How to Claim TDS Refund?

Being a responsible citizen, paying Taxes becomes inevitable. However, in case the TDS is deducted extra than the taxable amount, you can choose to go with the TDS claim process. Let’s find out how to claim TDS refund in this post.

What is TDS Refund?

The need to TDS claim arises when the amount paid through TDS for taxes is greater than the real tax payable assessed for the financial year. The refund can be easily calculated after consolidating the amount earned as an Income from different sources. The amount can vary as per your category as a taxpayer and the tax slab that you come under.

Now, let’s take an example. Suppose you have opened a fixed deposit account in a Bank and get interest out of it. Generally, banks and financial institutions levy 10% TDS on the gathered income. Now, if you belong to a tax bracket of 5%, you can choose TDS claim for the extra 5% deducted.

Similarly, TDS can be claimed on the extra salary if 80c form has not been submitted, on rent allowance, on investments, and more. When you file your returns, you would have to collect the income details from different sources, calculate the Tax Liability and minus the TDS applied on the income. If the TDS is higher than the total tax liability for that specific financial year, you become eligible to claim a refund.

TDS Refund Process

If you are new to the TDS refund process and claiming, there are certain things that you must keep in mind while moving forth with the same.

1. TDS Deducted by the Employer

If the tax deducted is not matching the actual tax payable, you can then calculate the income and taxes, file the ITR and claim a refund.

During the process of ITR filing, you will be asked to provide the name of your bank as well as the IFSC code. Such details make it easier for the IT department to refund the extra amount.

In case you don’t earn enough to pay the taxes, you can still apply for a NIL or lower TDS certification from the jurisdictional income tax officer in Form 13 under the section 197 and submit the form to the TDS deductor.

Talk to our investment specialist

2. TDS Deducted on Fixed Deposit

The TDS refund process on an FD is quite an easy one. If you don’t have an income that can be taxed, you would have to submit a statement in Form 15G to the bank before the end of the financial year. This will help them know that no TDS has to be deducted on the interest income. Even if the bank still deducts the tax on the interest, you can claim a refund by filing the ITR.

3. TDS Deducted on FD Accounts of Senior Citizens

If you are 60 years or above of age and own an FD, you are exempted from the tax deductions on the interest earned up to Rs. 50,000 per year. Further, once you have claimed the Deduction and you don’t have a Taxable Income for that financial year, you would have to submit Form 15H to the bank so as to notify them regarding the same.

How to Claim Online TDS Refund?

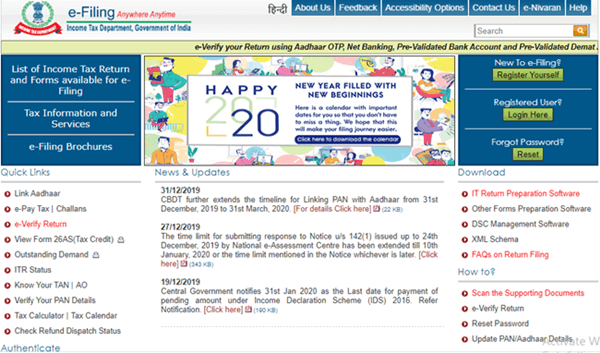

Follow the below-mentioned simple steps to claim online TDS refund:

- Register on log in to the official website of the IT department

- Now, download the Income-Tax Return form applicable as per your income

- Fill the required details, upload the form, and click the submit button for TDS return filing online

- Once you are done with filing, an acknowledgement will be generated to submit the returns, which you would have to e-verify

- For e-verification, use your digital signature, OTP based on Aadhaar or your net banking account

How to Check TDS Refund Status?

There are different ways that can help you with the checking of TDS refund status, such as:

- Refund processing or acknowledgement email from the IT department; or

- Checking on the official website via PAN Card; or

- By calling CPC Bangalore

Keep in mind that generally, it takes 3-6 months of time for the refund credit to your bank account. If the refund gets late, you can claim a 6% annual interest on the refund.

Conclusion

Even if the excess TDS has been deducted, you don’t have to worry about it. It is easier to claim a refund. Simply go for TDS refund claim online and keep checking the status from time-to-time.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.