Table of Contents

5 Major Difference Between Credit Card and Debit Card

With a 16-digit card number, expiration dates, PIN codes- a credit card and Debit Card typically looks identical. But did you know there's a huge difference between the two? They both also have different features and benefits to offer. Most importantly, they have their own pros and cons that you must know. In this article, you will read about the difference between credit cards and debit cards that will help you to make a better decision.

Credit Card

A credit card is issued by financial companies, typically by a Bank, and lets you borrow money to purchase goods & services and withdraw cash up to a certain limit.

Advantages of credit cards

Here are some of the advantages of credit cards:

Ease of purchases

By owning a credit card you are free from carrying liquid cash. You can use it anywhere, anytime during an emergency where you struggle paying immediately from your bank account. You can easily spread out the cost of larger purchases, such as monthly bills, home appliances, etc.

Build a good credit history

Using credit cards for transactions can be an amazing way to boost your Credit Score. It is also one of the easiest options to start your credit score journey. But, your score depends on how well you pay your dues on time. Delay in payments & exceeding your Credit Limit can bring your score down.

Offer rewards on purchases

It provides additional benefits in the form of rewards on purchases you are already making. The rewards are in the form of cashback, air miles, fuel points, gifts, etc.

Convenient to use

Cash isn’t the most efficient option to carry everywhere. Credit cards, on the other hand, are simple and hassle-free to use. You can swipe the card & withdraw cash from any part of the world.

Variety of options to choose from

Today there are many credit card options to choose. The most common ones are- Secured Credit Cards, unsecured credit cards, travel rewards credit cards, student credit cards, airline & hotel credit cards, etc. You can choose it based on your own preferences and needs.

Get Best Cards Online

Disadvantages of Credit Cards

Here are some of the disadvantages of credit cards:

Possibility of debt

Buying a credit card might put you in a huge risk of debt. This debt might be an issue for you if you don’t pay your dues on time. Creditors will charge interest rates over 15%-20%, and this can build up quickly if you don’t pay the balance off.

Credit limit

Every credit card has a credit limit above which the bank restricts any transactions. This can be quite problematic if you do heavy purchases quite often.

Debit Cards

Debit cards are issued by financial companies just like credit cards. But the way they work is completely different. When you use a debit card, your money is directly debited from your bank account your card is tied with.

Advantages of Debit Card

Here are some of the Advantages of Debit Cards:

Easy to opt

A debit card is quite easy to obtain and you don’t have to qualify for a lot of parameters. Usually, the bank will provide you with one if have an account in the respective bank.

Accessible everywhere

Debit cards are accepted widely in India as well as abroad. Before going abroad, you need to authorize international transactions by calling the respective bank.

Disadvantages of Debit Card

Using a debit card can be easy. But there is also a fair amount of disadvantages of using a debit card.

No grace period

Since, your money from a debit card is directly debited from the bank account, there is no concept of a grace period.

Transaction fee

Debit cards can be expensive as the bank will deduct a certain amount every time you make an ATM transaction from some other bank ATM.

Limited transactions

As the debit card is linked to your bank account, you will be able to make purchases until the balance suffices it.

Security risks involved

Debit cards can become a nightmare in case you lose it and someone else gets hold of it. You’ll have to report immediately to the bank or else it can be easily misused and you may lose your money entirely.

5 Differences Between Credit Cards and Debit Cards

Following are the 5 major differences between credit cards and debit cards

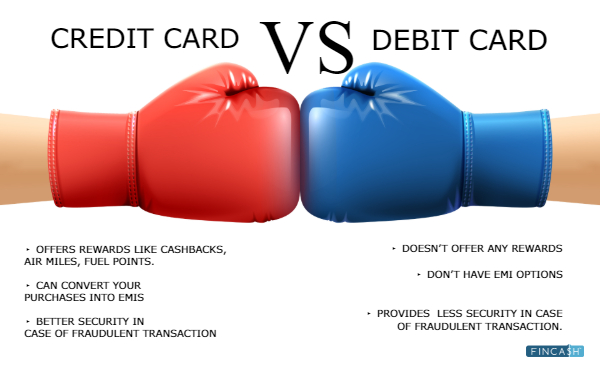

1. Reward points

Credit cards come with quite a lot of rewards and benefits like cashbacks, gift vouchers, sign up bonuses, e-vouchers, air miles, loyalty points, etc. On the other hand, debit cards rarely provide such rewards.

2. EMI options

When you purchase something using a credit card, you can pay back the amount by converting them into EMIs (Equated Monthly Instalments). This is not the same in case of debit cards as you’re liable to pay the entire amount in one go.

3. Security and protection

Both credit and debit cards come with secure PINs. Today, the majority of the credit card comes with a liability protection feature that protects the user from any frauds and illegal transactions. These features are not available for the debit card users and they need to additionally apply for a CPP (Card Protection Plan) if they want to protect their card from misuse or threats.

4. Interest charges

Credit card users are required to pay an interest charge, in case they don’t pay their bills on time, whereas for a debit card user, no interest rate is charged as no amount is borrowed by the bank.

5. Build a Credit Score

Your credit card helps to build your credit score. But, whenever you delay in paying your dues on time, your score gets hampered. A debit card has nothing to do with your credit score as you don’t owe the bank any money for making purchases.

In a nutshell-

| Feature | Credit Card | Debit Card |

|---|---|---|

| Reward points | Offers rewards like cashbacks, air miles, fuel points, etc. | Doesn’t offer any rewards |

| EMI options | Can convert your purchases into EMIs | Don’t have EMI options |

| Security and protection | Better security in case of fraudulent transaction | Provides less security in case of fraudulent transaction |

| Interest charges | An interest charge will be applied incase dues are not paid on time | Doesn’t apply to debit card users |

| Credit score | If you don’t pay your dues on time, your credit score gets affected | Credit scores won’t get affected |

Conclusion

Credit cards and debit cards both are an important tool to make transactions. It can also be a great alternative to cash. But you need to remember the risks and uncertainties involved with using them. Since you know the difference between credit cards and debit cards, you can now choose wisely.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Thank you for information