Table of Contents

Bid Price

What is a Bid Price?

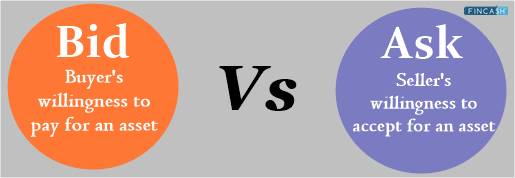

This one is a price that is offered for a contract, service or a commodity. Colloquially, it is also known as a bid in several jurisdictions and markets. Basically, a bid is lesser than the asking price (ask). And, the difference between both these prices is known as the bid-ask spread.

Further, bids can also be made in such cases where the seller doesn’t want to sell. In such a scenario, it is known as the unsolicited bid or offer.

Explaining the Concept of Bid Price

The bid price is the money amount that a buyer is ready to pay for a specific security. This one is different from the selling price, which is the price that a seller is ready to pay to sell the security. The difference between these two prices is known as the spread and is considered a profit source for traders. Hence, the higher the spread, the more will be the profit.

The bid price formula can be taken from the difference between the price that the seller is asking and the price that the buyer is bidding for.

When several buyers are putting bids at the same time, it can turn into a bidding war, where two or more buyers can place higher bids.

As far as stock trading is concerned, the bid price is referred to as the highest money amount that a potential buyer is ready to spend. Most of the quote prices that are displayed through quote services on the stock tickers are the highest bid price that is available for the given commodity, stock, or good.

The offer or ask price that gets displayed by the quote services is correlated directly with the lowest asking price for the given commodity or stock on the Market. In the options market, bid prices can also be known as market-makers only if the market for an options contract lacks adequate liquidity or is in complete liquid form.

Talk to our investment specialist

Bid Price Example

For instance, Riya wants to buy shares of XYZ company. The stock is trading in a Range between Rs. 50 - Rs. 100. But, Riya is not willing to pay more than Rs. 70. She places a limit order of Rs. 70 for XYZ. This is her bid price.

Buying at the Bid

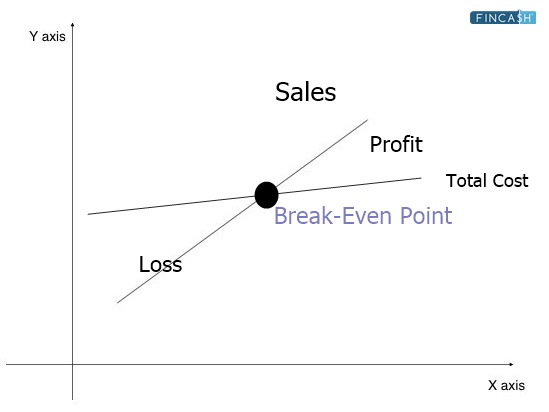

Traders and investors are needed by a market order to purchase at the current ask price and sell at the present bid price. In contrast, limit orders enable investors and traders to purchase at the bid and sell at the ask price, which, in turn, offers a better profit.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.