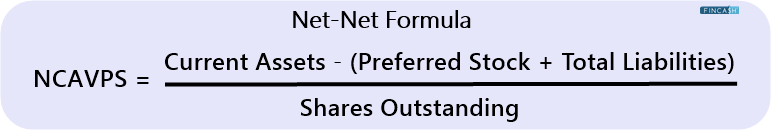

Net Worth Calculator/Formula

This step will finally determine your current NW. Calculate it by using this formula-

NW=CA-CL

| Current Assets (CA) | INR |

|---|---|

| Car | 5,00,000 |

| Furniture | 50,000 |

| Jewelery | 80,000 |

| Total Assets | 6,30,000 |

| Current Liabilities (CL) | INR |

| Credit out standing | 30,000 |

| personal loan standing | 1,00,000 |

| Total Liabilities | 1,30,000 |

| Net Worth | 5,00,000 |

The main idea behind evaluating it is to maintain a healthy financial future. Calculation of net worth should be done once a year. But, make sure each time you review your personal net worth, it should increase in value!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.