Table of Contents

Avail Tax Benefits on Tuition Fees Under Section 80C of IT Act

Education is the most powerful weapon. It has the ability to alter the way our world functions. But, today the fees of education is skyrocketing, which is becoming a huge concern for many parents. But, the good part is you can avail tax benefits from the tuition fees that you pay for your children.

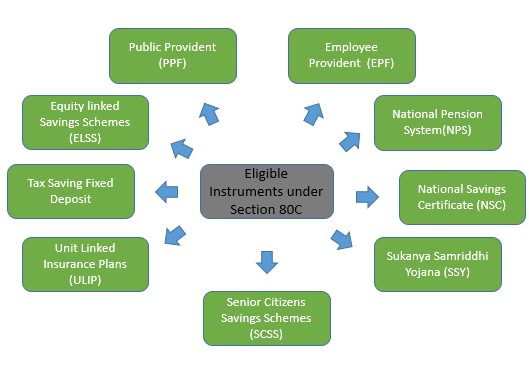

Tax Deductions of Tuition Fees Under Section 80C

Section 80C enables the benefits of tax deductions for tuition and education fees. Taxpayers can deduct Rs. 1.5 lakh under section 80C as per 2020-21 tax slabs. Parents can claim the tuition fees towards their children as deductions in a particular financial year.

Tuition Fees Calculation

For illustration purpose, let’s take an example-

For instance, Mr Akash is a salaried individual with two children aged 14 and 20. He pays annual tuition fees of Rs. 60,000 towards his son’s engineering fee and 20,000 for his daughter. The total spending of a father is Rs. 80,000 per year for educating his children. Now, he can claim this amount as tuition fee under Section 80C. It could help him to save a sizeable amount in tax.

Note: There will be no tax benefits if your ward is studying in a recognised institute in India

Talk to our investment specialist

Eligibility for Tuition Fees Under Sec 80C

Parents should ensure that they should fall under the following eligibility criteria to claim tax Deduction under section 80C:

Individual Assesse

The tax benefits on tuition fees can be availed only by individual taxpayers and hindu undivided family (HUF). Corporates are not eligible for the tax deduction under section 80C.

Limit

The maximum deduction allowed under section 80C is Rs. 1.5 lakh per financial year. The deductions are eligible for two children per assessee. If both parents are taxpayers then they can claim deductions for 4 children under this section. An individual assessee cannot claim the fee paid to educate more than 2 children.

Limited to Child’s Education

You can claim tax only to the extent of tuition fee paid towards educating the children of an assessee. Fee paid towards educating himself or his spouse cannot be claimed as a deduction.

Specified Courses

An individual can claim the deductions on the tuition fees paid towards full-time courses only which includes school fees, fees for graduation or post-graduation courses. Fees paid for the part-time courses cannot be claimed as deductions.

Affiliated

The school, college or the university in which your ward studies should have necessary affiliations.

Payments not Eligible for Tax Deductions

There are many financial components when it comes to educating your children from, for example- tuition fee, cost of books and materials, uniforms etc. Majority of educational institutes charge an extra amount of additional charges with their cost running into thousands. According to section 80C, only the tuition fee paid in a year can be claimed as deductions.

Additional costs like donations private clothing etc are not eligible for deductions. Other exclusions include hostel fees, library costs, transportation charges etc. As said earlier, an individual cannot claim deductions on distance education courses.

Tax Deductions on Tuition Fees Under Section 10

Section 10 of the income tax Act provides you with an additional tool to save tax. Under this section, a salaried individual is eligible to save tax of Rs. 100 per month on per child. The mentioned amount can be claimed as an exemption only in the financial year in which the fees were paid. This amount can be claimed for 2 children per taxpayer which means an individual is eligible for Rs. 200 per month.

The taxpayer can claim only in the financial year in which the fee was paid. Furthermore, you can also claim on the hostel costs on your children. The hostel allowance is covered at Rs. 300 per month per child.

Conclusion

In India, the average cost of education goes around Rs. 7,500 for each student. The eduction fees may go double as per further or higher studies. However, since now you know how to avail tax benefits from tuition fees, ensure you make the most out of it!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.