What is Basis risk?

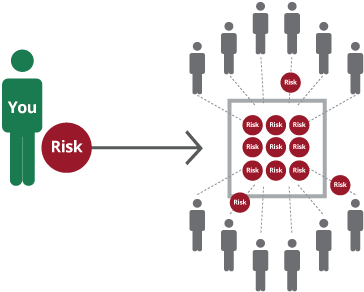

Basis risk in the index insurances appears when the index's measurement does not match the insured individual's actual losses. In other words, it is the Inherent Risk that a trader takes while hedging any position after taking a contrary position in an asset derivation, like the future contracts.

It is acceptable for hedging away the price risk. Basis Risk is also defined as the risk that occurs when the futures price for a commodity might not normally move with the Underlying asset's price.

Different Types of Basis Risks

There are various types of basis risks, including:

Price basis risk: This is the risk that appears when the asset's prices and its futures contract do not move cyclically with one another

Location basis risk: It is the form of risk arising when the Underlying Asset is in a different location from the place of trading the futures contracts

Calendar basis risk: In this type of risk, the spot Market position's selling date might differ from the future market contract's expiry date

Product quality basis risk: This risk arises when an asset's qualities or properties are different from the asset represented by the futures contract

Talk to our investment specialist

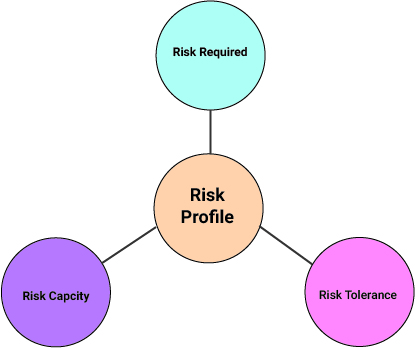

Components of Basis Risk

Risk can never be eradicated in investments, but it can be somewhat mitigated. Therefore, as the trader enters into a futures contract for hedging against some price fluctuations, they might partly change the inherent "price risk" into some other form of risk, called the "basis risk." It is considered a systematic or market risk.

Systematic risk is the one that rises from a market's inherent uncertainties. In contrast, the non-systematic risk is associated with some specific investments. Between the period when a futures position initiates or closes out, the difference between the spot price and futures price might narrow or widen; the primary tendency for a basis spread is narrowing. As the futures contract reaches near expiration, the futures price converges towards the spot price. This mainly happens because the futures contract becomes less futuristic. However, there is no guarantee for the narrowing of basis spread to occur.

The Bottom Line

Basis risk type is acceptable in the attempt to hedge away the price risks. If the basis stays constant until the trader closes both positions, they are known to have successfully evaded the market position. However, if the basis significantly changes, the investor might experience some extra profits or increased losses. All the investors looking forward to hedging their market position will profit due to the narrowing basis spread, and buyers will profit due to the widening basis.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.