Table of Contents

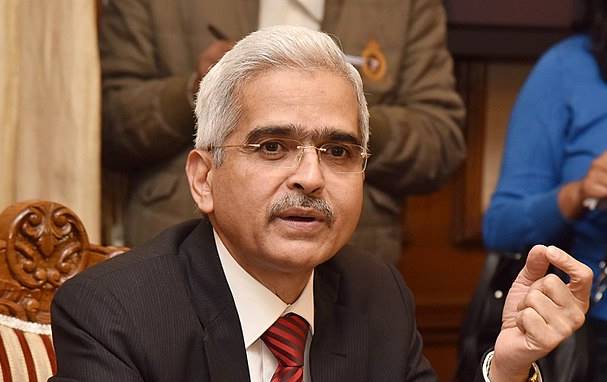

RBI MPC Update: Repo Rate Cut After 5 Years – Impact on Home Loan EMIs and Investments

The Reserve Bank of India (RBI) has announced a major relief for borrowers by cutting the repo rate by 25 Basis Points (bps) to 6.25%. This decision, taken during the Monetary Policy Committee (MPC) meeting held from February 5 to February 7, 2025, marks the first rate cut in nearly five years. Previously, the last rate cut was in March 2020, when it was reduced by 75 bps to 4.40%.

Why Did RBI Cut the Repo Rate?

The primary reason behind the rate cut is to stimulate Economic Growth. Inflation has been on a downward trend, reaching 5.22% in December 2024, giving the central bank room to ease monetary policy. RBI Governor Sanjay Malhotra stated:

"The Monetary Policy Committee unanimously decided to reduce the policy rate by 25 Basis points from 6.5% to 6.25%!"

As a result of this decision, the standing deposit Facility (SDF) rate has been revised to 6.00%, while both the marginal standing facility (MSF) rate and the Bank Rate have been adjusted to 6.50%.

How Will This Impact Home Loans?

A repo rate cut generally leads to lower Home Loan interest rates. However, how quickly borrowers see the benefit depends on their loan type and agreement terms:

- New borrowers: Banks and financial institutions are expected to lower their lending rates soon, making home loans more affordable.

- Existing borrowers: Those with Floating Rate home loans will see the impact at their next reset date, typically in six to twelve months.

EMI Reduction Example

If you have a ₹50 lakh home loan for 20 years at an 8.75% interest rate, a 25 bps rate cut can result in total interest savings of ₹4.20 lakh over the loan tenure, reducing 10 EMIs.

If you refinance your loan at 8.25% while keeping the EMI constant, your savings could be ₹14,480 per lakh, a 15% reduction per lakh over the loan tenure.

Borrowers can also expect ₹1.50 lakh in interest savings in the second year alone if the rate cut takes effect from April 1, 2025.

Talk to our investment specialist

Fixed Deposit Investors: What Should You Do Now?

While the rate cut benefits borrowers, fixed deposit (FD) investors may need to rethink their strategies, as banks could lower FD Interest Rates in the coming months.

Smart FD Strategies Post Rate Cut:

Lock in Current Rates – Open a new FD now to secure higher rates before banks reduce them.

Explore Alternatives – Consider debt mutual fund, corporate Bonds, or equity-linked savings schemes (ELSS) for better returns.

FD Laddering – Split your investment across multiple tenures to reinvest at potentially higher future rates.

Review Existing FDs – If your FD allows premature withdrawal with a low penalty, you might consider reinvesting in higher-yielding instruments.

Tax Savings + Loan Benefits: A Dual Advantage

The Union Budget 2025 has introduced tax exemptions for incomes up to ₹12 lakh, providing significant savings for the middle class. When combined with lower home loan interest rates, salaried individuals can experience substantial financial relief.

For instance:

- A person earning ₹25 lakh annually could save ₹1.14 lakh in Taxes.

- Adding ₹1.50 lakh in home loan interest savings, the total savings for the year could be ₹2.64 lakh (₹22,000 per month).

Conclusion

The RBI’s repo rate cut is a significant move to boost economic growth and provide relief to home loan borrowers. While borrowers benefit from lower EMIs, FD investors need to plan strategically to counter falling interest rates. Combining the repo rate cut with new tax exemptions makes this a great time for individuals to reassess their finances and maximize savings. Stay updated with us for more insights on RBI policies, home loans, and Smart investment strategies!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.