Table of Contents

How to Apply Aadhaar Card for NRI

It was way back in 2009 when the Aadhaar number was first introduced in India under the Aadhaar Act of 2016. Creating a new way to use technology, the primary objective behind this 12-digit unique number is to acquire the data and verify people as the citizens of India.

Although the card is for Indian citizens, however, earlier only those NRIs who are still residing in India or have been in the country for at least 182 days within the past 12 months were eligible to apply for an Aadhaar. On the other hand, Non-Resident Indians (NRIs), who were living in the country were not eligible for the same.

Taking away this hassle, during the Union Budget 2019, the UIADI validated the Indian passport as a substantial foundation to apply for the Aadhaar. So now, if you are wondering how can you apply aadhaar card for NRI, this post will clear your doubts. Have a read.

Documents Required for Aadhaar Card for NRI

The following documents will be needed to apply for Aadhaar for NRI:

- Valid Indian passport with photo ID In case, you don’t have a passport to provide as the Aadhaar card NRI address proof, the following documents will be required:

- Original identity proof (election photo ID card, passport, ration card, PAN Card, or a driving license)

- Original address proof (water bills or electricity bills from the last 3 months)

- Birth certificate

- School certificate (optional)

Apart from these above-mentioned certificates, however, you would also have to provide additional documents and proofs ascertaining your relationship to the country you are residing in, other than India. These documents will be verified and assessed by the officials and authorities to comprehend if you are eligible for an Aadhaar or not.

Talk to our investment specialist

Applying for Aadhaar Card for NRIs

- Pay a visit to the nearest local authorized Aadhaar Enrolment Center; you can also find one online

- Fill up the form for enrollment

- Now, verify the demographics, including address, name, date of birth, gender, email address (optional), and phone number

- The executive will take your biometric information, such as 2 iris scans, 10 fingerprints, and a picture of your face

- Submit all the documents for address and identity verification

- An acknowledgement slip will be handed over to you with your enrollment ID

Once the Aadhaar has been generated, you will be notified via an SMS and an email (in case you provide the ID). You can then get a print of your Aadhaar card from the official website of UIDAI.

Processing of the Aadhaar Card

Once the enrollment form has been filled and submitted all the documents, it will take at least 90 days to acquire and link your physical data and biometric to each other. After the procedure is complete, the Aadhaar card is then created and dispatched on the given address.

Booking the Appointment Online

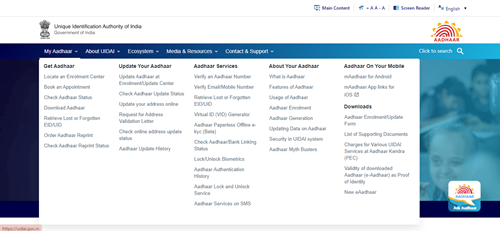

An option to book the appointment online enables NRIs to save data with their Aadhaar enrolment. By simply visiting the UIDAI website, you can choose the enrolment centre and book your appointment. This will allow you to get the Know Your Customer (KYC) done within some time, thus, cutting away the waiting time.

Conclusion

Although not mandatory, but having an Aadhaar number acts as a digital, paperless proof of identity in India for an NRI. This allows you to transact up to Rs. 50,000. Along with that, an aadhaar is also necessary for filing Taxes in India amidst others.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.