Best Bank of India Debit Cards 2025 - 2026

Bank of India (BOI) is one of the top 5 banks in India. It was founded back in 1906, and today it has over 5316 branches in India and 56 offices outside India. BOI is a founder member of SWIFT (Society for Worldwide InterBank Financial Telecommunications) that facilitates cost-effective financial processing and communication services.

In this article, you will find the various Bank of India debit cards that gives attractive reward points on various transactions. You can use these debit cards to get various privileges on shopping, dining, travel, etc.

Types of Bank of India Debit Cards

1. VISA Classic Debit Card

- VISA Classic Debit Card is meant for domestic and international use

- It is issued to all SB, current and OD (overdraft) account holders

- The maximum ATM cash withdrawal limit per day is Rs.15,000

- The POS (Point of Sales) daily usage limit is Rs. 50,000

2. Master Platinum Debit Card

- This card is meant for domestic and international use.

- Get one complimentary lounge visit per quarter at airport lounges in India

Daily Withdrawal Limit & Chargers

If you want to check the balance abroad you will be charged Rs 25.

Here is the daily cash withdrawal limit:

| Withdrawals | Limit |

|---|---|

| ATM | Rs. 50,000 domestically & equivalent of Rs. 50,000 abroad |

| POS | Rs. 100,000 domestically and equivalent of Rs. 100,000 abroad |

| Cash withdrawal charges abroad | Rs.125 + 2% currency conversion charges |

| Merchant transaction abroad at POS | 2% currency conversion charges |

3. Visa Platinum Contactless International Debit Card

- This is an International Debit Card which is accepted at all merchants portal having NFC terminal.

- No PIN is required up to Rs.2000 per Contactless Transaction, however, a PIN is mandatory for all the transactions above the value of Rs. 2000 (per transaction)

- Up to 3 contactless transactions allowed per day

- For the contactless mode, the maximum transaction limit is up to Rs. 2000

- Get Rs. 50 cashback on first contactless transactions

Daily Withdrawal Limit and Charges

Visa Platinum Contactless International Debit Card can be used for safe and secure online shopping.

The daily cash withdrawal limit are:

| Withdrawals | Limit |

|---|---|

| ATM | Rs. 50,000 domestically & equivalent of Rs. 50,000 abroad |

| POS | Rs. 100,000domestically and equivalent of Rs. 100,000 abroad |

| Issuance Charges | Rs. 200 |

| Annual Maintenance Charges | Rs. 150 |

| Card Replacement Charges | Rs. 150 |

Get Best Debit Cards Online

4. Bingo Card

- Bingo debit card by BOI is meant exclusively for students with the option of overdraft Facility up to Rs.2,500

- This card is issued to youth between the ages of 15 years to 25 years

5. Pension Aadhaar Card

- This debit card by BOI is exclusively meant for pensioners, but a photocopy, signature and blood group is must to be provided

- The pensioners have the facility of Overdraft equivalent to one month’s pension

- Pension aadhaar card is an SME Card that is issued for our small and medium entrepreneurs

6. Dhan Aadhaar Card

- It has the cardholder’s photo

- The debit card is issued on the RuPay platform with the UID number given by the Government of India

Daily Withdrawal limit

The Dhan Aadhar card gives PIN based authentication on ATMs.

The cash withdrawal limits are:

| Withdrawals | Limit |

|---|---|

| ATM | Rs. 15,000 |

| POS | Rs. 25,000 |

7. RuPay Classic Debit Card

- This debit card is valid in India, Nepal & Bhutan

- RuPay Classic Debit Card is issued to any BOI account holder

Daily withdrawal limit

It can be used at any ATM or at a merchant’s portal for online payments.

The daily cash withdrawal limit is:

| Withdrawals | Limit |

|---|---|

| ATM | Rs. 15,000 |

| POS | Rs. 25,000 |

8. RuPay Kisan Card

- RuPay Kisan Card is issued by BOI to farmers, and it can be used only in ATM centers

- The maximum limit of cash withdrawn per day at the ATM is Rs.15,000

- The maximum amount that can be withdrawn per day is Rs.25,000 in POS

9. Star Vidya Card

- Star Vidya Card is a proprietary photo card is exclusively given to students

- It can be used in any ATM and the POS provided by Bank of India at the college campus

10. Sangini Debit Card

- Sangini Debit Card by BOI is exclusively designed for women

- You can use the debit card for e-commerce transactions for online shopping, buying travel or movie tickets, paying your bills etc.

- The target group is 18 years + and the card is valid for 5 years

Daily withdrawal limit

This card can be used at ATMs and POS where RuPay cards are accepted.

The daily cash withdrawal limit is follows:

| Daily Withdrawals | Limit |

|---|---|

| ATM | Rs. 15,000 |

| POS | Rs. 25,000 |

How to Activate Bank of India ATM Card?

Follow the steps to activate your BOI ATM card:

- Find the nearest BOI ATM centre closer to your location.

- Insert your ATM card into the ATM machine.

- Select the language you would want to use on Machine’s screen.

- Punch your ATM PIN, and you are done with the process.

Similarly, you can reset the PIN of Bank of India debit card by following 3 ways:

- Through ATM machine

- Via BOI Internet Banking with transaction password

How to Apply for BIO ATM Card?

If you want to apply for the Bank of India ATM card, the easiest method would be to apply online. However, it is essential to note that you will have to hold a Savings Account with the bank. For example, if you are a primary account holder, you can apply for the VISA Classic Debit Card, which will give you benefits of maximum ATM withdrawal per day of Rs. 15,000 and Point of Sales usage of Rs. 50,000.

If you want a higher value card, you can apply for the Master Platinum Card, which, along with the VISA Classic Debit Card's facilities, has other additional benefits. The Master Platinum Card can be used for international transactions, and you can make ATM withdrawals of Rs. 50,000 per day. Thus, before applying for a debit card, you have to check your account balance and evaluate your eligibility.

You can apply for the card by downloading the form from the Bank of India website. After that, fill the form as per the instructions. When you have filled out the form, submit it at the nearest BOI branch. Once the bank checks all the details and your eligibility, the ATM card will be mailed to you.

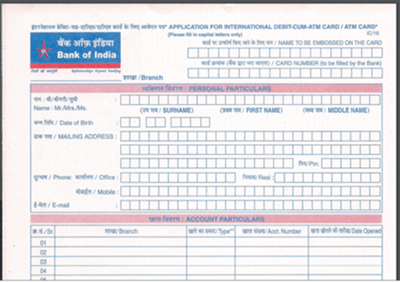

BOI ATM Card Application Online Form

The Bank of India debit card online application form snapshot is given below. You need to fill the form properly and submit it to the nearest BOI branch.

How to Block BOI Debit Card?

The Bank of India debit card needs to be blocked in case the card is stolen, lost or mishandled. It is very important to ensure that no fraudulent activity or unauthorized transactions take place.

You can block your Bank of India Debit Card by following ways:

- Call BOI customer care number

18004251112 (toll-free), 02240429123 (landline number).

The account holder needs to give a registered mobile number for further assistance. You also need to provide 16 digit Bank of India debit card number to customer care executive.

- You can block the Bank of India debit card by sending an email to

PSS.Hotcard@fisglobal.com.

Account-holders can also block the card by BOI net banking procedure. Or else, you can personally visit the branch, fill the form and submit it in the Bank.

BOI Debit Card Customer Care Number

Bank of India customer care unit helps you to solve your queries related to debit /ATM cards.

BOI customer care details:

| CC Number | Email ID | |

|---|---|---|

| Enquiry-Landline | (022)40429036, (080)69999203 | Email: boi.customerservice@oberthur.com |

| Hot Listing-Toll Free | 1800 425 1112, LandLine :(022) 40429123 / (022 40429127), Manual : (044) 39113784 / (044) 71721112 | Email: PSS.hotcard@fisglobal.com |

Conclusion

Bank of India debit cards is specially designed across many age groups so that individuals in different age brackets can avail the benefits to their full potential. So what are you waiting? Select a debit card of your choice!

FAQs

1. Why should I have a Bank of India Debit Card?

A: Bank of India is one of India's most reputed financial institutions and has 5316 branches in India and 56 offices outside India. Moreover, the bank offers its accountholders various types of debit cards based on their requirements. Different debit cards have different withdrawal limits and facilities.

2. What are the main types of debit cards offered by BOI?

A: Bank of India offers various debit cards, but the three leading platforms under which it offers the debit cards are the MasterCard Debit Cards, Visa Debit Cards, and the RuPay Debit Cards.

3. Is there any card offered by BOI that offers contactless transactions?

A: BOI offers Visa Platinum Contactless International Debit Card, which can be used for contactless transactions. This card is accepted by all merchants having Near Field Communication or NFC terminals.

4. Is it mandatory to have a bank account with BOI to have a debit card?

A: Yes, to get a BOI debit card, you must be an account holder with any Bank of India branch. However, you can be a savings or a current account holder to get a debit card.

5. Which BOI debit cards can current account holders apply for?

A: The BOI offers SME debit cards to owners of small and medium sized businesses. Entrepreneurs who have current accounts with a Bank of India branch can apply for the SME debit card.

6. Is there any debit card for students?

A: Bank of India offers students the unique Bingo Debit Card, which comes with a Temporary Overdraft Facility of Rs. 2500. However, this card is issued only to students, and they have to be aged between 15 to 25 years.

7. Is there any debit card for women?

A: The Sangini Debit Card offered by the Bank of India under the RuPay platform is exclusively offered to women. This debit card has a validity of 5 years and can be used at POS and ATM withdrawals. The card also comes with exclusive offers designed for women.

8. Why do I need a debit card?

A: A debit card has numerous benefits, such as you can use it for cashless transactions at POS, and you can also earn reward points by using the card for these transactions. Many debit cards also come with cashback offers, which can reduce your expenses and help you make purchases at discounts.

9. Do I have to go to the bank to apply for the card?

A: Yes, you will have to visit the nearest Bank of India Branch to submit the application form for a debit card. You can download the form online, but you will have to fill out the form and submit it by visiting the nearest BOI branch.

10. Does a debit card have to be activated?

A: Yes, once you receive your debit card, you will have to visit the nearest BOI ATM counter and activate the card. To activate the card, you will have to insert the card, select the language, and type in the PIN. Once you have done this, the card will be activated.

11. How to apply for ATM card, please tell me a solution?

A: If you want to apply for the Bank of India ATM card, the easiest method is to apply online. However, it is essential to note that you will have to hold a savings account with the bank. For example, if you are a primary account holder, you can apply for the VISA Classic Debit Card, which will give you benefits of maximum ATM withdrawal per day of Rs. 15,000 and Point of Sales usage of Rs. 50,000.

If you want a higher value card, you can apply for the Master Platinum Card, which can be used for international transactions, and you can make ATM withdrawals of Rs. 50,000 per day. You can apply for the card by downloading the form from the BOI's website. After that, fill the form as per the instructions and submit at the nearest BOI branch.

Once the bank checks and your eligibility, then the ATM card will be delivered to you.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Hello sir