Table of Contents

What is a Bottom Fisher?

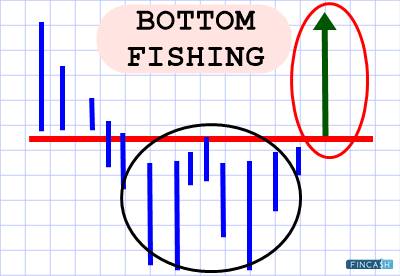

Bottom fisher is an interesting term that describes a certain type of trader. It’s an investor who buys a stock that has fallen to its lowest price to date, hoping that it’s a temporary decline and the price will recover soon. Basically, bottom fisher traders hunt for undervalued stocks through fundamental analysis.

Buying low and selling high is the mantra of bottom fishing.

Another phenomenon that describes bottom fishing in the stock Market is ‘catching a Falling Knife’ because some investors get in too early, and if the price continues to fall for a while then the results will be a loss. This strategy goes well with one who has a long-term vision, so there is enough time for the market correction to earn profits.

Bottom Fishing Trading Method

Bottom fishing is a strategy that is active during a prolonged Bear Market where stocks hit low through panic selling. Many shareholders impulsively sell stocks and are willing to accept any price. Bottom fishers wait for such opportunities where they can bargain and buy undervalued stocks.

To make the best out of such opportunities, traders need to do a lot of market research, Technical Analysis, price patterns, etc., in order to profit from undervalued stocks. The art of bottom fishing is to determine when the asset may bottom and turn higher. Long-term traders prefer to wait until the asset turns higher.

The key is also to remember and relate other phenomena like Cockroach Theory. There would be chances that a stock has hit down, and there are many hidden in the same place. Chances are there that the entire sector may decline during that time. If you know, bad stocks often trade at their lows for good reason. Therefore, it is not an ideal case where a stock performing low can’t decline more.

Talk to our investment specialist

Bottom Fishing Stocks India

One of the recent events where the market witnessed bottom fishing was during the COVID pandemic. There was massive fearful selling of assets, where stocks become undervalued. This opened up a window of opportunity for bottom fisher traders.

In the year 2020, where the virus case hits high every day in India, domestic as well as foreign investors became fearful. NSE Nifty 50 and BSE Sensex declined over 23% each in March, which was the worst March in history. Also, over 43 stocks in BSE 500 crashed over 50% in March. But, this opened up an opportunity for bottom fishing.

To generate profits from undervalued stocks needs a correct valuation. Also, you need to have the best view of the companies performances in the past and the future.

Limitations of Bottom Fishing

The strategy needs a lot of practical experience, research and also sharp insights into the market. It is a high-risk strategy and also an irregular art of trading that may not suitable for all types of investors. It also includes a sound method for determining when a stock could stop declining and start heading higher.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.