Table of Contents

Cash Balance Pension Plan

What is Cash Balance Pension Plan?

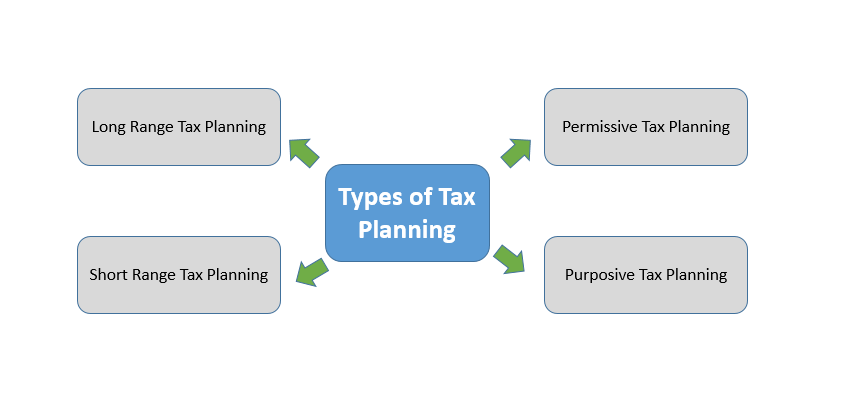

A cash balance pension plan refers to the specific type of a pension plan that comes with the lifetime annuity option. For a typical cash balance plan, the employer is known to credit the account of the participant with a particular percentage of the respective annual compensation along with the interest charges.

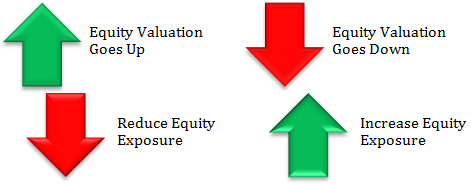

A cash balance pension plan can be referred to as a defined-benefit pension plan. Therefore, the overall funding limits of the plan along with investment risks and funding requirements are dependent on the requirements of the defined-benefit pension plan. Changes that occur in the respective Portfolio are not known to affect the overall benefits received by the given participants upon termination or retirement. In such a case, the company is known to bear the entire ownership of profits or losses in the given portfolio.

Getting an Understanding of the Cash Balance Pension Plans

While the cash balance pension plan might be referred to as the defined-benefit pension plan, in comparison to other standard defined-benefit plans, the given plan is known to be maintained on the Basis of individual accounts – mostly like the defined-contribution plan. The plan is known to serve as the defined-contribution plan due to the changes in the overall value of the portfolio of the participant that do not impact the annual contribution.

The additional features of the cash balance pension plan are known to resemble the 401(k) plans or other retirement plans. Like a conventional pension plan, in this mechanism also, the investments get managed professionally. Moreover, the participants in the given plan receive a particular benefit at the time of retirement. However, the overall benefits are stated like in the typical 401(k) pension or any other pension instead of the Income stream on a monthly basis.

When you have this plan, it can help to serve as a major retirement saver. Most of the older business owners are known to seek this pension plan for recharging the respective retirement savings because of the lucrative contribution limits that are known to increase with age.

Talk to our investment specialist

How Cash Balance Pension Plan Works?

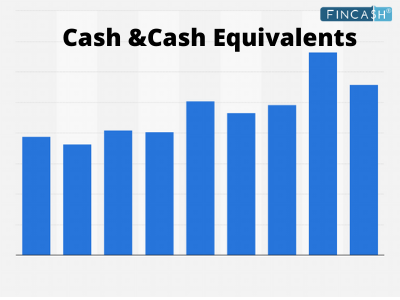

The employer contributions for rank & file employees under the cash balance pension plan are typically known to amount to around 6 percent of the overall pay in comparison to the 3 percent pay in other pension plans. Participants, in this case, are also known to receive the interest credit on an annual basis. The given credit might be at some fixed rate – like 5 percent, or even at a variable rate – like the 25-year treasury rate.

At the time of retirement, the participants are known to take the annuity on the basis of the respective account balance or some lump sum that could be rolled into some another employer’s plan.

Ensure a peaceful retirement with the help of the cash balance pension plan.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.