Early Exercise

What is the Early Exercise?

In an options contract, early exercise is the procedure of buying or selling shares of stock under specific terms and conditions of the option contract before its expiry date. As far as Call options are concerned, the holder of the option has the liberty to demand that the seller sells shares of the stock at the strike price.

And, as for put options, the situation is contradictory. Here, the holder of the option gets the liberty to demand that the options seller purchases stock’s shares at the strike price.

Explaining Early Exercise

The adequate execution of early exercise can only take place with an American-style option contract that the holder can exercise at any time within its expiry. As far as the European-style option contracts are concerned, the holder gets to exercise only on the expiry date, making the early exercise fairly impossible.

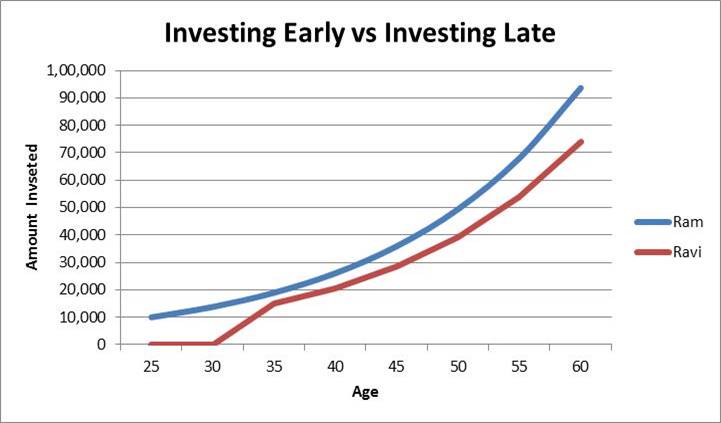

Generally, a majority of traders don’t use this method for the held options. And, traders try to acquire profits by selling off options and closing the trade altogether. Their objective, basically, is to comprehend a profit from the difference between the original option purchase cost and the selling price.

For a long put or call, the owner gets to close a trade by selling instead of exercising their option. Often, this type of trade results in more profit as the time value that remains in the lifespan of long option is more.

Thus, the more time there is to expiry, the greater the time value will remain in the option. Hence, exercising that specific option can result in the loss of time value. However, there are a few such situations when an early exercise could be beneficial for a trader.

For instance, a trader may go with exercising such a Call Option that is profoundly in-the-money and is about to be expired. As the option is already in-the-money, it will have an insignificant time value. Another reason for early exercise could be an incomplete ex-dividend Underlying stock’s date.

Since the holders of options are not responsible for either a special or a regular dividend paid by the company, this will allow investors to capture that pending dividend.

Talk to our investment specialist

Early Exercise Example

Let’s take an early exercise example here. Suppose a man gets 10,000 options to purchase an XYZ company’s stock price at Rs. 10 per share. Now, he exercised 5,000 of options to buy the stock of XYZ company, which have been valued at Rs. 15.

Exercising these options will cost him a huge amount as per the AMT rate. But he can decrease the tax percentage by holding on the exercised option for one more year to meet the long-term Capital gains requirement.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.