Table of Contents

What is an Inflationary Gap?

John Maynard Keynes introduced the inflationary gap in his book: How to Pay for War? (1940). The notion was used to research and address difficulties related to war funding. Keynes begins his examination of the inflationary gap at complete employment equilibrium, whereas his other studies begin at underemployment equilibrium.

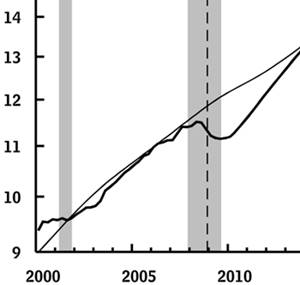

An inflationary gap refers to a macroeconomic concept that gauges the difference between the current level of real GDP and the GDP that would exist if an Economy was fully employed.

What does an Inflationary Gap Represent?

The inflationary gap is named so because a relative increase in real GDP causes an economy's consumption to rise, causing prices to rise in the long run.

It denotes the stage of the business cycle when the economy is expanding. Consumers are more likely to buy goods and services because more dollars are accessible in the economy. Prices rise to restore Market equilibrium when demand for products and services rises, but output has not yet compensated for the shift.

When potential GDP exceeds real GDP, the difference is a deflationary gap. The Recessionary Gap, which reflects an economy functioning below its full-employment equilibrium, is the other sort of production gap.

Causes of Inflationary Gap

Inflationary gaps occur when aggregate demand exceeds predicted demand, which can be generated by one of two factors:

Increase in Total Demand

A rise in demand will inevitably result in a mismatch between actual and potential demand. Several factors can create excess demand, including decreased unemployment, more consumer confidence, increased government spending, or increased private investment.

Decrease in Aggregate Supply

Decreasing supply will inevitably result in a disparity between actual and potential demand. Increased tariffs, wage rises, and wartime supply reductions are all possible reasons.

Talk to our investment specialist

Managing Inflationary Gap

To bring rising price levels into market equilibrium, inflationary disparities can be handled in two ways:

Budgetary Policy

Fiscal policies are government policies established to control the money supply. Governments can conduct contractionary fiscal policies to manage inflationary gaps, reducing the money supply and demand. These measures may include cuts to government spending and tax increases.

Fiscal Policy

Monetary policies are those implemented by central banks to control the money supply. Banks can raise interest rates to make borrowing money more complex, reducing the money supply and cutting demand to manage inflationary gaps.

Conclusion

An inflationary gap occurs when demand for products and services exceeds supply due to more significant employment, increased trade activity, or government spending. Real GDP may surpass potential GDP in this context, resulting in an inflationary gap.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.