Table of Contents

A Guide to PAN Card Aadhaar Card Link Process

As per the updates from the Central Board of Direct Taxes (CBDT), all users must link their PAN with Aadhaar cards before March 31, 2022.

The CBDT has repeatedly postponed the deadline for linking PAN with Aadhaar until now. Under the current laws, it is mandatory for one to link PAN with their Aadhaar number. Also, it is made mandatory to mention Aadhaar numbers at the time of filing an ITR and while applying for a new PAN to avail of monetary benefits from the government such as scholarships, pensions, LPG subsidies etc.

In case you don’t link aadhaar with PAN by then, your PAN Card will be inoperative. Therefore, to avert any risky situations, this post helps you with the steps that can make pan card aadhaar card link successful. Let’s find out more.

PAN Aadhaar Link Process Through SMS

One of the easiest ways to go for aadhaar link with pan card is via SMS. All you have to do is:

- Form an SMS in your phone with your UIDPAN [space] and then your 12-digit aadhaar number [space] your 10-digit PAN number

- After that, simply send that message to either

56161or567678

You will then receive a message that the process to link aadhaar to pan card by SMS is successful.

Talk to our investment specialist

PAN Aadhaar Link Online Process

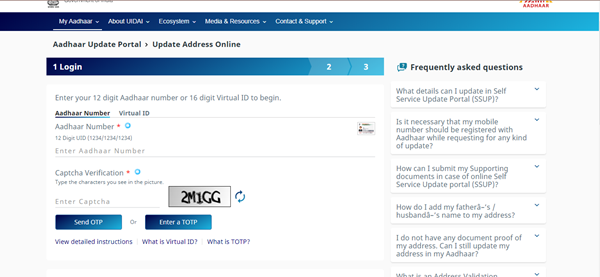

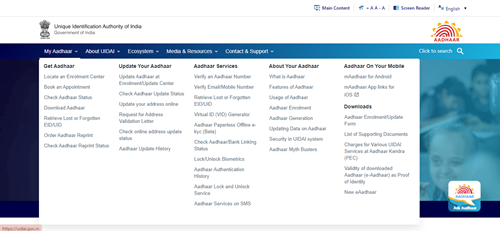

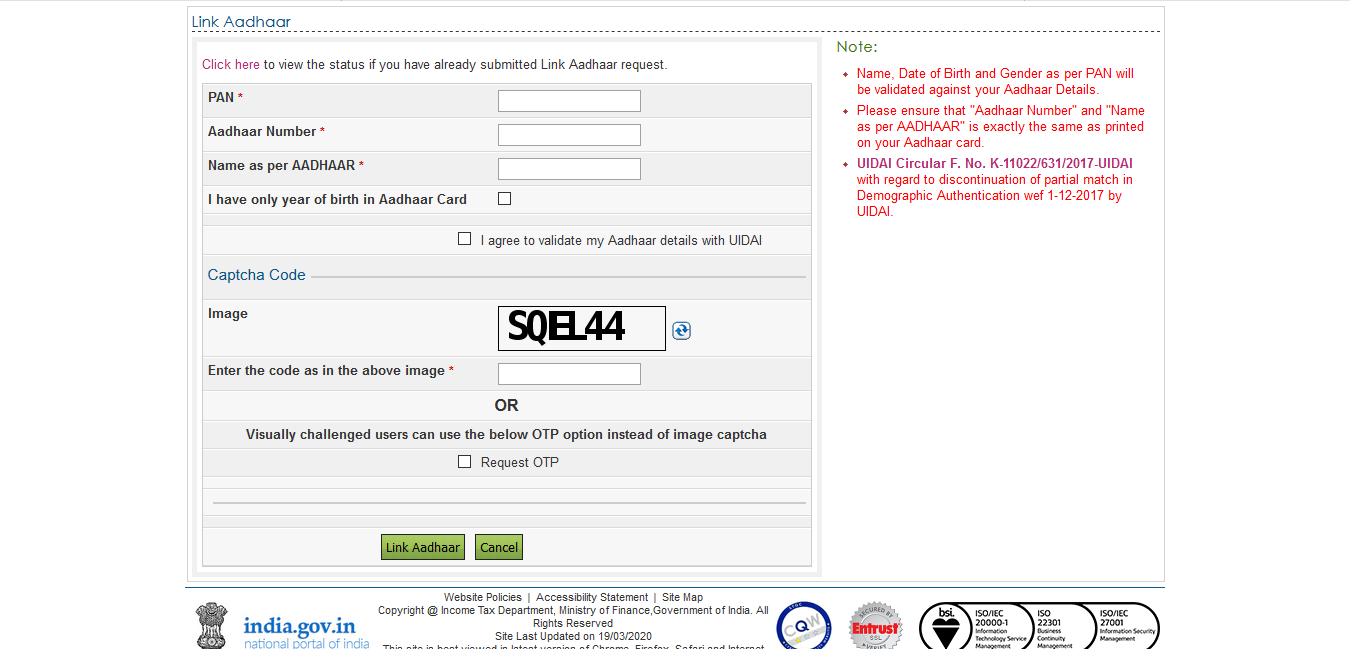

In case you would like to go for the PAN link with aadhaar procedure online, here are the steps for that procedure:

- Visit the income tax Department’s official website

- On the homepage, click Link Aadhaar option available on the left-side

- Now, enter the details, such as PAN, aadhaar number and name on the aadhaar

- If you only have the birth year on your aadhaar card, check the box

- Then, check I agree to validate my aadhaar details with UIDAI

- Enter captcha code

- Click Link Aadhaar

PAN Link Aadhaar via the Manual Process

Apart from the ones mentioned above, CBDT has also come up with a manual method to streamline the process. This one method is specifically essential if you come across mismatch in the data of your aadhaar and PAN. To link PAN card with aadhaar card manually, follow these steps:

- Visit a service centre of any PAN service provider, UTIITSL or NSDL

- You will be provided with a form, called Annexure-I, fill it for pan card link

- Attach the copy of required documents, such as aadhaar card and PAN card

- However, keep in mind that for this service, you would have to pay a fee, which majorly depends upon whether corrections have been made while linking

- In case PAN details were correct, you would have to pay

Rs. 110 - In case aadhaar details were corrected, you would have to pay

Rs. 25 - If there arises a significant mismatch in the details, biometric authentication is mandatory

Once you are done with the procedure, your linking will be successful.

Conclusion

When you prepare yourself for PAN card aadhaar card link process, keep in mind that you will receive an OTP on the registered number if you are choosing the online method. If there is a mismatch on any details that need to be sorted, then you should go with the offline method.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.