What is Arbitrage Pricing Theory?

Arbitrage Pricing theory was coined back in the year 1976 by a popular American Economist named “Stephen Ross”. The theory suggests that the returns generated from any form of a financial asset can be predicted based on the current macroeconomic factors as well as the possible returns. To put it in simple terms, the arbitrage pricing theory determines the return of the Financial Instrument based on the expected returns as well as risks associated with the investment.

The main goal of the arbitrage pricing theory is to find out the actual Market price of the particular stock or financial instrument that might be priced incorrectly. The economists discovered this theory considering the fact that the market can never be in a fully-efficient position. That being said, there could be inefficiencies in the market prices of the securities. As a result, the assets could be overvalued or undervalued.

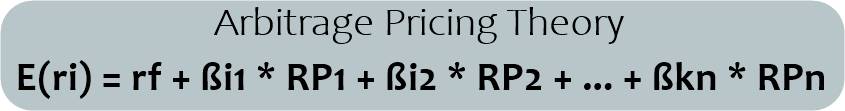

Arbitrage Pricing Theory Formula

E(ri) = rf + βi1 * RP1 + βi2 * RP2 + ... + βkn * RPn

Here,

How Does Arbitrage Pricing Theory Work?

The only possible way to price the stocks correctly is by taking the appropriate market action. This will shift the price back to the correct market value. Now, this mispriced financial instrument might imbalance the stock market for a brief period. However, this could turn out to be a profitable situation for the arbitrageur who is always on the lookout for risk-free profit opportunities. They buy the assets at a low price from one exchange and sell them at a higher price on another exchange. However, the prices of the securities change every moment.

The arbitrage pricing theory gives a perfect opportunity to the researchers as well as analysts to get customized research on the stock prices. Still, research of the stock market is often seen as a challenging job. You are supposed to consider quite a few factors when researching the performance of the stocks, which may require a considerable amount of time.

Talk to our investment specialist

It is important to note that APT is absolutely different from the Capital Asset Pricing Model. That’s because the latter takes only the overall risk Factor into consideration when establishing the market price.This theory, on the other hand, considers quite a few macroeconomic factors. It tells that the investors will consider diversifying their investment portfolio, but at the end of the day, they are going to rely on their individual investment profiles. The professional and experienced investors will always be ready to use the discrepancies in the price of the stocks and other financial instruments through the help of arbitrage.

APT suggests that arbitrage is never a risk-free deal. In fact, it involves a significant amount of risk while providing the users with a high profit. The theory helps these arbitrageurs determine the Fair Market Value of the security so that they can invest in it accordingly. After considering this value, the arbitrageurs check for the stocks with small differences from the fair market value. They invest in the stock assuming that the price will be corrected in no time.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like