Table of Contents

Back-End Ratio

What is the Back-End Ratio?

Back-End Ratio, also known as the debt-to-Income ratio, is the one that signifies the part of a monthly income that should be going into paying debts.

The total monthly debt covers several expenses such as credit card payments, loan repayments, mortgage, child support, and more.

Back-End Ratio Formula

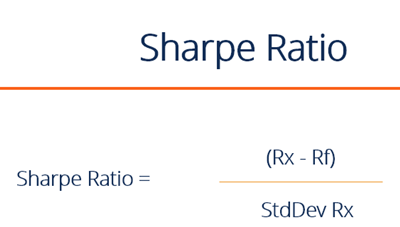

This can be calculated with the back-end ratio formula:

Back-end ratio = (total monthly debt expenditure / total monthly income) x 100

Understanding Back-End Ratio

The back-end ratio signifies one of a few metrics that mortgage underwriters use to evaluate the risk level linked with lending money to a borrower. It is essential to assess this metric as it denotes how much monthly income the borrower gets and how many commitments he already has.

In case the potential borrower is already paying a high percentage of monthly income to other expenses, he comes under the high-risk borrowers' list.

Talk to our investment specialist

How to Calculate Back-End Ratio?

The back-end ratio can be calculated by combining the monthly debt payments of a borrower and dividing the result by the monthly income.

Now, suppose that there is a person who wants to take more loan. His monthly income is Rs. 50,000 and he already has a debt payment of Rs. 20,000. This borrower’s back-end ratio will be 0.4% (Rs. 20,000/ Rs. 50,000).

Generally, lenders trust such borrowers who don’t have a back-end ratio of more than 36%. However, there are some lenders who may even make an exception, given that the borrower has Good Credit.

Improving a Back-End Ratio

One of the major ways of decreasing the back-end ratio is by paying off the pending bills and loans as quickly as possible. In case you have a mortgage loan, you can refinance the same if the home carries adequate equity.

And then, combining other debts with this Cash-Out Refinance can help decrease the back-end ratio as well. However, if you choose this option, you may have to bear high-interest rates as lenders are always at great risk when providing cash-out refinance in comparison to a standard rate-term refinance.

Additionally, lenders may also require you to pay off other debts in cash-out refinance to close the previous loans and debts.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.