Table of Contents

How to Cancel a SIP?

Want to cancel SIP? Have investments in a SIP, but want to discontinue? It’s possible! How? We will tell you to step by step. But let’s first understand the SIP in detail.

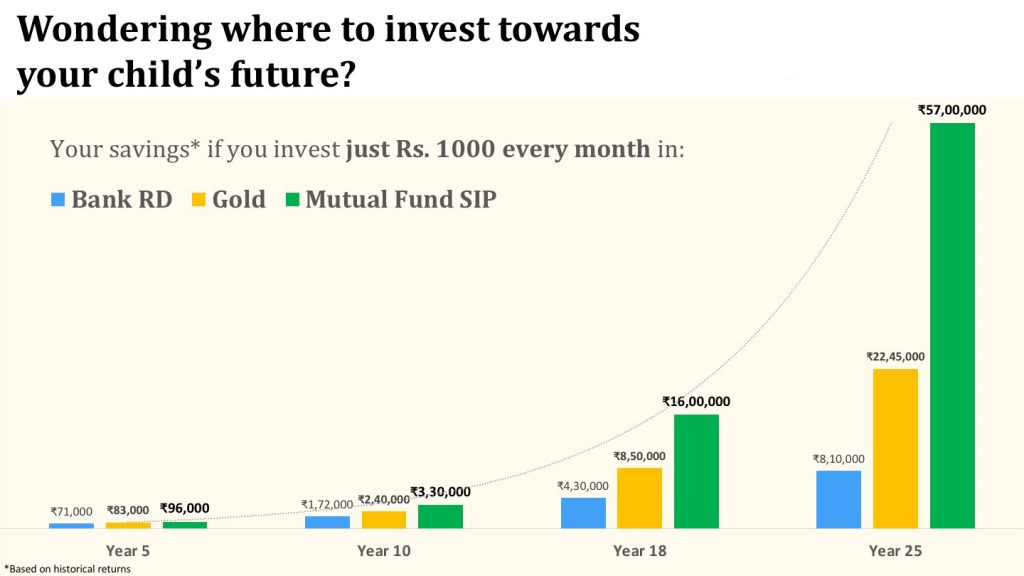

A Systematic Investment plan or SIP is a process of wealth creation where a small amount of money is invested in Mutual Funds over regular intervals of time and this investment being invested in the stock Market generates returns over time. But sometimes people want to cancel their SIP investments midway due to certain reasons, and they wonder if they will be charged anything?

SIP Mutual Funds are voluntary in nature, and the Asset Management Companies (AMCs) do not charge any penalty for discontinuation of SIP (however the inherent fund may have an exit load within a certain period). However, the procedure to Cancel SIP and the time taken for cancellation may vary from one fund house to another. The other important things to know for canceling your SIP are listed below.

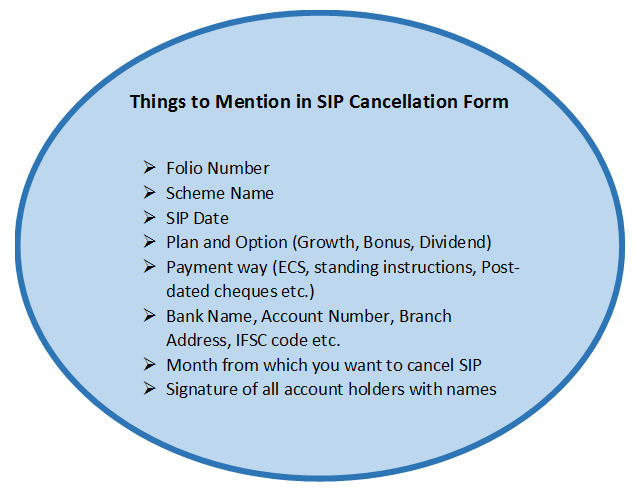

SIP Cancellation Form

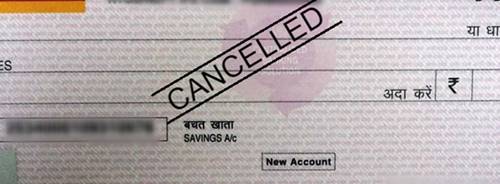

The SIP cancellation forms are available with Asset Management Companies (AMCs) or Transfer and Registrar agents (R&T). Investors who want to cancel SIP need to fill in the PAN number, folio number, Bank account details, scheme name, SIP amount and the date from which they started to the date they wish to stop the plan.

SIP Cancellation Procedure

After filling the form, it has to be submitted to the AMC branch or R&T office. It takes about 21 working days to discontinue.

Talk to our investment specialist

Cancel SIP Online

Investors can cancel SIP online as well. You can log into your Mutual Fund account and choose “cancel SIP” option. Also, you can even login to the particular AMC web portal and cancel it.

Why do you Want to Cancel SIP?

Here are some of the important things that you can consider before stopping your SIP investment.

You want to stop SIP as you have missed an installment?

Sometimes investors tend to cancel SIP even if they have missed an installment. SIP is an easy and convenient mode of investing in Mutual Funds and not a contractual Obligation. There are no penalty or charges even if you miss an installment or two. At most, the fund house would stop the SIP, which means further installments would not get debited from your bank account. In such case, an investor can always start another SIP in the same folio, even after the earlier SIP investment was stopped.

Want to stop SIP as the fund is not performing well?

If the SIP is not performing good or as per your expectations then you can definitely stop the SIP investment. But, there is also an alternative to this.

Stopping a Systematic Investment Plan has an an alternative called Systematic Transfer Plan (STP) where the amount that has already been invested in that particular mutual fund via a SIP can be transferred to some other mutual fund via STP. Here a fixed money will be transferred to the other fund on a weekly or monthly Basis.

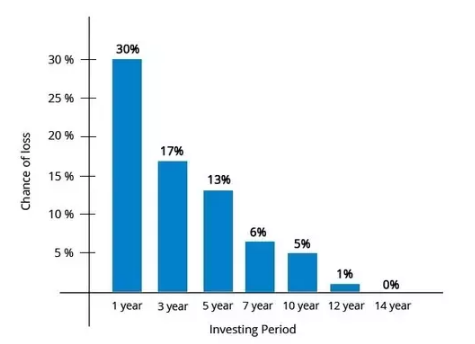

Your SIP is getting lower returns?

Usually, when you invest in equities you may get lower returns in the short term. Anyone who is invested in equities via a SIP should plan their investments for a long-term.In the long-run your SIP investments tends to stabilize and deliver good returns. So, if an investor wants to stop a SIP as they are getting lower returns by their funds, it is advisable to increase their investment horizon, so that the fund gets time to perform well and overcome short-term market fluctuations.

You wan to cancel SIP as you have committed a SIP period?

Many investors believe that if they have committed a tenure to a SIP investment they cannot change the tenure or the amount, and they would be penalized. This is not true. For instance, if an investor has set the time period of their SIP of say 10 or 15 years, and now cannot invest for that long they can continue their SIP till they can or want to.

A SIP can be continued until the investor wants to and can also terminate whenever one wishes to do. Also, if an investor needs to change the amount of their SIP; all you need to do simply is stop the SIP and start a new SIP.

Things to Know before Canceling a SIP

- The AMC can cancel SIP if the Mutual Fund account is under-funded or the instruction to stop SIP is given for more than two months.

- The AMC cannot charge any penalty to discontinue the SIP midway.

- If someone has started a SIP online, it can be cancelled using the same platform.

So, if you plan to cancel a SIP, know the cancellation details well beforehand.

AMC That allow SIP Cancellations online

- Reliance Mutual Fund

- HDFC Mutual Fund

- SBI Mutual Fund

- UTI Mutual Fund

- Aditya Birla Mutual Fund

- Kotak Mutual Fund

- DSP BlackRock Mutual Fund

- Principal Mutual Fund

- Pioneer Mutual Fund

- IDFC Mutual Fund

- Franklin Templeton Mutual Fund

- Invesco Mutual Fund

- Motilal Oswal Mutual Fund

- ICICI Prudential Mutual Fund

- Axis Mutual Fund

- IIFL Mutual Fund

- Tata Mutual Fund

you can enroll yourself to fincash and reap online SIP and online SIP cancellation benefits without hassle get started here Get Started

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

nice sir this is very Informative thanks for regards amantech.in