Table of Contents

Defining Indirect Method

One of two Accounting techniques used to construct a cash flow statement is the indirect method. This method converts the operating component of the Cash Flow Statement from the accrual to the cash method of accounting by increasing and decreasing Balance Sheet line items.

The direct approach, which details actual cash inflows and outflows made during the reporting period, is the alternative option for generating a cash flow statement. In practice, the indirect method is more generally adopted, especially by larger companies.

Cash Flow in Indirect Method

The cash flow statement focuses on a company's cash sources and uses, and it is heavily scrutinized by investors, creditors, and other stakeholders. It displays the implications of changes in asset and liability accounts on a company's cash position and provides information on cash generated from various operations.

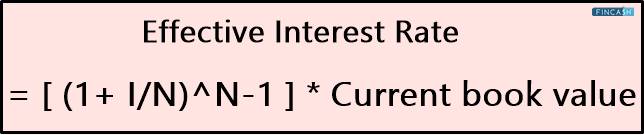

The indirect approach starts with net Income or loss, then adds to or subtracts from that amount for non-cash revenue and expense elements, resulting in cash flow from operations.

Examples of Indirect Method

Revenue gets recognized as it is earned, not necessarily when cash is received, under the accrual method of accounting. When a consumer purchases a Rs.500 widget on credit, the sale is complete, but the money has not yet arrived. The revenue is still recorded in the month in which the deal was made.

The cash flow statement's indirect method tries to convert the record to the cash method to show actual cash inflows and outflows over time. In this case, a Rs.500 debit to accounts receivable and a Rs.500 credit to sales revenue would have been made at the time of sale. The debit raises the number of accounts receivable, which is then shown on the balance sheet.

The cash flows statement will show net income on the first line if you use the indirect technique. Increases/decreases in asset and liability accounts will be shown on the following lines. These items will be added to or deducted from net income based on their financial impact.

In this case, no money had been received, yet income of Rs.500 had been recorded. As a result, on a cash Basis, net income was inflated by this amount. On the balance sheet, the Offset was in the accounts receivable line item. "Increase in Accounts Receivable (500)" would be displayed.

Talk to our investment specialist

Difference Between Indirect and Direct Method

Here are the types of financial activities included in cash flows:

- Cash flows from operating activities

- Cash flows from Investing activities

- Cash flows from financing activities

Although the total cash earned from operating operations is the same in the direct and indirect techniques, the data is presented differently.

The cash flow from operating operations is provided using the direct approach as actual cash inflows and outflows on a cash basis, rather than starting from net income on an accrued basis. For both indirect and direct methods, the investing and financing portions of the statement of cash flows are constructed in the same way.

Many accountants favour the indirect technique since it is easier to generate the cash flow statement using the data of the balance sheet and income statement. Because most businesses employ the accrual method of accounting, the income statement and balance sheet will reflect these values.

The Financial accounting standards Board (FASB) also recommends that businesses utilize the direct approach to provide a clearer idea of cash flows in and out of the company. Even if the direct method is employed, a Reconciliation of the cash flow statement to the balance sheet is still recommended.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.