Table of Contents

Why Continue with SIPs Even in High Markets?

The recent fall in the equity Market is causing a huge tension amongst investors. In such Bear Market conditions, many investors are in a dilemma as to whether they should continue or discontinue their SIPs. And if they continue, how would they still benefit?

First, let us recapitulate what a SIP is and its benefits.

A Systematic Investment plan (SIP) is a disciplined way of investing in Mutual Fund schemes, in which an investor can make a particular investment at regular intervals (monthly/quarterly) over a stipulated period of time. SIPs are an ideal investment for a long-term plan. It inculcates the habit of disciplined savings and building wealth for the future.

Benefits of SIP

Some of the key Benefits of SIP are:

- Reduces risk because of rupee cost averaging

- Timing the market is not necessary

- Helps in building long-term wealth

- Can be started with an amount as low as INR 500

- Helps in achieving long-term Financial goals like Retirement planning, child’s education, etc.

SIP, in particular, helps the investors to mitigate the risks. Though in the short-run, they may not perform that well, but, historically SIPs have delivered great returns in the long-run.

Why Should You Continue Holding Your SIPs?

Let’s have a look at the worst period of the stock market.

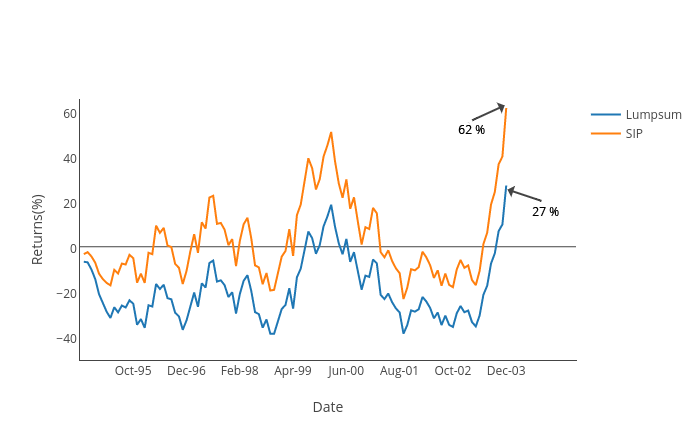

The worst period that got hit was around September 1994. This was the period when the stock market had peaked. If one looks at the market data, the investor who made a lump sum investment sat on negative returns for 59 months that is nearly for five years. The investor broke even in about July, 1999.

The next year, though some returns were generated via a lump sum, these returns were short lived due to the 2000 stock market crash subsequently. After suffering for another four years with negative returns, the investors finally became positive in October 2003.

This was possibly the worst time to have invested in a lump sum.

What happened to the SIP investor?

The investors who invested via a SIP mode faced negative returns for only 19 months and started posting profits, though, these were short-lived. After suffering interim losses, the SIP investors were up again by May 1999.

While the journey still continued to be instable, SIP investors showed profits in the Portfolio much earlier.

So, who made better profits? The maximum loss for the lump sum investors was nearly 40 percent, whereas for the SIP investors it was only 23 percent. The SIP investors had a faster recovery period as well as a lower loss in the portfolio.

Talk to our investment specialist

Conclusion

To conclude, investors shouldn’t worry about stopping SIPs when the market is declining. Instead, this is the time when an investor can accumulate more units at a cheaper cost and later benefit from the eventual up move in the markets. SIPs have a great potential to deliver high returns in the long-run, so investors should stay invested for at least 5-10 years. They should not be worried about the small negative returns in the near-term.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.