Fincash » Best Debit Card » Online Money Transfer from Debit Card

Table of Contents

Online Money Transfer from Debit Card

Modern-day technology has changed banking operations. Customers these days do not have to visit their Bank to carry out banking activities. One such change is the transfer of money from one bank account to another.

Online money transfer is where the old fashioned concept of wiring money meets the new technology of electronic fund transfer. Online money transfer takes place between two bank accounts.

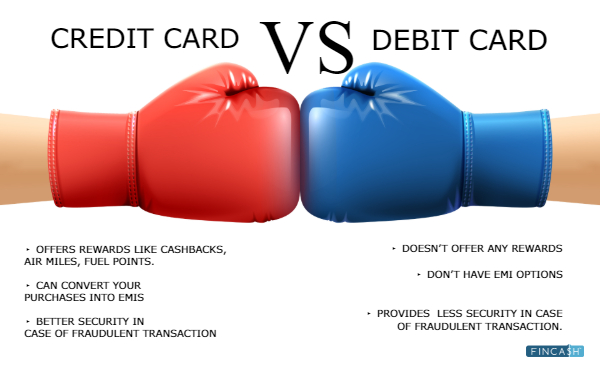

Electronic Money transfer can be done through the electronic terminal like Debit Card, credit card, ATM, online, POS etc.

How to Transfer Money Via ATM?

You can easily transfer the money through the ATM centre to another bank account in the following way-

- Insert your ATM card in the ATM machine

- Enter your Personal Identification Number (PIN)

- Select Fund Transfer option

- Select Transferee Bank i.e select the bank in which you want to transfer the money

- Enter the Account Number of the person you wish to transfer the funds to

- Select the Type of bank account, i.e., Savings or Current

- Enter the amount you want to transfer

- Collect your transaction Receipt

When you complete all the steps, funds will be transferred from your bank account to the another account of your interest.

Talk to our investment specialist

Debit Card to Debit Card Money Transfer Online

Funds can be transferred from one debit card to another. However, this doesn’t take place literally. What you actually do is you transfer the money from your debit card linked to your savings or current account to another bank account, which is linked with the debit card.

This transfer of funds can be done using the following channels like:

- Through ATM centre

- Internet banking

- Via Mobile through Immediate Payment Service (IMPS), UnifiedPayment Interface (UPI), Unstructured Supplementary Service Data (USSD)

- Transfer of funds by visiting the branch

Money Transfer from Debit Card to Merchant Portal

Today, most people do not prefer carrying too much liquid money. They are more comfortable by 'Swipe & Pay' via debit card.

So, how exactly the money is transferred from our debit card to the merchant?

Fund transfer takes place when you swipe your card and then enter the correct PIN in the card machine. The payment gateway - VISA, MasterCard, RuPay, Maestro, Cirrus, etc., connects the debit card to the merchant portal and the money is deducted from your account. Money flows through this payment getaway and get deposited into the merchant's account.

This is how the transaction takes place between your debit card and merchant portal.

Money Transfer Through Banks

Transfer of funds from banks take place through National Electronic Fund Transfer (NEFT), Real-time Gross Settlement (RTGS) or Immediate Payment Service (IMPS). Let’s take a look at each of these:

National Electronic Fund Transfer (NEFT)

NEFT transactions are specified by RBI. It is the most convenient and cost-effective online money transfer. You can do NEFT via online banking and mobile banking. Nowadays, almost every offers these services. NEFT transactions get processed in batches and the funds are settled based on the cutoff time as per RBI guidelines.

Real-Time Gross Settlement (RTGS)

RTGS is usually used when you need to transfer Rs. 2 lakhs or above. The advantage of doing RTGS is that the funds are settled in real-time without any delay. Also, unlike NEFT, RTGS doesn’t follow the Batch Processing method. This money transfer system is a faster and more efficient as each transaction takes place on an instruction Basis.

Immediate Payment Service (IMPS)

As the name suggests, you can actually immediately transfer the funds to the respective bank account through IIMPS. This mode of online fund transfer is relatively new to our country. IMPS can be carried out through internet banking or mobile banking platforms.

Money Tansfer Apps

There are certain money transfer apps, which allows you to send the money anywhere in the world using different currencies. These apps are simple, easy and hassle-free. You need to connect the app to your bank account or by debit card. Money gets directly deducted and the transfer takes place within a few clicks. However, a transaction fee might be charged to both the vendors and users.

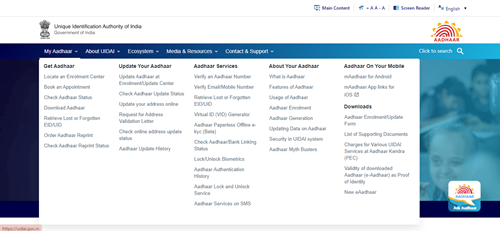

One of the most commonly used apps in India is BHIM. Bharat Interface for Money (BHIM) allows simple, easy and quick transactions using Unified Payments Interface (UPI). Through a short series of steps, you can use BHIM account for transactions.

Conclusion

Today’s world is rapidly moving towards cashless Economy. One of the biggest advantages of online money transfer is that you don’t have to carry wads of notes to make payment, be it for a shopping or paying your utility bills.

One-click on your computer, mobile phone or just a swipe of your card, and your payment is done. This reduces a lot of time as transactions take place online and instantaneously. Opt for an online money transfer option and enjoy hassle-free transactions at your fingertips.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.