Table of Contents

What is Inherent Risk?

In a process, when a natural risk hasn’t been regulated or reduced through risk management is known as an inherent risk. This can be applied to a company's financial statements, where the potential of misrepresentation due to current transactional mistakes or fraud is deemed an inherent risk.

The error might be found in either the financial statements or the supporting disclosures. Outside auditors can evaluate this risk as part of their audit of a company's financial statements.

Types of Inherent Risk

1. Human Intervention

Human error is a possibility in some tasks when several actions are done, or the same activity is performed many times. There's a potential, for example, that a buy transaction from a seller with many transactions may get unrecorded or will be recorded with the incorrect amount.

2. Complex Organisation Structure

Due to the development and existence of a significant number of subsidiaries, holdings, joint ventures, associates, and other entities, many organisations become more complicated in structure. As a result, tracking reporting transactions between these organisations become more difficult.

3. Frequent Meetings & Engagements

These might lead to the development of personal connections with auditors. It's possible that this isn't in the company's best interests. In addition, having auditors on a regular Basis might lead to complacency or overconfidence.

4. Judgmental Accounting

Despite the fact that Accounting standards provide specific accounting procedures and regulations for documenting and reporting transactions, there are still grey areas where companies must make decisions and assumptions. This might differ depending on the type of company that creates a risk gap.

5. Non-Routine Transactions

It may be necessary for an organisation to record a transaction that does not occur on a regular basis or in a consistent manner. It can result in a mistake as a result of a lack of or incorrect knowledge.

Talk to our investment specialist

Aspects of Inherent Risk

To understand inherent risk in a better way, two aspects that are usually identified are explained below:

Inherent Risk in Accounting

Financial audits frequently employ the idea of inherent risk in accounting. It refers to the probability of a severe discrepancy in a company's financial accounts, such as an omission or error, occurring due to reasons beyond its control. One of the issues that auditors must consider throughout their investigation is inherent risk.

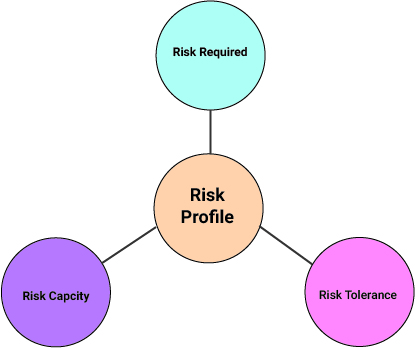

Inherent Risk in Risk Management

Inherent risk has a variety of connotations depending on the context. It is the degree of risk that occurs in the absence of controls or mitigations in risk management. Impact and probability are the two elements that might be used to assess it.

When an incident occurs with no mitigation measures in place, the inherent impact evaluates the impact on a firm or organisation. The likelihood of an incident occurring in the absence of risk control is measured by inherent likelihood.

How to Reduce Inherent Risk?

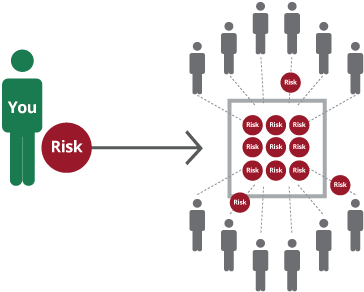

By employing one or more carefully targeted controls, the impacts of an inherent risk can be reduced. Too many controls, on the other hand, might result in a less efficient organisation. Therefore, management should measure the benefits of risk reduction against the increased burden of extra controls on the firm. The end result is frequently a streamlined set of controls that maximises the risk-to-Efficiency ratio.

The Bottom Line

The outcome of error, omission, or misrepresentation of financial transactions, inherent risk occurs in the financial statement owing to events outside the control of an Accountant. The inherent risk of financial statements being false is also increasing as business models change and technology advancements emerge.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.