At Par

What is At Par ?

At Par, commonly used with Bonds but is also used with preferred stock or other debt obligations, indicates that the security is trading at its Face Value or par value. The par value is a static value, unlike Market value, which can fluctuate on a daily Basis. The par value is determined upon issuance of the security.

Details of At Par

At par can define whether a security, such as a bond, was issued at its face value or if the issuing company received less or more than the face value for the security.

A bond that trades at par has a yield equal to its coupon. Investors expect a return equal to the coupon for the risk of lending to the bond issuer. Bonds are quoted at 100 when trading at par. Due to changing interest rates, financial instruments almost never trade exactly at par. A bond is not likely to trade at par when interest rates are above or below its coupon rate.

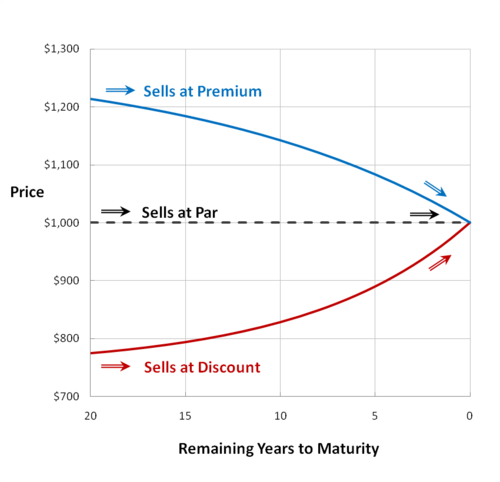

When a company issues a new security, if it receives the face value of the security, then the issuance is said to be issued at par. If the issuer receives less than the face value for the security, it is issued at a discount; if the issuer receives more than the face value for the security, it is issued at a premium. The coupon rate for bonds or dividend rate for preferred stocks has a material effect on whether new issues of such securities are issued at par, at a discount or at a premium.

Talk to our investment specialist

Example of At Par

If a company issues a bond with a 5% coupon but prevailing yields for similar bonds are 10%, then investors pay less than par for the bond to compensate them for the difference in rates. Investors receive the coupon but pay less than the face value to get the yield for their bonds to at least 10%.

If prevailing yields are lower, say at 3%, then investors are willing to pay more than par for the bond. The investors receive the coupon but have to pay up for it due to the lower prevailing yields. If prevailing yields for similar bonds are 5% and the issuer pays a 5% coupon, then the bond is issued at par; the issuer receives the stated face value (par value) on the security.

Par Value for Common Stock

Par value for common stock is not often mentioned because it is an arbitrary value mostly for legal purposes. Whether a common stock is issued at par or not does not affect its yield for investors like bonds and preferred stock, nor is it a reflection of prevailing yields.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.