Table of Contents

Accepting Risk

What is Accepting Risk?

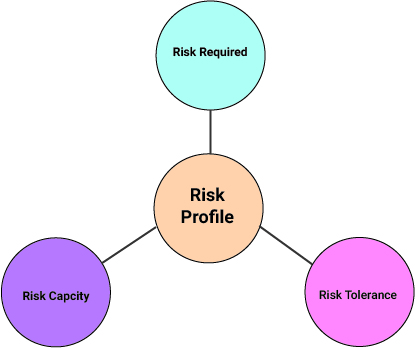

Accepting risk or risk acceptance means that a business or an individual is ready to accept the identified risk. And, therefore they won't take any action as they can accept the impact. This is also known as “Risk Retention”, which is an aspect of risk management commonly found in the business or investment sector.

Risk acceptance is a strategy and it is accepted when it turns out to be the most economical option to do nothing about it. The business thinks that the risk is so small that they are ready to cope with the consequences (in case the incident occurs).

Detailed information on Accepting Risk

Most of the businesses use risk management techniques to recognise and evaluate risks for the purpose of monitoring, controlling and minimizing. The risk management personnel will find they have more risks than they can manage, mitigate or avoid given resources. Such a business should find a balance between the potential cost of an issue resulting from a known risk and the expense involves in avoiding.

Some types of risk include difficulty in financial markets, project failures, credit risk, accidents, disasters and aggressive competition.

Alternatives for Accepting Risk

In accepting risk there are few ways to approach and treat risk in risk management are as follows:

Avoidance

It requires changing plans to reduce risk and this strategy is good for risk that could potentially have an important impact on business

Mitigation

Limit the impact of the risk, if any, obstacles occur, then it will be easier to fix. This is most common and known as optimizing risk or reduction. In this hedging strategies are common forms of risk mitigation.

Talk to our investment specialist

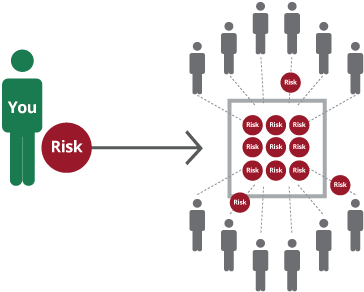

Transfer

The transfer is applicable to projects with many parties, but it is not frequently used and often includes insurance. It is also known as risk-sharing insurance policies efficacious shift risk from the insured to the insurer.

Exploitation

Some risks seem to be good such as if a product is so popular, so there are not enough staff to keep the flow of sales good. In this type of scenario, the risk can be exploited by adding more sales staff.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.