Table of Contents

Section 80CCD of Income Tax Act

To help people get the most out of their filing, the government offers a variety of deductions that work wonderfully and keep the citizens as well as NRIs on their toes by the end of every financial year.

Amidst a variety of other deductions, Section 80CCD of the income tax Department is specifically meant for those who are contributing to a National Pension Scheme. Seems interesting? Read on to know more.

Defining Section 80CCD

The section 80CCD Deduction is for individuals who made contributions to the Atal Pension Yojana (APY) or the National Pension Scheme (NPS). Contributions by employers to the NPS are also counted under this section.

What is the National Pension Scheme?

Introduced by the Central Government, NPS is a scheme for the Indian citizens. Earlier, it was only for government employees. However, later, its benefits were opened for self-employed as well as private-sector employees as well.

The primary intention behind this scheme is to help people come up with a retirement corpus and get a monthly fixed payout to lead a comfortable post-retirement life. Some of the major factors of this scheme are:

- The contribution to NPS should continue till the age of 60 years, which is mandatory for central government employees and voluntary for others

- To get deductions under NPS Tier 1 Account, the contribution should be Rs. 500 per month or Rs. 6000 per year (minimum)

- To get deductions under NPS Tier 2 Account, the contribution should be Rs. 250 per month or Rs. 2000 per year (minimum)

- Varied investment options are available, such as government securities, government Bonds, Equity Funds, and more

- Up to 25% of partial withdrawal is allowed under 80CCD deduction

- 60% lump-sum of the corpus can be withdrawn while the remaining 40% should be invested in an annuity plan

Talk to our investment specialist

Categories of Section 80CCD of Income Tax Act

Section 80CCD of the Income tax act has been divided into two different subsections so as to keep the clarity intact for deductions available for income tax assesses.

Section 80CCD (1)

80CCD (1) is a subsection is meant to define the terms and rules related to deductions available for individuals in regards to their contributions towards NPS. It is irrespective of the profession of the contributor, meaning you could be self-employed, privately employed or even a government employee.

This section’s provisions are for every citizen and NRI contributes to NPS and is between 18 to 60 years of age. Some of the essential points are:

- The maximum deduction is 10% of the salary or 10% of the entire income.

- The FY 2017-18 increased this limit to 20% of the total income for self-employed contributors with a maximum capped limit at Rs 1,50,000 for a specific financial year.

Section 80CCD (2)

The provisions under this subsection are applied if an employer is contributing to NPS on behalf of an employee. This contribution can be made in addition to EPF and PPF. Also, the amount of contribution could be equal to or higher than the amount of contribution made by the employee. Under this section, salaried individuals can claim a deduction of up to 10% of the total salary, including the dearness allowance and the basic pay.

Terms and Conditions of Section 80CCD

To avail deductions under section 80CCD, the following terms and conditions should be kept in mind:

- Available for Indian citizens as well as NRIs

- hindu undivided family (HUF) are not allowed to get deductions

- The maximum deduction limit under Section 80CCD is Rs. 2 lakhs and an additional deduction under sub-section 80CCD (1) is available of Rs. 50,000

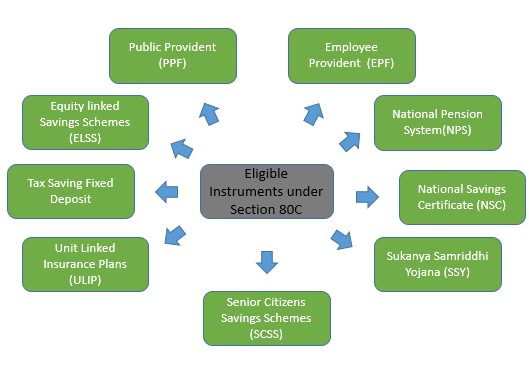

- Tax benefits, once claimed under Section 80CCD, cannot be claimed under Section 80C

- The amount received monthly from NPS will be liable to taxation according to the applied provisions

- Amount received from NPS and reinvested in an annuity plan is completely exempted from Taxes

- The payment proof will be required to claim this deduction

In a Nutshell

Investing for a convenient, comfortable post-retirement life is a decision that can never go wrong. So, if you have not yet, consider investing in this scheme. On top of that, the deductions that you can avail should be a significant reason to invest. Take a step towards happy old-life today!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like