Table of Contents

What is Net Premium?

The outcome of adjusting the gross premium for expenditures linked to the maintenance of insurance policies is the net premium. It is also known as a benefit premium. Net premium is equal to the present value of insurance benefits minus the present value of future premiums payable. Thus, it doesn't take any future policy costs of maintenance in the calculation.

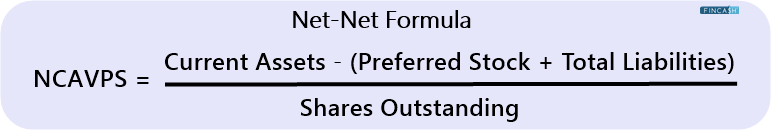

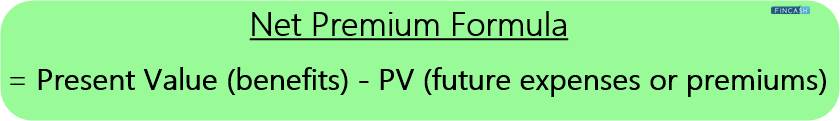

Net Premium Formula

To calculate the net premium, the net loss function is used. If the present value of the benefits provided exceeds the present value of the future premiums received, the firm will lose money.

On the other hand, the company will profit if the present value of future premiums is less than the present value of benefits. The formula to calculate net premium is as follows:

Net Premium Example

Suppose an insurance company provided a policy with the present value benefits of Rs. 1,00,000 and the present value of future expenses of Rs. 10,000, then the net premium can be calculated as follow:

- Net Premium = Rs. 1,00,000 – Rs. 10,000

- Net Premium = Rs. 90,000

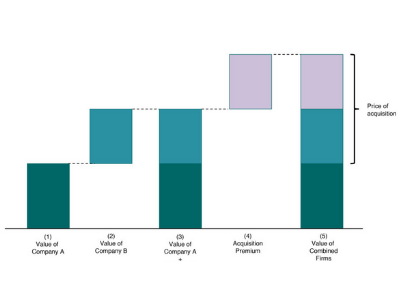

Net Premium Vs. Gross Premium

Net premiums and gross premiums are terms used to indicate the amount of money an insurance firm receives in exchange for taking risks under insurance contracts. Premiums are the sums paid by policyholders for Insurance Coverage to safeguard them against financial loss.

However, there are distinctions between gross and net premiums as follow:

Gross Premium

The sums that an insurer anticipates receiving during a policy are known as gross premiums. This impacts the amount the insured pays for the insurance contract's coverage.

Net Premium

It refers to the amount of money an insurance company will get in exchange for accepting a risk under an insurance contract, less the costs of providing coverage under the policy. reinsurance, which pays claims beyond a specific amount, is typically purchased by insurance firms. This shields the insurer from having to pay out in a large or catastrophic loss. A reinsurance policy's payment is subtracted from the gross premiums.

Talk to our investment specialist

Net Premium Reserve

A premium reserve is placed aside for level premium conventional Life Insurance plans in the first year of coverage. It is done to compensate for insufficient premiums collected in later years. The net level premium reserve is calculated by multiplying the excess premium charged in the early years by the interest received on the accumulated excess premium. mPart of a policy's death benefit is made up of the net level premium reserve as long as it exists.

The Bottom Line

Insurance is a high-risk endeavour. An insurance company assumes the risk of its policyholder in exchange for a premium. No one can guarantee that the insuree will follow the policy's rules and file a claim. As a result, an insurance firm faces a variety of risks.

These insurance firms enlist the assistance of a reinsurance business to reduce their risk. If the insuree makes a claim, both the reinsurance and insurance firms are responsible for paying the benefits according to a predetermined ratio.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.