Table of Contents

Best Pet Insurance Policies in India 2025

When you are a pet owner, the well-being of your furry companions takes centre stage. As devoted pet parents, you must cherish the unconditional love and joy your pet brings into your life. Alongside the fun, however, you are responsible for ensuring their health and happiness. Recognising the significance of this commitment, pet insurance has emerged as a valued resource for pet owners in India.

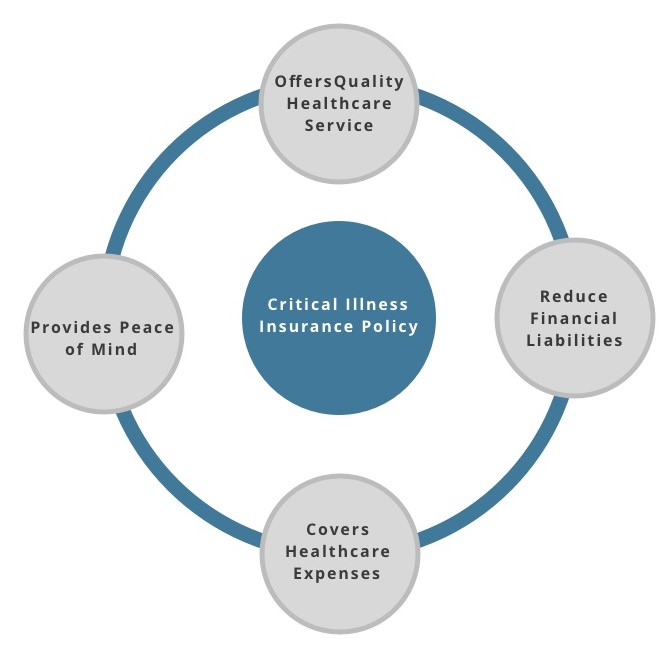

These policies serve as a safety net, Offering financial support to pet owners when unexpected medical expenses arise. Whether vaccinations, routine check-ups, or unforeseen illnesses and accidents, pet insurance provides peace of mind, allowing pet parents to prioritise their pets' health without the burden of excessive veterinary bills. This comprehensive guide aims to navigate the landscape of pet insurance in India, shedding light on the best pet insurance policies in India available for your beloved friends.

Understanding the Need for Pet Insurance

If you are not sure of how pet insurance can help you, here are some of the significant reasons why you should invest in one:

The Rising Cost of Veterinary Care

As veterinary care becomes more advanced, so does its associated cost. Pet owners today face the reality of substantial veterinary bills, especially in the case of emergencies, surgeries, or prolonged treatments. Pet insurance alleviates this financial burden.

Unforeseen Health Challenges

Pets, like humans, can encounter unexpected health challenges. The unpredictable nature of a pet's health, from accidents to illnesses, underscores the need for financial preparedness. Pet insurance covers the costs of medical treatments. It offers a sense of security, allowing pet parents to make decisions based on the best interest of their pets rather than financial constraints.

Holistic Well-being for Pets

Beyond covering medical expenses, some pet insurance policies extend their coverage to include wellness and preventive care. This proactive approach encompasses vaccinations, routine check-ups, and preventive treatments, emphasising the importance of holistic pet well-being. Such policies contribute to your four-legged family members' overall health and longevity.

Talk to our investment specialist

Best Pet Insurance Policies in India 2025

Here is the list of best pet insurance policies in India that you can consider buying:

1. Bajaj Allianz Pet Dog Insurance Policy

Bajaj Allianz Pet Dog Insurance Policy offers comprehensive coverage for your canine companion. With a maximum annual coverage of up to Rs. 50,000, this policy is available for dogs aged between three months and seven years. The minimum premium starts at Rs. 315, making it an affordable option for pet owners. The policy covers various aspects, including hospitalisation, mortality benefits, surgery expenses, terminal diseases, third-party liability, theft, loss, and straying. Additionally, pet vaccination is also covered. With a policy period of up to six months, Bajaj Allianz ensures that your furry friend receives quality healthcare without breaking the Bank.

- Maximum Annual Coverage: Up to Rs. 50,000

- Entry Age: Permitted between three months and seven years

- Premium: Rs. 315 (minimum)

- Co-payment: 10% applicable on each claim

- Coverage: Hospitalisation, mortality benefit, surgery expenses, terminal diseases, third-party liability, theft, loss, straying, and more

- Policy Period: Up to six months

2. New India Assurance Dog Insurance Policy

New India Assurance Dog Insurance Policy provides essential dog coverage, safeguarding against accidents or illnesses leading to death. The policy applies to dogs aged between eight weeks and eight years, offering a maximum annual coverage of Rs. 50,000. Whether your furry companion is of indigenous origin, cross-bred, or an exotic breed, you can benefit from this plan. The basic premium, equivalent to 5% of the sum insured, ensures affordability. A co-payment of 20% of the claim amount is applicable.

- Coverage: Dogs are insured against death due to accidents or any illness

- Entry Age: Permitted between eight weeks and eight years

- Maximum Annual Coverage: Up to Rs. 50,000

- Premium: Basic premium is 5% of the sum insured

- Co-payment: Insured to bear 20% of the claim amount

- Coverage Highlights: Covers indigenous, cross-bred, and exotic breeds, offering protection for hospitalisation, mortality benefits, surgery expenses, terminal diseases, third-party liability, theft, loss, straying, and more

3. Digit Pet Insurance

Digit Pet Insurance prioritises the well-being of your pet with its comprehensive coverage. This policy is designed for dogs and cats, offering protection against medical expenses, surgeries, and treatments. With an easy and hassle-free online process, Digit ensures a quick settlement of claims. It covers accidental injuries and illnesses and even provides optional add-ons for enhanced coverage. The policy is available for pets aged between three months and ten years.

- Entry Age: Permitted between three months and ten years

- Maximum Annual Coverage*: Up to Rs. 50,000

- Coverage: Annual routine healthcare expenditure, like minor illnesses, tick treatment, deworming, vaccination, etc.

- Exclusions: Does not cover pre-existing diseases

- Additional Coverage: Coverage for third-party liability

4. Oriental Insurance Dog Insurance Policy

Oriental Insurance Dog Insurance provides comprehensive coverage for dogs aged between eight weeks and eight years. With a maximum annual coverage of up to Rs. 50,000, it protects against death due to illness or accidents. This policy encompasses vital aspects, including vaccination and tick treatments. However, it doesn't cover partial and permanent disability, rabies, canine distemper, and leptospirosis.

- Entry Age: Permitted between eight weeks and eight years

- Maximum Annual Coverage: Up to Rs. 50,000

- Coverage: Death due to any illness or accident, vaccination, tick treatments

- Exclusions: Does not cover partial and permanent disability, rabies, canine distemper, leptospirosis

- Additional Coverage: Coverage for vaccination and tick treatments

5. Future Generali India Dog Health Insurance

Future Generali India Dog health insurance is tailored for dogs aged six months and ten years. This policy offers a flexible annual coverage that depends on the size and breed of the dog. It ensures comprehensive protection by covering terminal illnesses, surgery expenses, pre and post-hospitalisation costs, and more. The plan also provides optional add-ons like doctor-on-Call, third-party liability, and lost/stolen cover.

- Maximum Annual Coverage: Depends upon the breed and size of the dog

- Entry Age: Permitted between six months and ten years

- Coverage Highlights: Terminal illness, surgery and treatment costs, pre-hospitalisation and post-hospitalisation expenses, death and funeral expenses

- Optional Add-ons: Doctor on call, third-party liability, lost and stolen cover

Prerequisite for Pet Insurance Coverage

To qualify for pet insurance, the cat or dog must be registered with the Municipal Corporation, a recognised local government authority, certified by the Kennel Club of India, or micro-chipped by the policyholder. In addition to completing the insurance proposal form, the insured individual must provide photographs of the insured animal, adhering to specific requirements, such as:

- Face Photo

- A photo displaying the birthmark

- Photos from both the right and left sides

- Documents Required for Purchasing Pet Insurance

- Here is the list of documents you must furnish to get pet insurance in India:

- Completed application form with details about your pet

- Colour photos of the pet to facilitate pet identification

- Confirmation of timely vaccinations

- Diagnostic test results, such as Circulatory Blood Count (CBC), urine test, or chest X-ray (if required)

- A pedigree certificate from the Kennel Club of India (KCI) in case you're opting for a Sum Insured based on pedigree lineage

Pet Insurance Claim Settlement Procedure

Pet insurance policies offer two methods for claims settlement:

Cashless Claim Settlement Process

For this, you must notify the network veterinary hospitals at least 72 hours before any planned medical treatment or within one day in case of an emergency. Share a copy of the E-Cards and your proof of ID at the veterinary hospital and obtain the pre-authorisation form. Submit the filled and signed pre-authorisation form to the veterinary hospital. Once all formalities are completed, your insurance company will directly settle the bills with the hospital.

Reimbursement Claim Process

You must opt for reimbursement from any veterinary hospital within India for this process. The key distinction is that the insured must pay all bills upfront to the hospital. After making the payment, submit the original bills and expenses to the insurance company. This Facility is not cashless, and the insurance company reimburses the expenses within 30 minutes once you submit the bill on time.

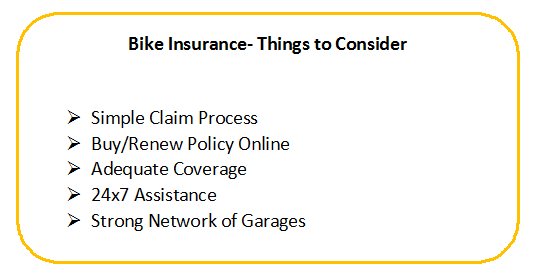

Features to Look for in a Pet Insurance Policy

When buying a pet insurance policy in India, jotted down below are:

Hospitalisation Cover

A robust pet insurance policy should provide comprehensive coverage for hospitalisation expenses. This includes emergency treatments, surgeries, and post-operative care, ensuring that your pet receives the necessary medical attention without compromising the quality of care.

Outpatient Department (OPD) Cover

Outpatient care, including diagnostic tests, consultations, and medications, is crucial to pet healthcare. A well-rounded pet insurance policy should encompass OPD cover to address a wide Range of medical needs for your furry friend.

Coverage for Lost or Stolen Pets

Some policies go beyond medical coverage to address unforeseen circumstances like loss or theft of your pet. This inclusion provides financial support for efforts to locate and recover your beloved pet, offering a comprehensive approach to pet protection.

Surgery Expenses Cover

Whether elective or necessary, surgeries can be a significant financial burden. A good pet insurance policy should cover various surgeries, ensuring that your pet receives timely and adequate medical interventions when required.

Death Due to Diseases or Accidents

In the unfortunate event of the demise of your pet due to diseases or accidents, a compassionate pet insurance policy should cover funeral expenses. This ensures that pet owners can bid farewell to their cherished companions without the added stress of financial strain.

Specialised Coverages

Certain policies offer specialised coverages, such as coverage for tick treatments, vaccination expenses, and more. Tailoring the policy to specific needs ensures that your pet receives personalised care, addressing unique health concerns and preventive measures.

Conclusion

Like humans, your furry friends deserve quality healthcare, and pet insurance is a financial safeguard for their well-being. With numerous options available, reviewing and comparing pet insurance policies in India is crucial to finding the one that aligns with your pet's needs and budget. Therefore, whether you currently have a pet or are considering getting one, it's advisable not to overlook affordable pet insurance. Take the time to review and compare pet insurance prices, assess the applicable conditions, and scrutinise the inclusions and exclusions of each plan. Select the one that aligns best with your needs.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.